Uncovering an Innovative Monetization Strategy to Keep Your Business Relevant

Monetization Strategy. Innovation. Brand Relevancy. These words can inspire excitement, enthusiasm, and perhaps even some trepidation. On one hand, you might be excited about the possibilities of bringing in more revenue. On the other hand, however, you might worry about how you’ll make changes without shaking your internal culture.

And that, ladies and gentlemen, is the crux of this post. Get yourself comfortable; in this post, I’m going deep to unpack how to discover new ways to bring in more top- and bottom-line margin and gain organizational buy-in while pursuing something as big and impactful as new revenue models and pricing strategies. While it might seem next to impossible to get your entire team on board with this (especially the C-Suite), this post is designed to help you clarify big goals and build in an insights-driven approach that’s hard to ignore. But before I get ahead of myself, you need to understand why I’m so passionate about this topic that the concept of pricing permeates nearly every conversation I have these days around staying relevant in business.

Innovating within your “monetization strategy” (your revenue model, business model and pricing strategies) is paramount today — and I don’t say that lightly. Making strategic changes and optimizing prices has proven time and again to attract new customers like a moth to a flame. These practices also enhance business models, build new paths-to-purchase, boost loyalty and much more. Yet these benefits don’t fall in your lap if you simply adding new SKUs or products into the mix. They happen when you turn your existing suite of services and products into something your customer will love, while simultaneously using sophisticated data loops and robust analysis to help you achieve a level of retention that is second to none.

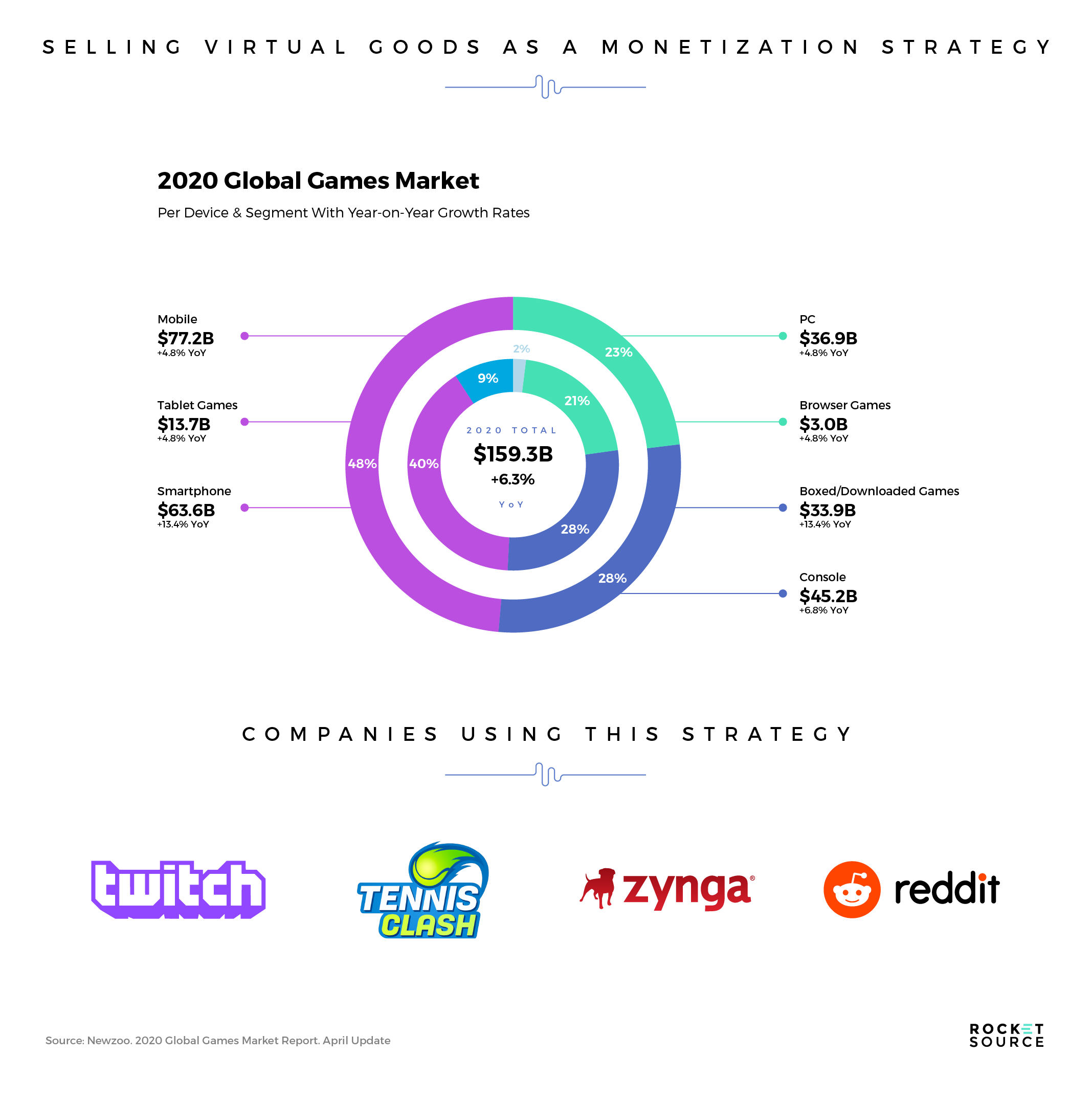

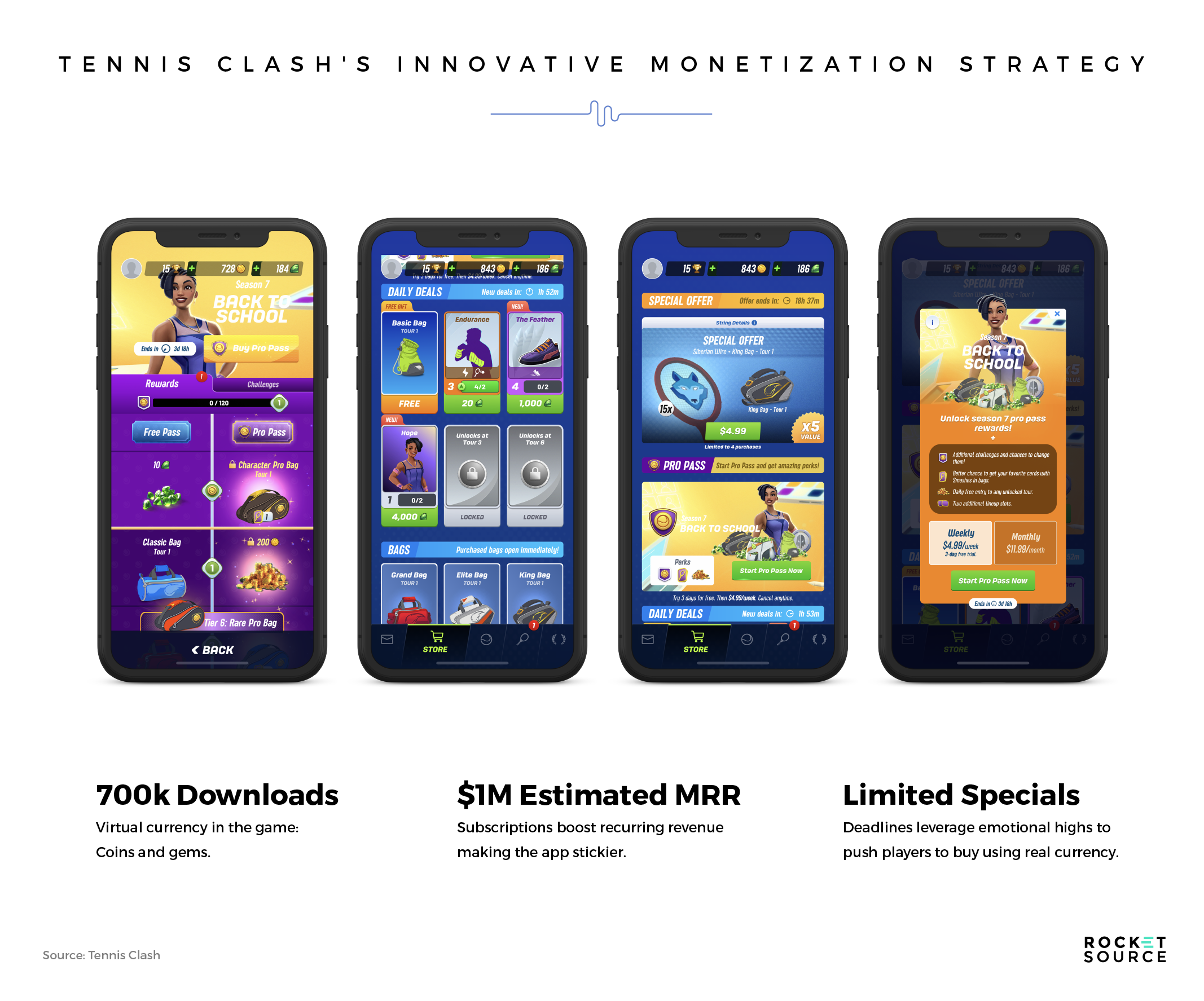

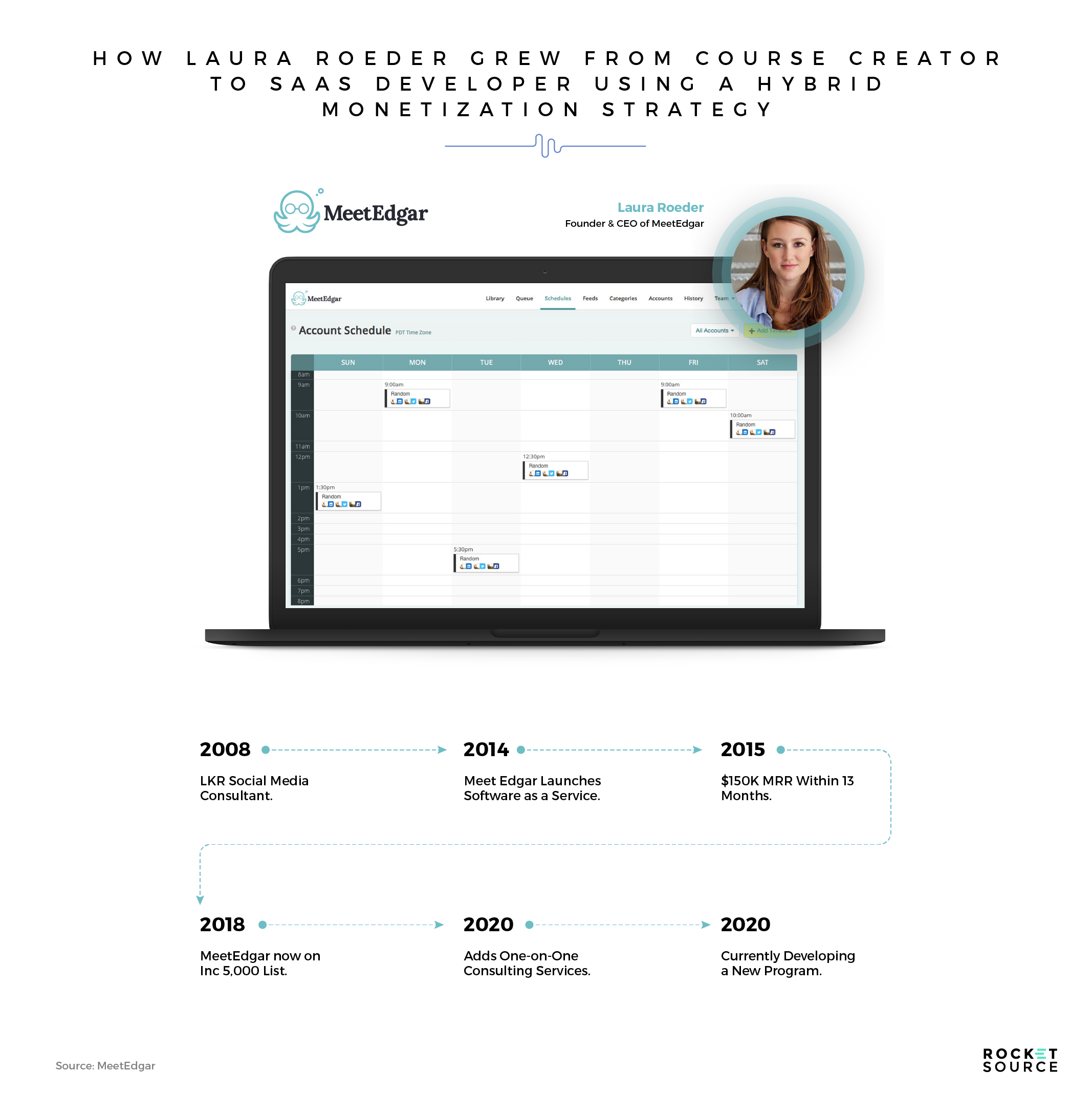

Software as a Service (SaaS) and Creator-Led Content are eating the world these days. By studying innovative SaaS and Content Creator Monetization playbooks, one can see how the top players in these fields have facilitated new ways of monetizing across the journey, going well beyond the basic software and gated content. For example, consumers today can now make down payments to reserve a car (think Tesla), set up recurring push payments with a tangible device — think Amazon’s skewed but innovative Internet of Things (IoT) Dash button — and create both recurring and one-off gamification monetization strategies in mobile apps (think Tennis Clash). As a result, one thing is clear — the old way of approaching revenue models has gone the way of the horse and buggy. Today’s most innovative and relevant companies are those that have evolved alongside consumer behaviors and demands.

What is a Monetization Strategy Anyway?

Before I get too far ahead of myself, let’s talk about the term monetization strategy, as I’ll be using it quite often in this post. Rest assured that I won’t be constantly bolding, italicizing and underlining the words throughout (I know some of you may already be stressing over this little nuance!). That’s just an SEO experiment at play, so please look beyond this little Google-induced tactic as we dive into the origins of this phrase and understand why it’s so frequently bandied about. Then I’ll dig in deep about why it matters for keeping your business relevant today.

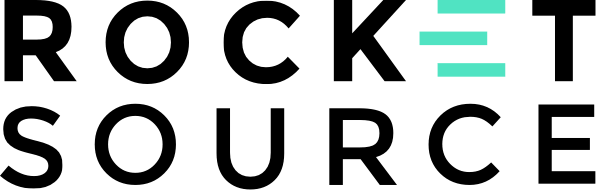

In the simplest economic terms, the goal of monetizing any business is to put dollars in the bank by converting X (your time, software, content, etc.) into Y (a form of payment like cash, Bitcoin, etc.). However, the digital world has made earning money far more sophisticated than traditional simple transactions like exchanging a dollar for a candy bar at the local convenience store. This swift rise in monetization complexity is on full display via YouTube, Twitch, Apple, Amazon and plenty of others.

As you can see, plenty of innovative organizations have picked up on the term monetization strategically so much so that they’re using this term inside partner agreements, terms and conditions, and other documents between creators. One of the biggest users of the term, YouTube, is known for giving content creators a space to share their work, but they’re also well-known for paying those creators for driving their audience. The YouTube monetization strategy is incredibly robust, with numerous layers such as merchandise opportunities, live stream chats, and channel membership tiers. While the term itself might feel new, many innovators expect it to continue to grow in popularity and complexity over the coming years. At RocketSource we’re helping to make big strides on the front lines of that growth.

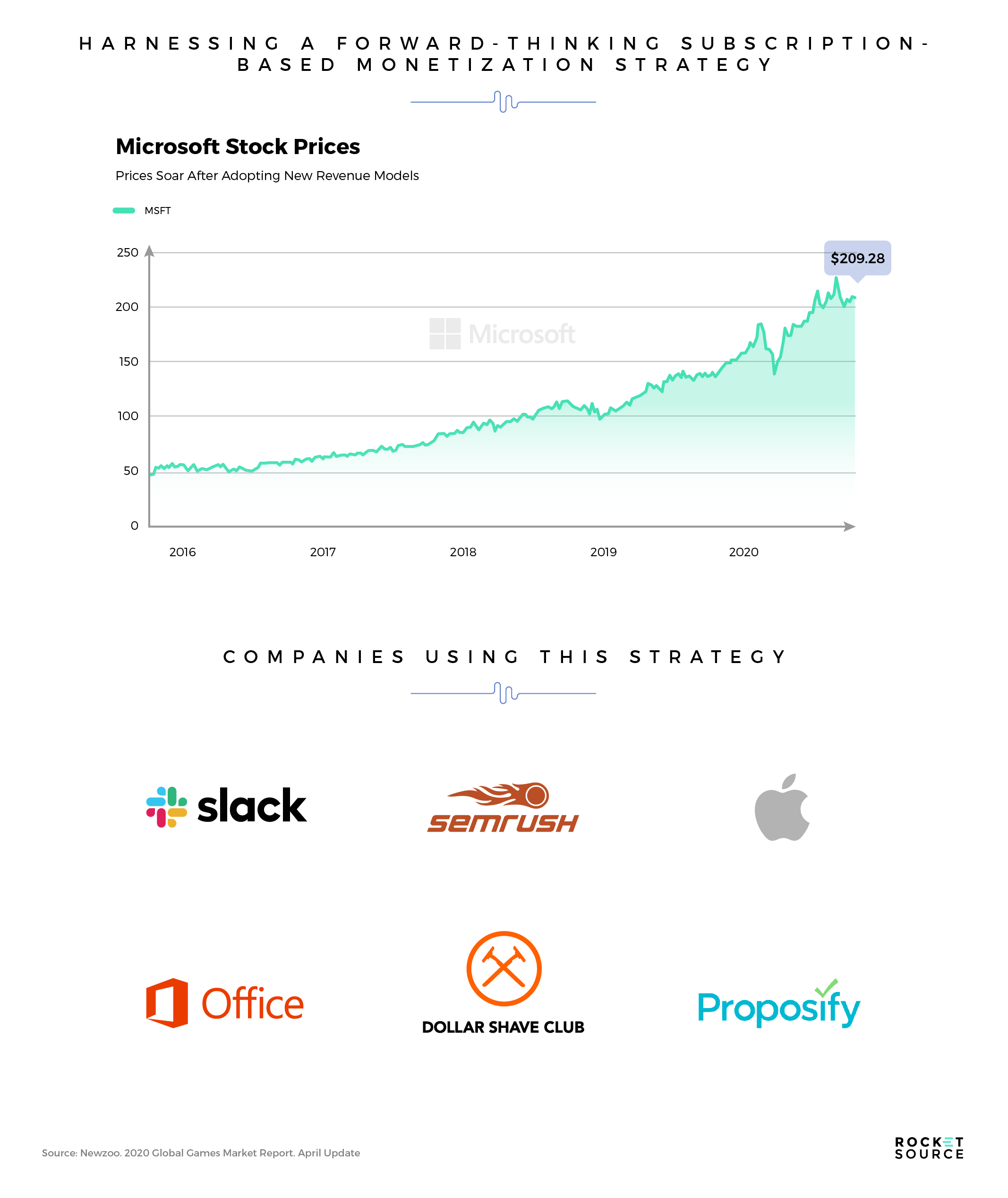

Subscription services — whether SaaS, Streaming, Recurring or any other business model based on a “subscription”— allow businesses to “monetize” their relationships with customers over time instead of fighting for inconsistent one-off sales. It’s about establishing consistency, not only to deepen understanding of Revenue Cycles, Lifetime Value of the Customer (LTC, LTV, etc.), and so on, but to enhance and deepen the customer relationship. It’s less about “selling” and more about monetizing an ongoing relationship. It’s no wonder that forward-thinking companies have adopted this relationship based revenue-generation model, as it represents a shift toward not only helping Creators monetize their audiences but also helping companies leverage new markets and communities to enhance their Voice of the Customer and Customer Experience initiatives.

If you’ve ever been a part of a strategic positioning team working to innovate on your revenue model or pricing strategy then you know things can get very complex, very quickly. When you start considering all that’s available to make this simple act possible, including translating insights found through mining and modeling, it’s clear that the data and content available to organizations today can be — and must be — strategically monetized.

Innovating on price — choosing pricing strategies and then trickling them out across your organization and your customer channels — is very tricky. Even gaining a good understanding of your market in general takes diligence. While we’re experts at simplifying the complex here at RocketSource, I want to caution you about oversimplifying something as powerful as changing how much and how often you charge your customers. There are many layers to the revenue model onion and I’ll start peeling back those layers in this post.

Full disclosure: if you’re new to the market and just trying to throw together a cost-plus pricing strategy, this post probably isn’t for you. There’s plenty of information out there to help you learn the basics. In this post, I’ll detail how we help clients innovate and optimize overarching strategic revenue models and boots-on-the-ground pricing strategies to stay relevant. And to whet your whistle for what’s ahead, I will tell you that we do this by leveraging a business transformation framework to drive important data loops including (but not limited to) conjoint analysis of your price-to-value and price-to-experience propositions.

With modern business becoming more and more digital, the time is ripe to innovate on your stodgy old monetization levers and up your game with a digital and mobile-first monetization strategy that resembles a multi-faceted multi-tool. The hard work you do now can ensure that your revenue models are aligned with the modern emotive and cognitive value proposition of your market and offering and that your tactical boots-on-the-ground pricing strategies are rooted in experience-centric competitive choice data loops.

Look, staying relevant requires making methodical and constant shifts along the S Curve of Business. I can hear all of you saying it now: “Buckley, we get it.” And yet, adjusting how you strategically monetize is one of the most underutilized and yet most powerful levers you can pull to achieve relevance and gain a market-leading position with a moat large enough to cushion you in times in which your new product and service experiments fail to deliver as promised.

Nuances Matter When Considering Your Monetization Strategy

If you’re reading this post freshly caffeinated and with a keen eye, you probably noticed above that I referenced revenue models separately from pricing strategies. That’s intentional. Throughout this post I’ll use both terms, so before I get too far ahead let me explain the nuances between them.

Revenue models are a lot like blueprints for how the company makes money. These models are the constructs that inform a company’s core strategy for bringing in revenue day after day while maintaining relevance. The way an organization designs its revenue model while considering the emotional and logical needs of the customer influences the strategic direction of the business as a whole.

Pricing strategies are a bit more tactical. These strategies are something organizations tinker with constantly in an effort to improve value proposition, competitive differentiators and more. They’re often twisted and tweaked across the buyer’s journey. Depending on where a user stands in the funnel, companies can elegantly optimize price to improve cost-of-acquisition (CAC) to lifetime value (LTV) ratios.

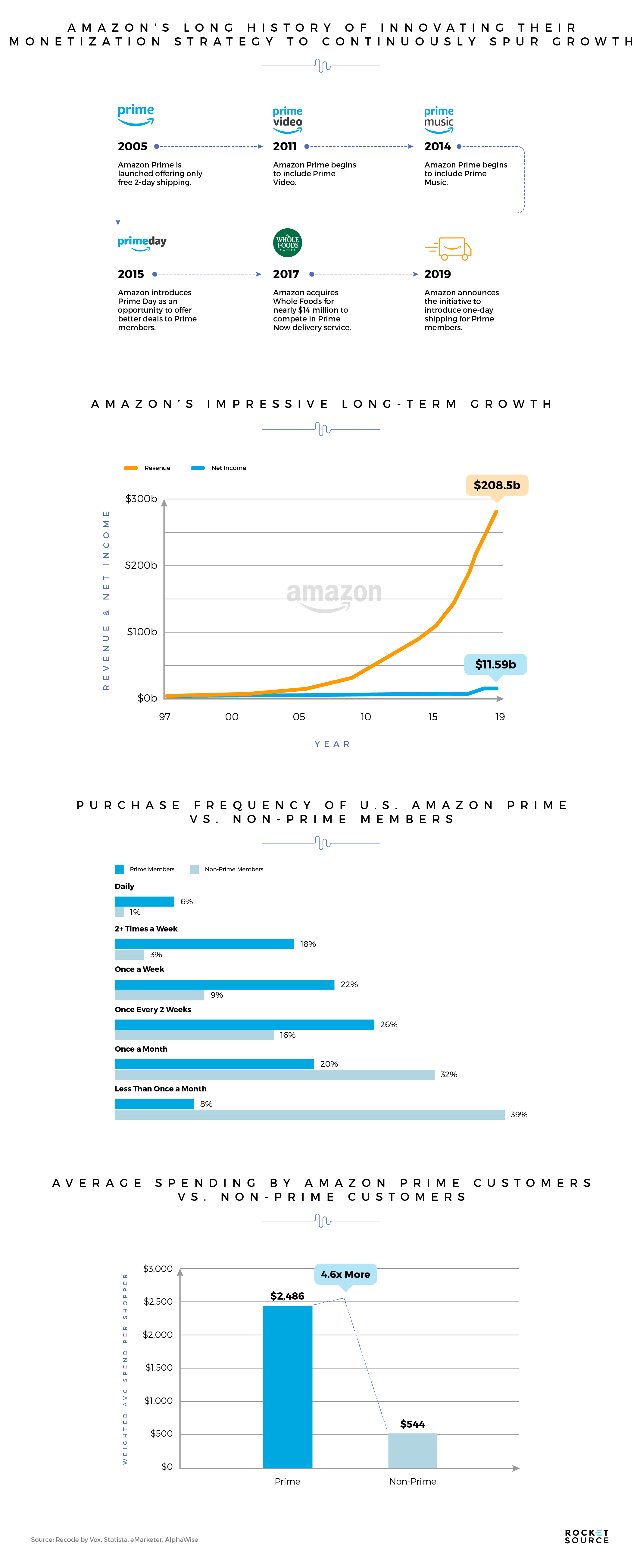

Bringing these differences to light is critical. Throughout my years of helping businesses analyze their monetization strategy and move up the S Curve of Business, I’ve quietly learned a solution to the puzzle of how unit economics directly affects user acquisition and retention and vice versa. To start, it’s important to know which side of the funnel matters. Many companies prioritize new user acquisition over retention and, as a result, pricing strategies become misguided in multiple ways. I strongly advocate looking first at retention before trying to fill the top of the funnel with leads that could result in quick wins. To understand why, you must first understand what the heck a modern customer journey looks like.

Finding Micro-Moments of Opportunity for Monetization Strategy Innovation by Analyzing the Customer’s Journey

Acquisition is a flashy nuance of growth that earns a lot of press. After all, sales numbers are often equated with growth, and for good reason. But without an equally concerted effort at retaining the flow of new users, companies are essentially pouring time, energy, money and all manner of resources into a very leaky sieve.

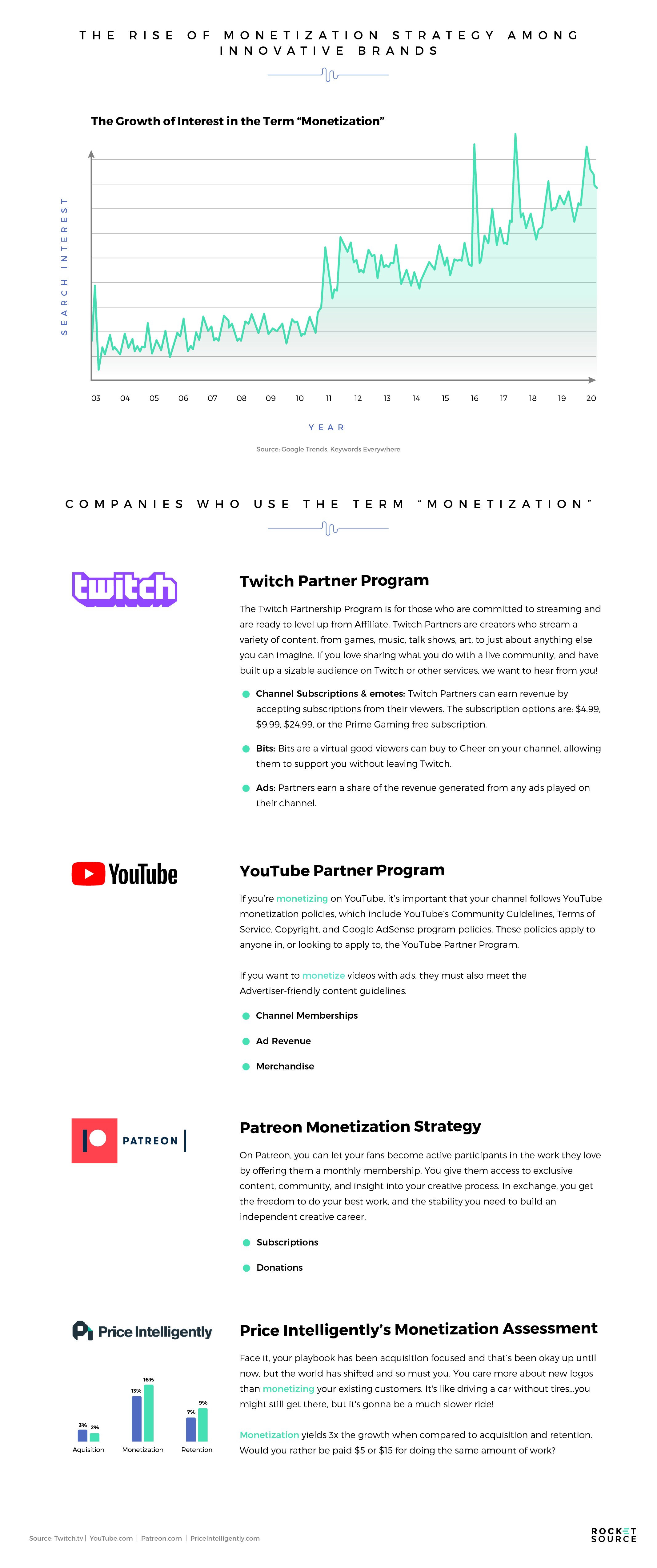

Revenue models, pricing optimization, and pricing strategy adjustments must all be intertwined with an interconnected customer journey funnel and customer journey mapping that extends from acquisition to retention.

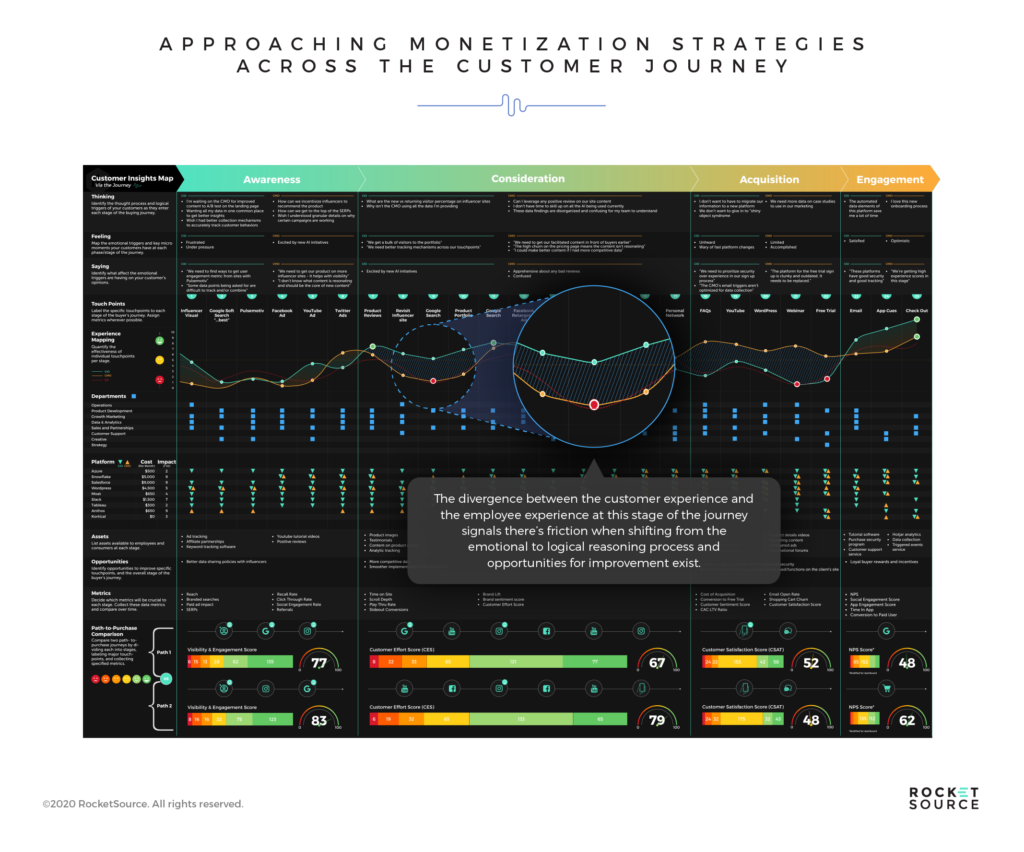

This graphic is a 30,000 foot representation of the standard customer lifecycle with a company. In it, you’ll notice that there are many moving parts that determine a buyer’s loyalty to a brand. Buried within each of these points are subtle nuances about a buyer’s behavior. Getting these nuances right is crucial to avoid unintentionally creating friction along the buyer’s journey.

Let’s unpack this a bit.

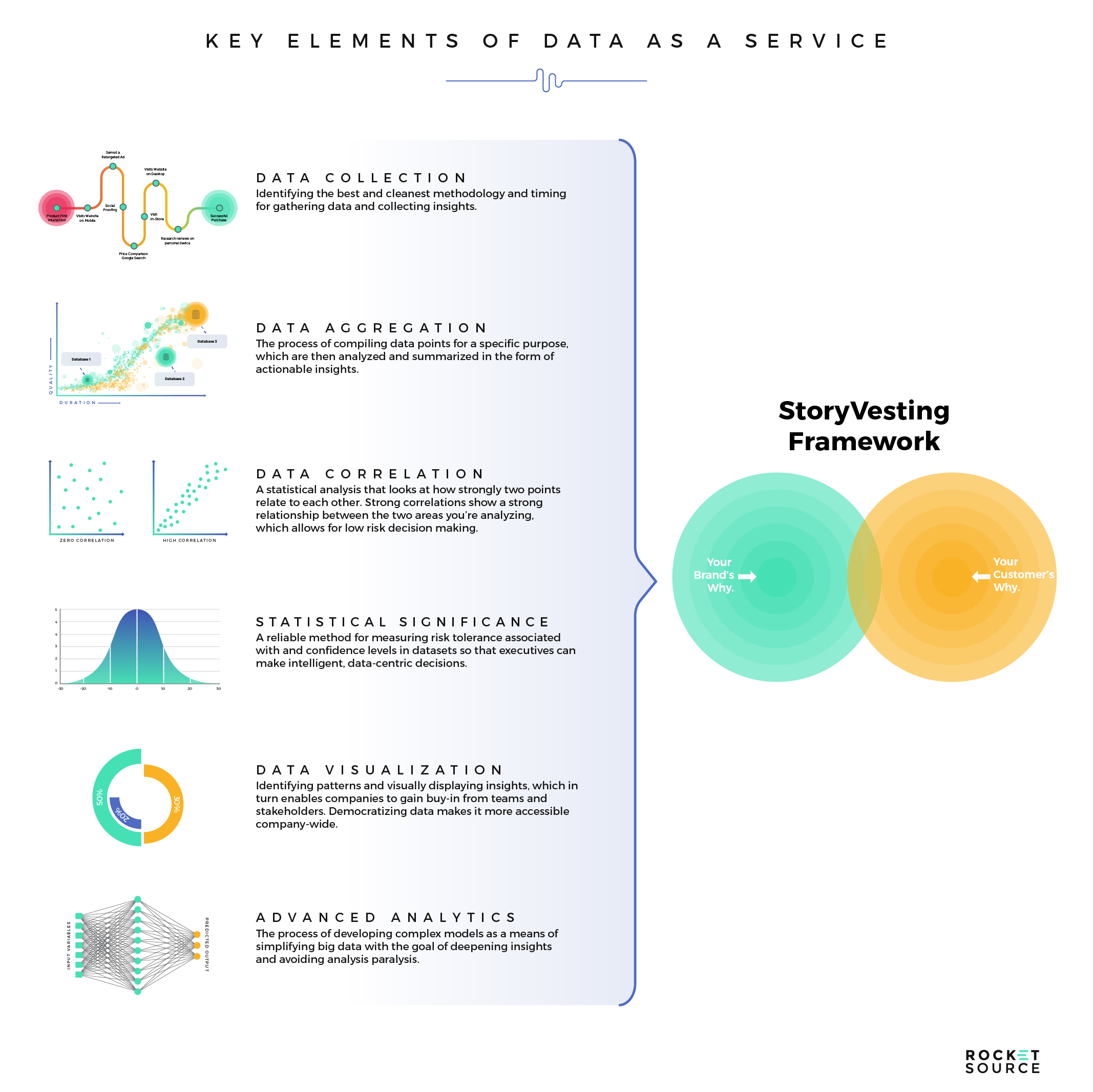

There’s a fine line between the emotional connections made in the inner concentric circle within the StoryVesting framework and the logical reasoning that takes place in the second concentric circle. Razor-thin triggers exist at the moment a person moves from an emotional response into a logical reasoning state. These triggers take only milliseconds to happen along your buyer’s journey, but it’s crucial that your company get them right. From what we’re seeing in the market, this precise moment when a buyer makes a shift from an emotional response to a logical connection in the buyer’s journey is ripe for innovation and opportunity. The same goes for the transition from purchase to onboarding. Although these experiences are razor-thin, they must align with the customer’s emotive and cognitive associations of the brand from the moment they say, “I think this is something I want because I want security/power/relief/whatever.” Immediately after the price is presented, all of the dominoes in the buyer’s journey — from the way the copy is written to the way the pages are designed, and beyond — to be stacked in a perfectly positioned sequence so that each one falls at precisely the right time.

I often see companies diffuse customers’ emotional feelings as soon as they translate their offer into a logical state. I’m splitting hairs here but I believe, as a market, that we need to zoom in on this ultra-fine corridor, widen it up, and explore ways to innovate on the handoff from emotional to logical reasoning, especially in someone getting ready to buy. At RocketSource, we approach leveraging these transitionary touchpoints by drilling down on the interconnections, expectations, and convergences/divergences between Employee Experience, Customer Experience, and resultant Brand Experience:

Employee Experience [the sum of the levers driving the touchpoints as they pertain to the Monetization Model, Competitive Positioning, 3Ps (People Process Platform Alignment), Tech/Data Stack, Funnel Management, Design Thinking… ] + Customer Experience [the sum of the levers driving the emotional and logical touchpoints as they pertain to the counterpoints in the EX…] = Brand Experience [the sum of the value proposition as it relates to the competitive positioning, overarching brand signals, extrapolation of the various KPIs, metrics evaluating such Brand loyalty….].

Leveraging a Customer Insights Map to Fine-Tune the Emotional-to-Logical Experience in Your Monetization Strategy

Humans are complex creatures. As you develop pricing strategies around your revenue model or consider innovating on your revenue model entirely (a daunting task, to say the least), you must keep the customer and the people within your organization at the forefront. Doing so will help you better understand how your pricing strategies will impact the customer’s journey as a whole.

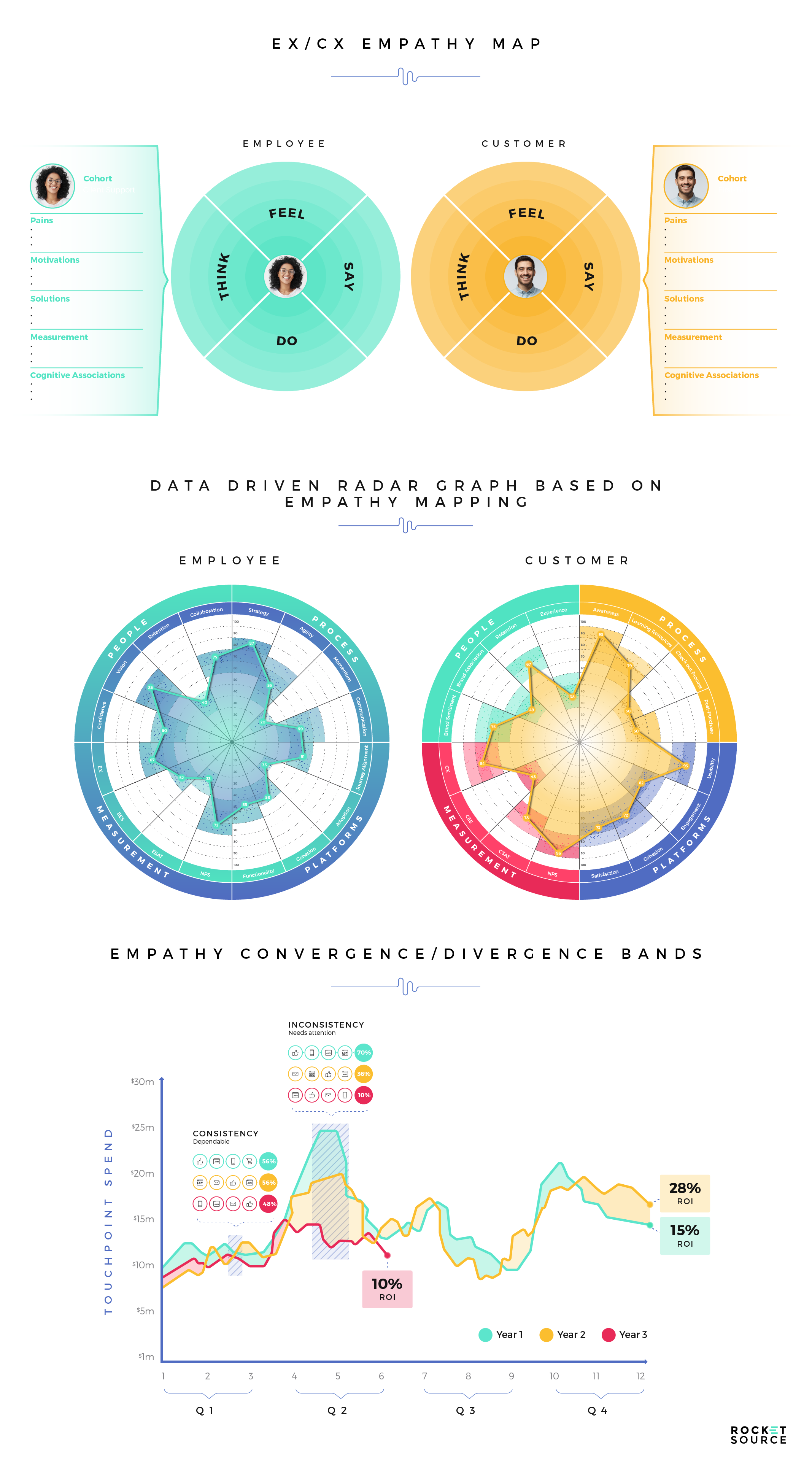

One way I do this is through our insights-driven approach to customer journey mapping. We call it Customer Insights Mapping. Here’s what it looks like:

On this map, I specifically focus on both the employee and customer experiences using what I call Convergence/Divergence bands (or Barlow Bands, as my team lovingly refers to them). These bands show me how all the people directly involved in the journey are feeling at every single point along it. Specifically, when it comes to revenue model innovation, I look squarely at the point between the first and second concentric circles. If I see a massive divergence, I know there’s a problem (or an opportunity for innovation).

Consider this basic case study: when a divergence like this one exists between the shift from emotional to logical reasoning, I know there’s a total lack of alignment between the employees putting the funnels and experiences together and the customers navigating them. It might be a process issue. It might be a technological one. Regardless, there’s a missed opportunity because employees don’t realize they have a churn or spend problem that’s costing sales. What employees see and what customers feel isn’t lining up in that narrow corridor of a micro-moment. There’s a divergence between employee and customer experiences which signals a potential shortfall in moving those buyers closer to purchase. Rather than nurturing customers toward becoming brand ambassadors, employees are already moving on to the next upsell or merchandise sale. The team dusts off their hands, thinking they’ve checked a box and are ready to make the next sale.

The customer, however, is already looking at other options.

At this point, the retention side of the funnel is especially critical. Rather than working forward on the funnel, I encourage teams to work backward, starting with retention when adjusting pricing scenarios. This approach will help you increase the LTV:CAC ratio and build loyalty with buyers. If you get this wrong, there’s more at stake than losing a few dollars from poor pricing. The whole market will see where the breakdown happened and companies will adjust their monetization strategies accordingly, sending your brand into a tailspin to correct.

By mapping important metrics along a customer insights map like this one, we’re able to take unit economics out of excel files and leverage them to significantly impact the entire customer experience. Users retained for the long-term are not only going to help your top and bottom lines but are also more likely to evangelize the product. That’s why, again, a pricing data loop usually begins and ends on the retention side of the funnel. Let me repeat that for emphasis:

The data loop must start and close on the retention side of the funnel.

Knowing exactly which combination of experiences retains users across the entire journey on every single product SKU, line, service offering, and more is critical. Getting this right requires more than simply creating a sales page that answers basic questions customers may have. There isn’t anything inherently wrong with this approach but it often leaves opportunity on the table because it’s too simplistic in nature. Humans are complex. To understand how to reach your audience, you must see how the journey looks, from sales to support, for each product SKU. Then you must document it thoroughly, starting with your power users, pulling out the deep cognitive associations of your brand from both an emotional and a logical standpoint. From there, you can partition each cohort into segments from power users to outliers, map those customers on a Customer Insights Map using convergence/divergence lines, and watch for patterns across multiple cohorts.

Using data visualization systems like the Customer Insights Map seen above will help pinpoint areas in which pricing strategy begins to unravel in the entire retention process. I know things can get challenging at this point, and the goal of this post is to help. Unless your C-Suite, particularly your CFO, is fully in-the-know about the interconnectedness of modern business, you’ll be hard-pressed to solve complicated leaky sieves. Gaining organizational buy-in requires some heavy lifting, starting with hitting home on a core attribute — the desire and organizational life-or-death need to stay relevant.

Is Your Monetization Strategy Still Relevant?

It’s safe to say that most companies have pretty robust systems in place. The problem is that their monetization strategies aren’t built for changing market dynamics. Adding to this challenge is the fact that bureaucracy can slow down pricing optimization and innovation plans for services, product innovations or new launches.

These struggles are often amplified by the struggle to maximize efficiencies of scale and active data loops to mine the most important pieces of pricing strategy.

- What are users actually doing with their time, money and mindspace?

- How will users perceive this new widget?

- Will our organization take money away from competitor X after this new product launch?

- Will our share of the market grow based on this new product aimed at undermining the current competitive price by 20%?

The list of questions goes on and on. For most companies, the answer is that there’s plenty of room for improvement. The question isn’t whether improvement is necessary but rather how to make improvements to become more relevant in today’s market. That’s where having a framework like our business transformation framework, StoryVesting, is paramount.

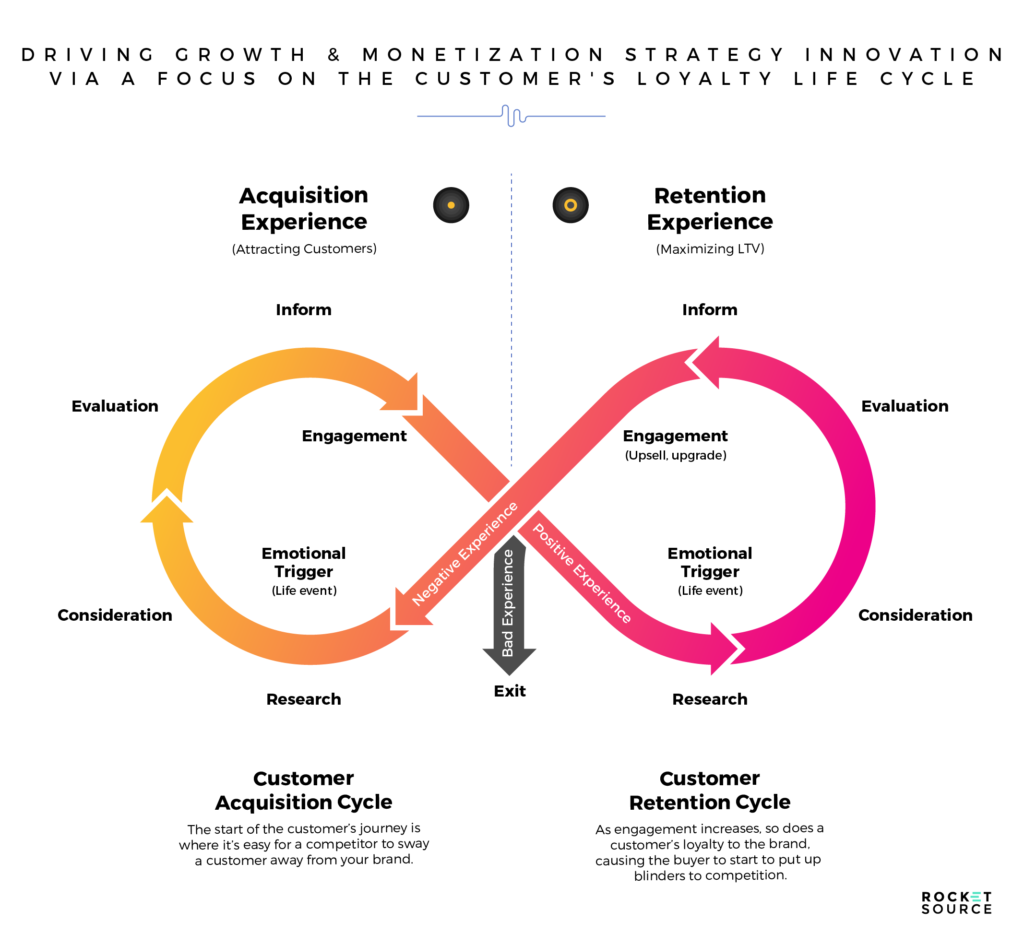

For the sake of monetization strategies specifically, I will say this — using a framework like StoryVesting will enable you to uncover whether revenue models are still relevant against the business model in general and determine the core cognitive associations with the brand’s “why” moments across each product or service journey. Amazon is a prime (pun intended) example of a company strategically balancing the art and nuances of revenue model innovation.

How Amazon’s Monetization Strategy Has Helped the Retailer Stay Relevant

From inception, Amazon has proven that they understand the subtle differentiation between revenue models and pricing strategies through their self-proclaimed “obsession” with their customers. Anne Goodchild, a professor of civil and environmental engineering at the University of Washington, addressed this obsession specifically relating to Amazon Prime’s two-day shipping. She said:

“Amazon has pursued a growth trajectory rather than a profit one. I think everyone would agree that their strategy has been to please customers and, in doing so, grow their market share.” – Anne Goodchild

In grounding themselves in their “why,” Amazon has been able to use all sorts of levers within their organization to maximize their top line and, more importantly, their bottom line. Amazon’s goal as an e-commerce business was to increase the average order value (AOV) of each sale. To do that they offered a service called Super Saver Shipping. That service proved to be insanely complex, which prompted a software engineer to voice his frustration. In response, Amazon zoomed out and recognized the importance of free shipping for their customers and innovated on their revenue model around that core desire by introducing Amazon Prime.

In the beginning, Amazon had some major stability problems in fulfilling its promise of 2-day shipping. After pushing through these issues and poaching employees from other departments, Amazon’s goal proved lucrative. Amazon Prime has paid off, with members today spending more and buying more frequently than non-Prime members. Amazon’s earnings show that the AOV of the typical Prime order is $23.33 and Amazon spends $5.08 to fulfill on the order.

Amazon’s world-famous 2-day Prime shipping option served as an enticement to draw customers to their site. Once there, these customers could clearly experience and appreciate Amazon’s “why” as the company showcased the value of doorstep delivery, the convenience of finding obscure book titles, and other innovative ways they made the buying experience exciting. These value drivers were effective in changing people’s behaviors, which helped increase customer retention. In its beginning stages that retention boost was more important to Amazon than profits. As more customers bought, they were able to plow those profits into other infrastructure like Amazon Cloud, which today is worth $550 billion, according to Morningstar’s analysis of Amazon’s value. They’re improving their bottom line by building their own infrastructure while simultaneously building a massive revenue generator.

But Amazon hasn’t stopped their race for retention. Today, they’re navigating how they will shorten Prime shipping times even further to be one of the first to offer one-day shipping. Once again, they’re pouring money from one cash bucket — in this case, Amazon Cloud — into solving this problem and getting closer to their “why” of getting items to their customers faster. Currently, the AOV for one-day shipping is $8.32 and Amazon is spending $10.59 to fulfill and ship orders. You don’t have to be an economics expert to know why that’s not sustainable. However, Amazon has committed to spending $800 million and counting to get this right. Why? Because they’re continuing to see unit sales increase by 22%, a growth rate that’s doubled since they kickstarted this initiative. They know that, like Prime, the chances of this revenue model panning out profitably are high as they continue to increase the AOV on one-day shipping.

Bottom line profits allow companies to stay relevant because organizations are able to reinvest those dollars into new strategies. Focusing on tweaking and optimizing price is a mistake and can cause you to miss the boat on massive profits — profits that will help your organization stay relevant in the first place. Like Amazon, focusing on customer retention by using a relevant monetization strategy will help drive your bottom line and keep your organization on track, no matter which inflection points you encounter on the S Curve of Growth. Pricing optimization comes into play once your revenue models align with the cognitive associations of your brand.

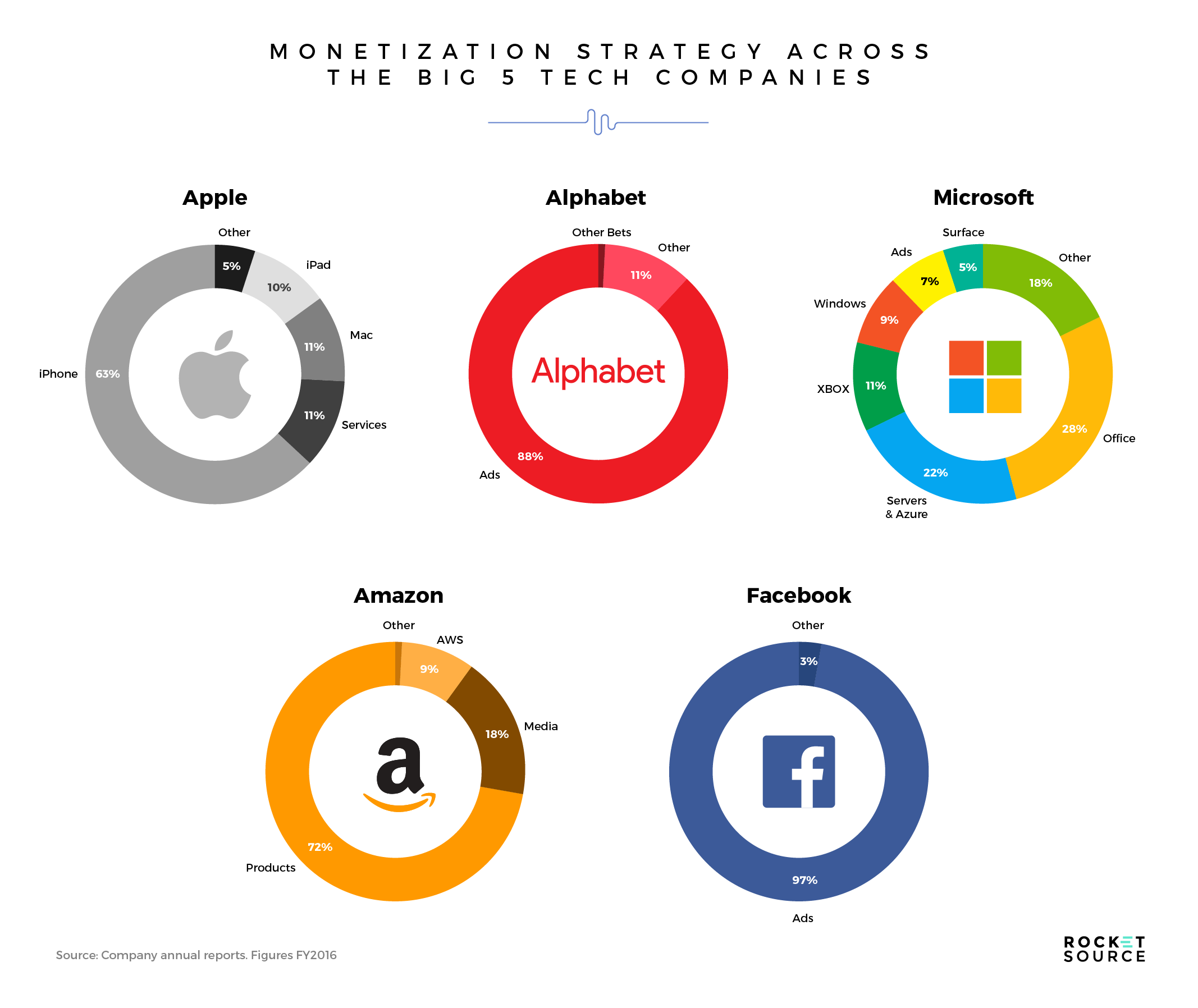

Amazon aligned its brand with the cognitive association of convenience and have followed suit with every pricing strategy since then. Optimizing your pricing to balance value with profit can have a huge effect on your company’s success too, but it requires finding the right revenue model to guide your next steps, from development to sales and marketing to growth and profitability. And there’s no one-size-fits-all approach here. Take a look at the differences in the monetization strategies of the Big 5 tech companies:

While Alphabet (which is the technical company name behind Google) primarily makes money from ads, Apple is more focused on hardware, Microsoft on software, and Amazon on products. We could play the guessing game about why each company charges the way they do, but the truth is that there’s more to these differences than meets the eye. In this post, I’m going to walk you through why these subtle differences matter when it comes to staying relevant, how we approach pricing optimization and revenue model shifts, and what implementing adjustments, both big and small, can accomplish.

Innovating on a Monetization Strategy for Relevancy

I know how you may feel when you hear buzzwords like innovate. Frequent use of the term innovation and its derivatives in articles, on podcasts, or in business meetings has diluted its meaning a bit, which is a shame. The term innovation is so popular because the process is critical for any business that wants to stay relevant. These organizations don’t want a disruptor to elbow past them in the marketplace, stealing customers and causing their brand to look antiquated.

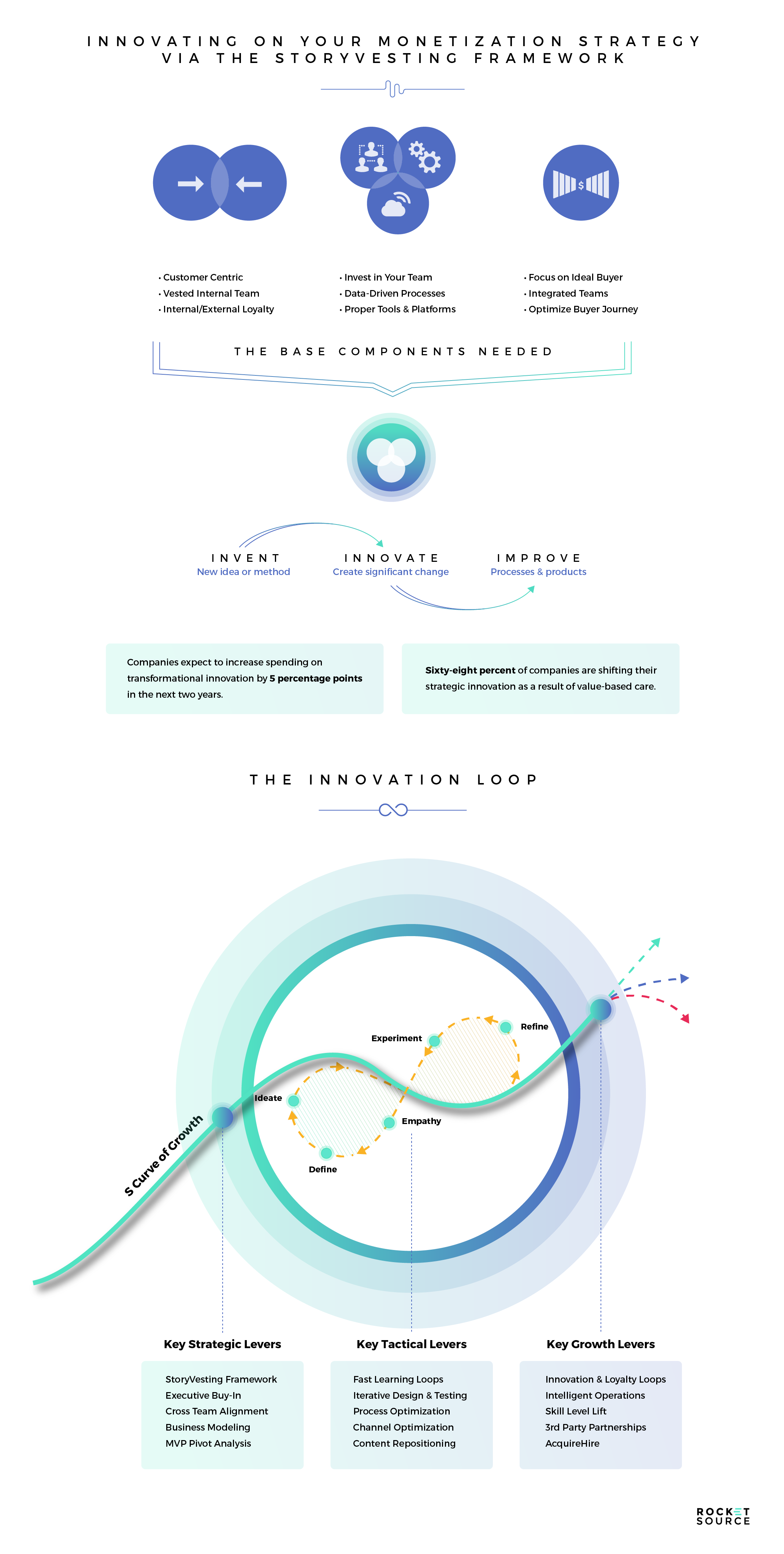

Though the word may be diluted, the concept of innovation is neither diluted nor simple. Not even close — especially when it comes to innovating on something as complex and deeply ingrained in the organization as revenue models. There isn’t a simple one-two punch strategy that will instantly bump you up the S Curve of Growth and into relevancy. Instead, you need to analyze something we call the 3 Is.

The 3 Is — invent, innovate and improve — represent three core ways companies can push upward through an inflection point on the S Curve of Growth. Inflection points, if you’re unfamiliar, are periods in which a business’ growth starts to slow, often due to a loss of relevancy. At these points — and before if a company is diligent enough in their strategy to plan ahead — a fundamental shift is required to maintain or capitalize on forward momentum and continue pushing upward. This requires the invention of something completely unique, an improvement to an existing product, or innovation through the introduction of new methods, ideas or products.

Often, companies look first at innovating their product line or adding a new service. While that route is valid, Harvard Business Review’s research on innovation in pricing shows that pulling the pricing lever might be just as powerful when it comes to maintaining competitive advantage, enhancing the customer experience, and ultimately growing in a changing market.

”Innovation in pricing brings new-to-the-industry approaches to pricing strategies, to pricing tactics, and to the organization of pricing with the objective of increasing customer satisfaction and company profits.” – Harvard Business Review

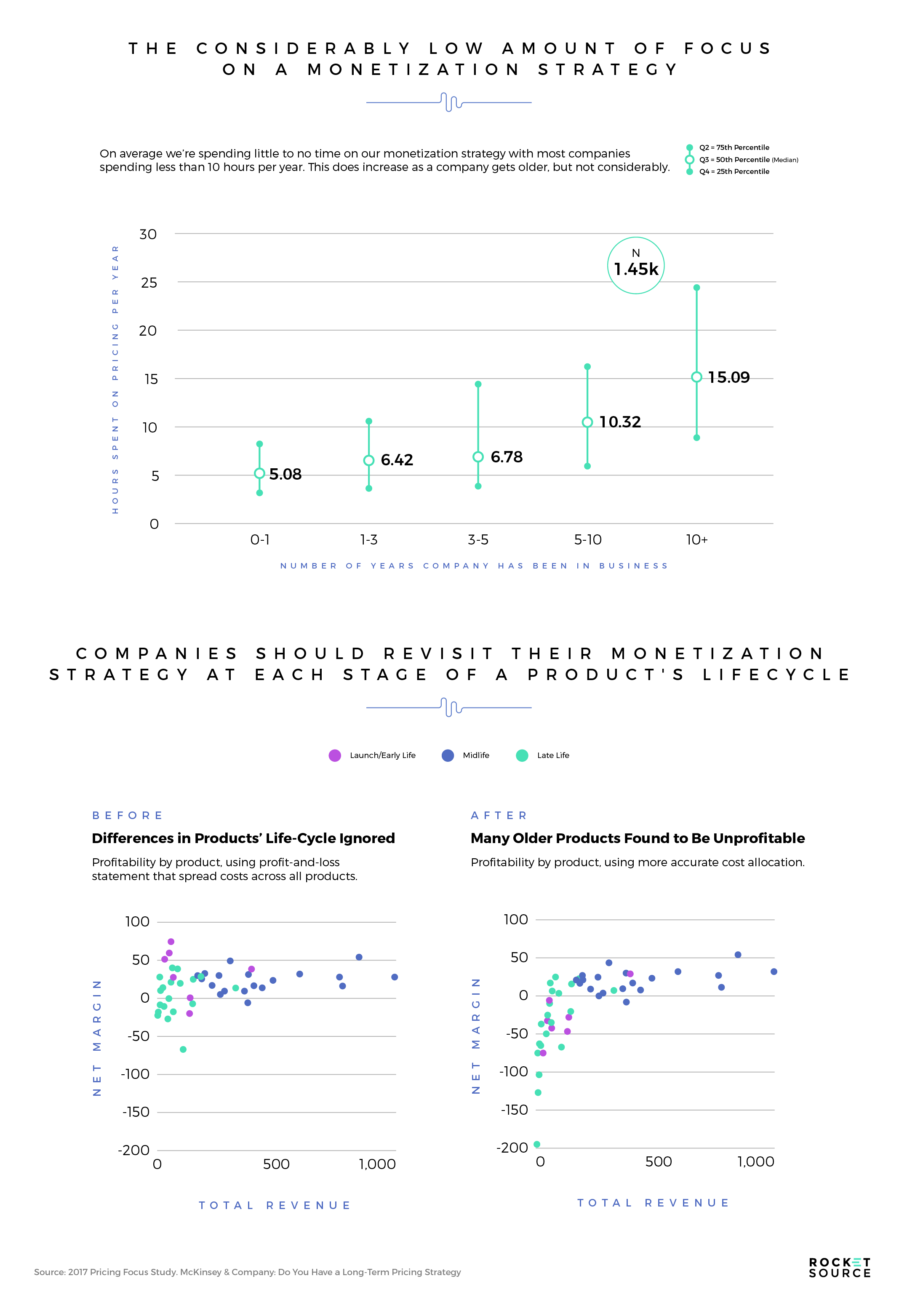

Sadly, the monetization lever often sits in a dark corner, untouched and unnoticed. Take a look at these findings from Profitwell that show how much pricing for bottom-line growth and overall revenue models are ignored.

It’s sad that companies neglect their monetization strategy, because not understanding the conjoint relationship between price and customer satisfaction costs companies opportunities to grow their top and bottom lines. Here’s why.

Revenue models and pricing strategies land squarely in the second concentric circle of the brand experience side of StoryVesting — the business model. In order to reach brand euphoria, this circle must overlap with the logical side of customers’ experiences with the brand, which is only reached once their emotional needs are met. Getting that transition from emotional to logical flow and association right is critical.

A product is never just a product to a customer. Minimum viable product (MVP) often defines the relationship between a customer and a company. The monetization strategy around that one product has the potential to forecast the depth and length of the buyer’s relationship with your brand moving forward. With Amazon, for example, the importance of establishing a cognitive association of the brand around convenience meant creating a pricing strategy that would encourage customers to add more to their shopping carts, thus increasing the AOV of each buyer. As another example, consider Best Buy circa 2008. This retailer offered two-year, no-interest financing for purchases over $999. In doing so, they were able to ditch the discounts and get customers to add items to their shopping carts just to hit that $999 minimum. If something had been off with either the pricing strategy or revenue model, they would have created cognitive dissonance, causing the customer to seek a competitor rather than taking advantage of that special. The same is true for your business.

We’re well past the days of one-off transactions and one-time interactions. Pricing products in this way leaves a tremendous amount of opportunity on the table. However, if you leverage the 3 Is and innovate on your revenue models you’ll be in a better position to navigate inflections on the S Curve of Growth, add profits to your bottom line, and foster better retention from your customers by creating revenue streams that make the most sense for the customer and company relationship.

Competitive-Based Pricing is Both Common and Flawed

When considering your strategy to monetize your offering, you might look square in the path of your competition to figure out your next steps. The problem is, looking sideways in an effort to match competitors tit for tat doesn’t always pan out as you might hope. To a certain extent there’s validity in analyzing your competitors, but as you’ve probably guessed by now, there’s a better way to approach the market.

There are a lot of high-school-like dynamics in play when it comes to the process of competitive-based pricing. Much as jocks often look over the shoulders of nerds to copy their work (because nerds study a lot and know their stuff, right?), businesses often pick prices based on the price points of the competition. While these stolen efforts aren’t as blatantly obvious to the market as cheating is to a physics teacher, the result is the same. Everyone is turning in the same or similar work, even if the answers are wrong.

Because most companies do, in fact, do the work researching their market, the competitive-based pricing monetization strategy is low-risk. It can, however, often cause organizations to miss opportunities to innovate. Rather than assessing value, they assess the competitive market, which can cause organizations to engage in a rat race with other companies, pushing customers’ needs to the side out of fear of losing potential revenue or in an effort to be the most affordable option.

The Dangers of Blindly Raising Prices

Simple inflation deems that you’ll want to raise prices over time to adjust for your own rising costs. That’s understandable. Yet many companies raise prices blindly, without letting the customer know what prompted the change. In doing so, the brand suddenly creates a rift with their buyers, causing massive cognitive dissonance from the brand. Customers end up perceiving that they’re receiving the same amount of value for a higher price — which rarely, if ever, feels good.

When making a purchase decision, customers regularly ask, “what’s in it for me?” To answer that question head-on, you must address the value inside the price increase before raising your rates. You must show more and offer more, so the customer can understand how they’re benefitting from giving you more money.

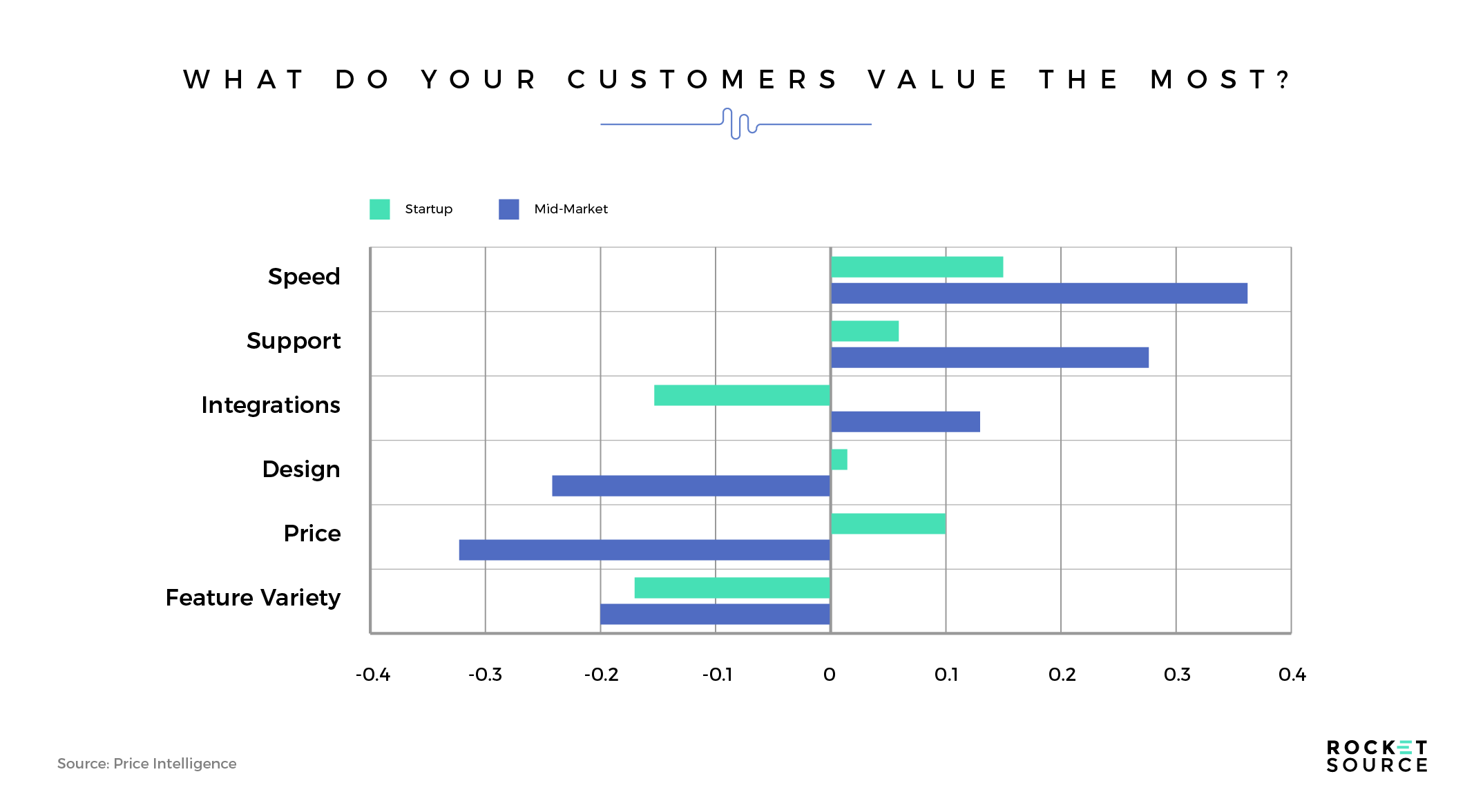

Here’s an example: let’s say you choose to increase your price by 20% to stay in line with the competition and cover the cost of sales. From your perspective it makes sense, but your customers wouldn’t be sold on that reasoning, so you’ll have to get creative by honoring what your customers value the most and then adding value that meets those needs.

You can see in this sample data that both cohorts of customers you serve — startups and mid-market organizations — highly value speed and support. Knowing this, you can turn those values into low-cost action items to accompany your price increase. Rather than doing a flat raise of $99 to $149 for a B2B Software as a Service (SaaS) product, you could look at your cost structure and see that there is opportunity to include white glove service. By adding a 15-minute chat with one of your team members during onboarding, you speed the process of learning your product and offer immediate support. That’s a value add that both markets will gladly pay $50 more for.

In this example, you’re not spending extraordinarily more, but you are showing significantly more value by aligning your actions with the value-drivers of your customers. If the support team is paid $20 per hour, this retention-driving value add is a drop in the bucket for costs. You’ve shown how you’re offering more rather than blindly raising prices to align with your competition, thus boosting acquisition and retention simultaneously.

Tweaking prices is fine, and it’s necessary over time. The way to innovate a transactional price increase is to adjust prices across the customer journey and funnel. In doing so, you not only acquire more customers, but also retain more.

Serial Discounters, Beware!

The flipside of raising prices is to lower them, another monetization strategy that requires you to tread carefully. If you’re discounting as a means of keeping up with the Joneses in your market, you’re going to incur a huge increase in costs because you’re either adding a ton more value or adding higher infrastructure costs to deliver your service.

Discounts and flashy sales are tempting; I get it. It’s hard to snub your nose at a surge in newly acquired customers. Still, many companies become addicted to seeing that spike in sales figures, causing them to lean a little more heavily on this strategy than is healthy. To show why, let’s zoom out and look at what can happen when you discount too often.

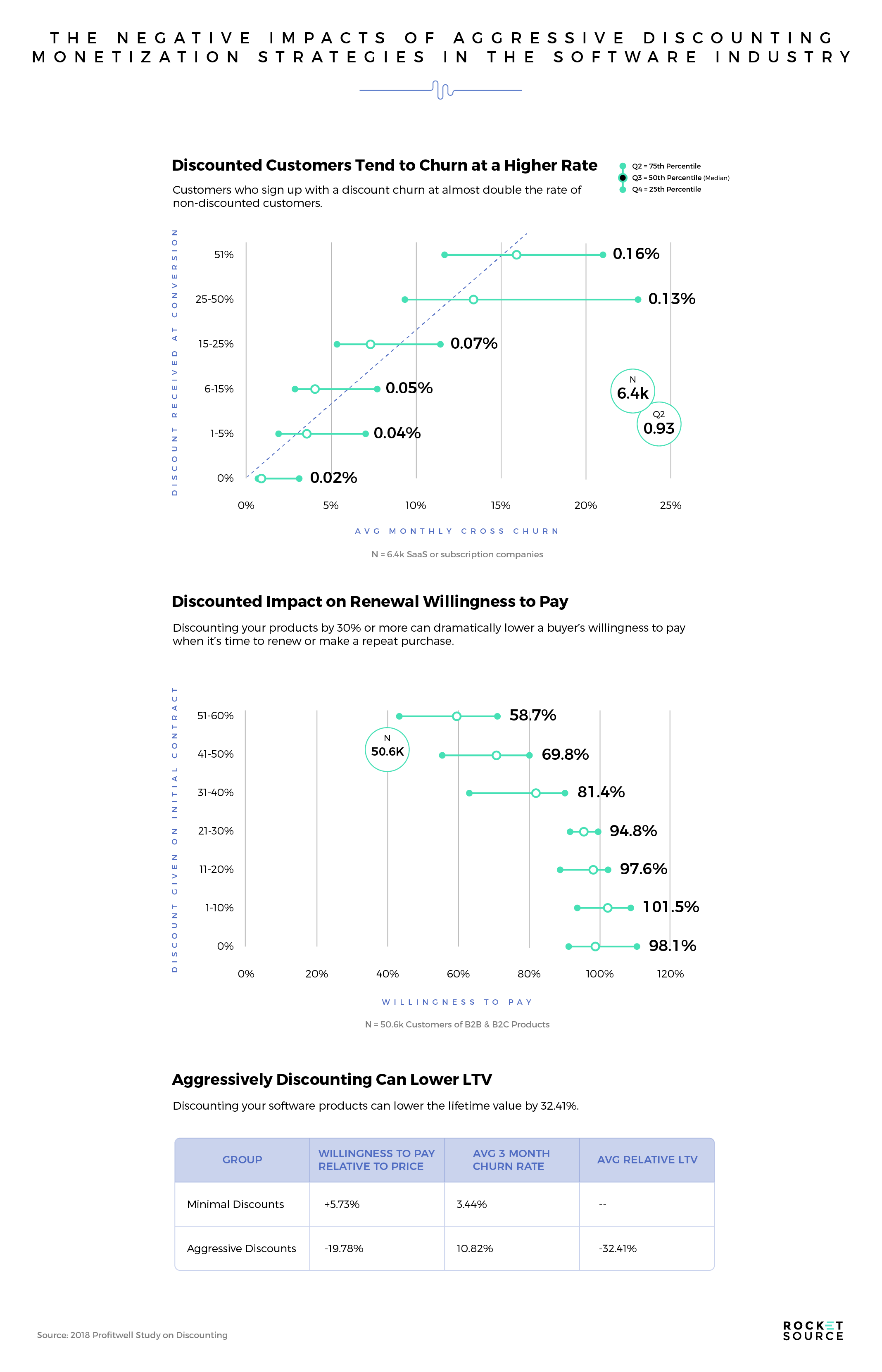

These data points were gathered by analyzing the software industry specifically, but there’s truth to the findings across the board. Although acquisition rates are higher up front, discounting benchmarks showed that churn rates of those who paid full price can double over time. Also, a customer’s willingness to pay when it came time to renew a subscription was far less among those who bought at the discounted price than those who bought at full-price. Overall, discounting strategies lower LTV by over 30 percent in the Software as a Service (SaaS) industry.

You get that discounting has drawbacks, so what should you try instead to get people in the door? 99% of the time, my answer will be to lean into experiences. Here’s what that could look like.

A few years ago, a car dealership reached out to me and asked me to innovate on their current business model. Long story short, a quick analysis of modern consumer behavior and a small data loop showed that customers were starting to demand delivery of goods. Cars are no exception to that rule. Rather than competing based on discounts and price alone, I encouraged the dealership to compete by creating an experience that felt as luxurious as the cars they were selling. I urged them to consider adopting and building a sublime online ordering portal accompanied by an out-of-home delivery service. When the car was delivered, the customer would be able to immediately accept/reject it after a test drive. At that time, At that point I hadn’t even heard of Carvana, but using a very quick and efficient data loop powered by StoryVesting data, the reliable shift in market demand of “Carvana” was quickly identifiable as an innovation on their business model which would ultimately affect their monetization strategy (resulting in a lot more net income). Instead of being transactional, I advised them to think experiential.

When analyzing your monetization strategy, think experiential over transactional.

Hopefully, your head is spinning up new ideas now. If both raising prices and discounting come with such risks, what should your organization do? How should you approach strategies to monetize in a way that will also boost retention? The short answer involves strategically optimizing your pricing strategies and revenue models. The long answer might not be as cut and dried as you’d think.

Our Approach to Monetization Strategy Innovation

As I said above, at RocketSource we thrive on simplifying the complex. Part of that simplification requires pulling out critical insights from giant data lakes through sophisticated analysis, modeling data and, in some cases, harnessing the power of machine learning. These actions are relevant here because pricing is an ongoing process driven by your data and feedback loops. While continually collecting data, you’ll also need to continually analyze the value customers perceive and receive from your offerings. Monitoring insights — from subtle tweaks of your monetization strategies to bigger changes to your overall revenue model — can help you understand where and how you need to reevaluate or adjust. Doing this requires taking a customer-centric approach when optimizing your prices.

Price Optimization Puts the Customer First

So often when I bring up monetization strategies in terms of innovation, the conversation takes a 90-degree turn to ideas such as pricing strategy, lowering prices, raising rates, matching competitors, and so on. Rather than looking outwardly at the people making the purchase decisions, professionals at every rung on the ladder look inwardly at the organization’s numbers, needs and opportunities. If you ask me, this introspection is a mistake. There’s a far better, customer-centric approach — price optimization.

Price optimization takes a customer-first approach, pulling data from your buyers and the market to find your sweet spot — the most effective place to price your product.

Finding the right price point for your product — one that aligns with your “why,” is easy for your employees to rally behind, and still increases profits — requires analyzing a wealth of data including, but certainly not limited to:

- Survey data across both the retention and acquisition sides of the funnel, Usability Scores, Customer Effort Scores (CES), Net Promoter Scores (NPS), and Customer Satisfaction (CSAT) scores

- Psychographic data pulled from qualitative feedback loops and smart empathy mapping exercises (based on real cohort data)

- Usage data pulled from cohort analytics like Mixpanel and GA as well as Heat Mapping to User Experience profiling

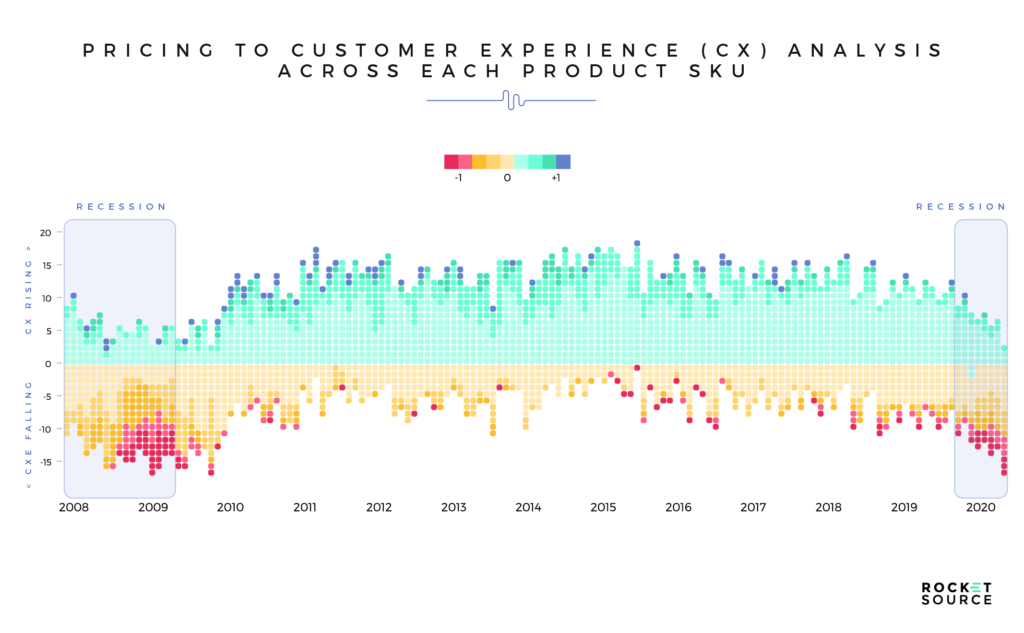

- Historic sales and brand experience data, visualized using convergence/divergence bands

- Algorithmic tweaks adjusted for seasonality and supply/demand logistics

The goal of pulling from such a variety of data sources is to lean into the trifecta of price optimization — value, desire, and profits. The combination of gathering and leveraging these and other data sets empowers organizations to balance dynamic pricing strategies by having a cornerstone starting price and a promotional strategy smart enough to follow customer demands via sophisticated data loops. Let me break down each of these areas.

Your starting price point is important. Your customer doesn’t want to feel like you played a guessing game when it came to price, but rather determined the figure based on the end-value you’re delivering. Determining your starting price points is important because they serve as the baseline for dynamic pricing strategies.

With your baseline in place, you can start unpacking strategies to optimize your price points to various seasons and purchase behaviors. This optimization isn’t as easy as ratcheting up the price on Christmas trees in December to accommodate the increased demand. For many businesses:

Innovative price optimization requires leveraging data and even deploying complex algorithms to evaluate nuanced changes in the market while simultaneously matching those results with costs and inventory levels to laser in on optimal price points and maximize profits.

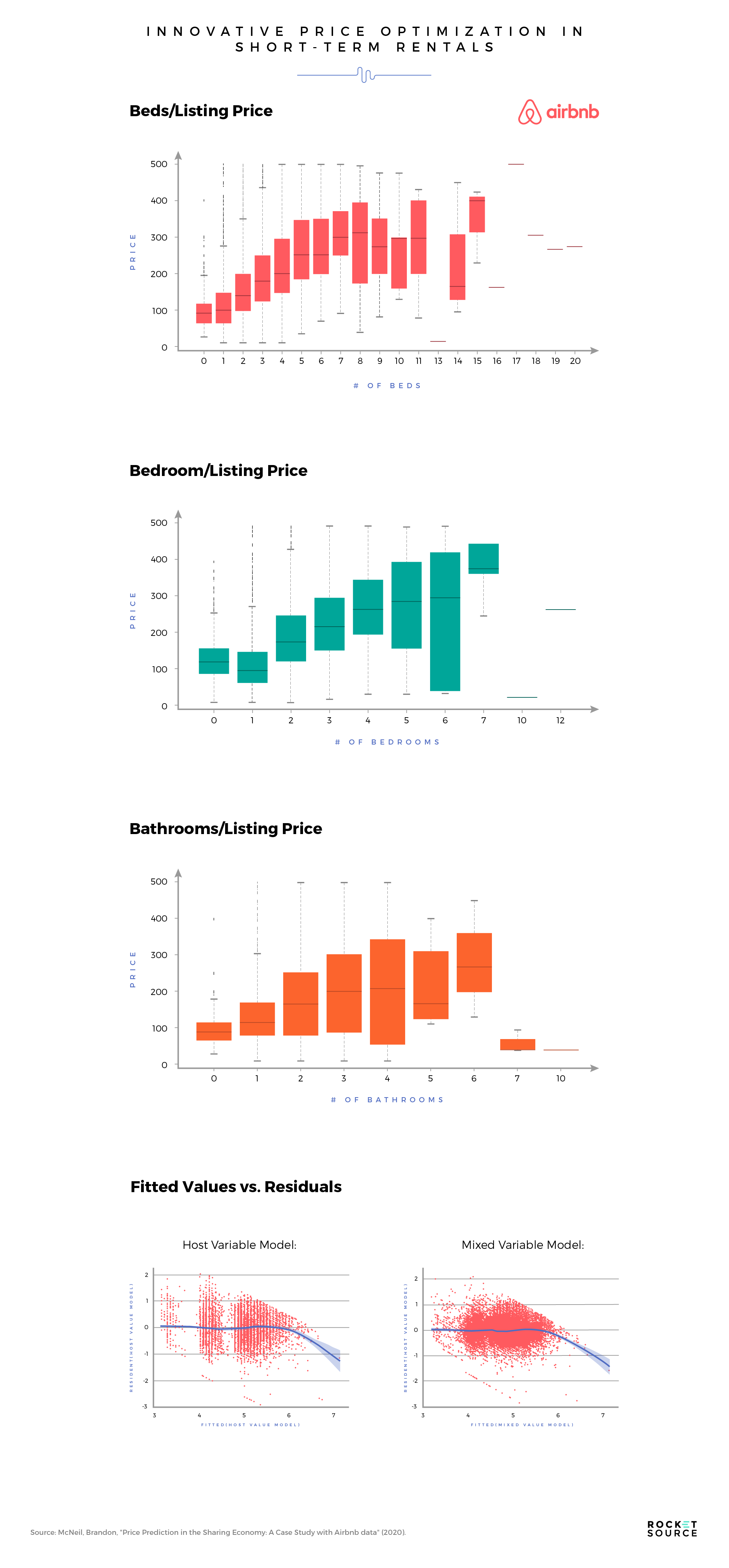

This consistent analysis and adjustment in price to meet demand is called dynamic pricing. The travel industry has done an excellent job of matching prices to meet demand — and they’re only continuing to improve. Take a look at how PriceLabs is helping Airbnb’s short-term rental property managers innovate through dynamic pricing strategies:

Revenue Management For Short Term Rentals

PriceLabs is just one company out there offering property managers a way to leverage machine learning algorithms to adjust prices on short-term rentals. Beyond Pricing is another company offering dynamic pricing to hosts, and there are more. The goal of each of these companies is to help short-term rental property managers use factors both inside and outside of their control to pick the perfect price that will yield the highest revenue.

In a recent study, the University of New Hampshire looked specifically at how models are being used to predict price in the sharing economy. They wanted to know whether factors within managers’ control had more influence over the combination of variables in the market. Their findings showed that it was a combination of factors both inside and outside of property managers’ control that impacted price, thus proving the importance of dynamic pricing against the market’s backdrop. Rather than relying on human intuition, guesswork, or the hosts’ preferences to consistently change prices to meet demand in the area, dynamic pricing tools base rates on a variety of factors, such as regional events, seasonal demand, and more. As a result, this data-driven approach to price optimization offers hosts a way to adjust prices and earn more revenue —10% to 40% more, according to Beyond Pricing’s estimates for the price of Airbnbs.

The algorithms that go into recommending and adjusting prices based on so many variables are complex in nature. However, the results speak for themselves. The better we can match data on costs and inventory with changes in demand, the easier it will be to maximize profits through price optimization.

As you can see, making frequent price changes should be done off-the-cuff. Regardless of industry, a number of factors come into play. To understand when, where, and which monetization levers need to be pulled, we start with empathy.

Monetization Strategies Start With Empathy

Often, when I tell clients that I like to start with empathy to gauge customer preferences, I see shoulders shrug. It’s an understandable response, given the fact that so many businesses have undergone meaningless empathy-mapping exercises that tend to gather dust in the corner because they lack depth. But at RocketSource, empathy is everything. While there’s a time and place for those high-level overviews, those who’ve worked with me know how much deeper I like to dig. To illustrate this point, look at the empathy map we use to begin filling out the Customer Insights Map I mentioned above. You’ll see that we truly get empathetic at every stage of the journey and on top of just empathy, we’re drilling down into that data rabbit hole to build out connected and layered visualizations as seen below.

The first map looks quite a bit different than traditional empathy maps. Not only does it include two maps — one for employees and one for customers — but it highlights other emotional drivers and cognitive associations of a brand. Seeing these two cohorts side-by-side allows us to start seeing if our monetization strategies align with what buyers and employees are thinking, feeling, saying and ultimately doing. Here’s why that’s so critical.

To stay relevant in today’s highly competitive market, companies can’t think of a strategy to monetize as a top-line game. Everything you do — especially how you design your revenue models and approach pricing strategies — has to drill down to the bottom line. Sure, you need to have top-line revenue for everything, but it’s those bottom line profits that keep businesses humming and alive. That’s why these experiences must be thought through with the end in mind. You can only grow so much with one dollar in and one dollar out. Instead, you need to bring in several dollars for every dollar spent, and then reinvest that spend toward R&D, employees, or pivoting your product into different channels.

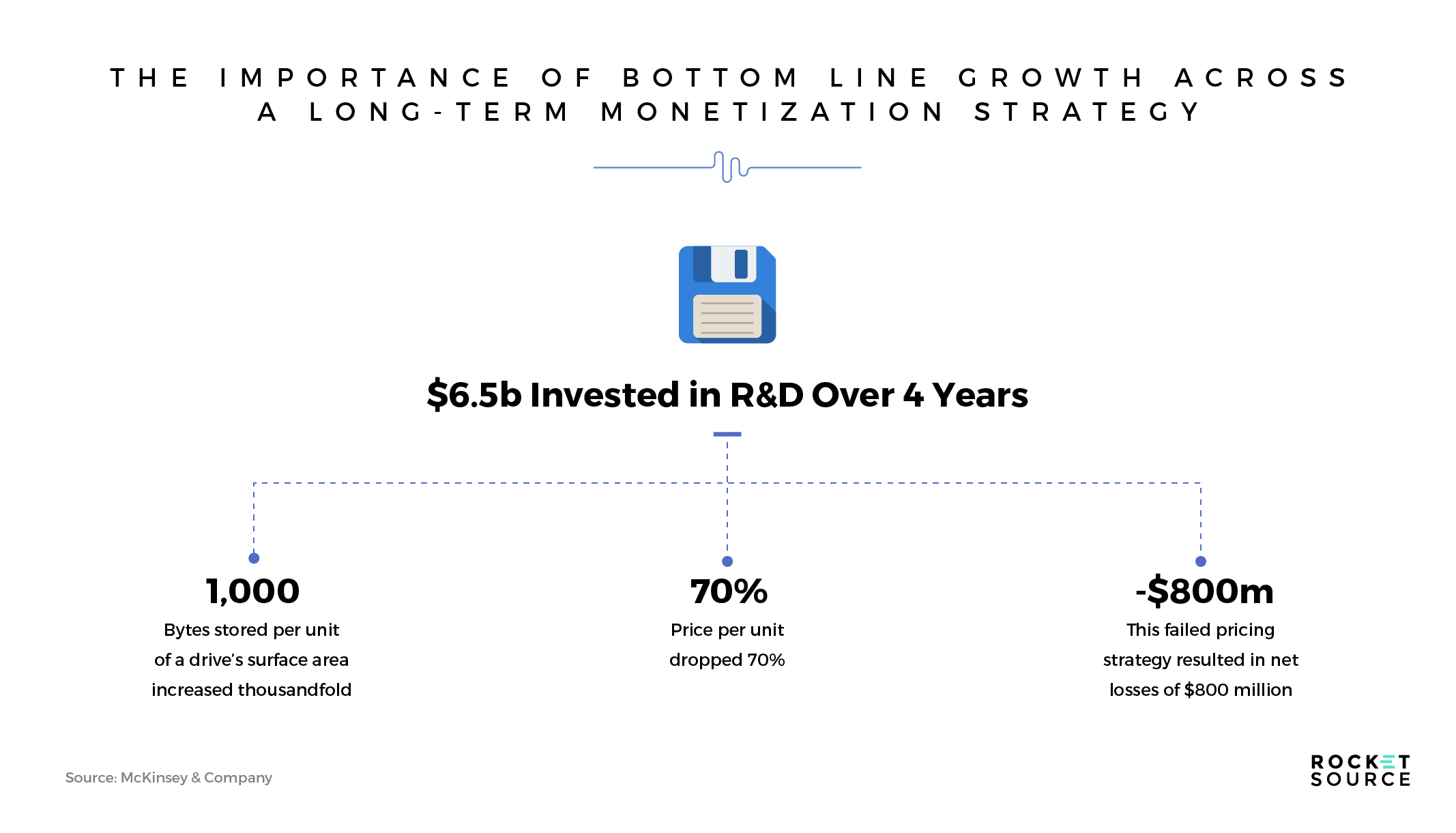

But so often, I see this fund reallocation approach go sideways. Take this study from McKinsey that analyzed the long-term pricing strategy of hard-disk drive manufacturers back in the 1990s:

These manufacturers invested $6.5 billion in research and development. As a result of that investment, storage capacity improved 1,000%. Still, they failed to eventually price their innovations correctly, resulting in a net loss of $800M. They didn’t fall short because the innovations weren’t great. Although their developments resulted in significant innovation as storage capacity improved, their pricing strategy was off. Employees put too much emphasis on the launch of the new products, stealing from their companies’ other products in the marketplace at the time. Customers didn’t see the value proposition because the IT companies weren’t focused on their experience. As a result, manufacturers set prices based on the pressures they were feeling to deliver more for less. There was no long-term pricing strategy, and therefore no chance to recoup that bottom-line growth and further drive innovation.

Bottom-line growth starts by driving the employees and customers into a blended experience.

Before any monetization strategy can take hold, your employees need to get behind it wholeheartedly. Once you have your team rallying for your brand and product line as a whole, your customers will be able to get behind the price much more easily. As a result of aligning the two experiences, both can then sync with the bottom line. By understanding those areas that truly differentiate a brand — the nitty-gritty ones that require a magnifying glass to see — a company can create customer experiences that allow their products, placements or creatives to stand apart from those of their competitors. To get there, I always start with the employees first.

Take an Internal Empathetic Response to Monetization Strategies

Whenever I go into a company to analyze growth or examine their pricing strategy, I always start by looking at pricing parity. More specifically, I look closely at profit margins first. With those profit margins in mind, I can then do a thorough gap analysis of the cost, technology infrastructure, processes, and employees’ experiences. That analysis starts with asking each employee to visualize how the company makes money.

It might seem like a strange starting point, but so often there’s a disconnect here. If team members don’t understand the company’s revenue models they’re going to have a heck of a hard time understanding the depth within the flows and customer journey at those micro-moments that involve price.

Sequence is the killer of most brands.

How you stack the dominoes matters for your conversions, growth, and operational efficiencies at scale. It matters for the way engineers architect the systems and experiences. Yes, price is one pinpoint in the customer’s journey, but it has a ripple effect throughout the entire organization when everything else isn’t stacked in the right order.

I track employee experience so closely along the customer’s journey because the two experiences need to align. If employees don’t see how a pricing strategy syncs with the business as a whole, they will be disconnected from how the customer feels along their entire journey. However, if an employee can outline how the business makes money and visualize it for me on a whiteboard, I know something’s syncing and we can move into the Customer Experience side of things and strategize how to drive that retention experience early on.

Optimizing Monetization Strategies Using Qualitative and Quantitative Experience Data

The term experience can feel fluffy if we’re not careful. Getting it right requires the use of both qualitative and quantitative data.

Quantitative data is critical for understanding how much your customers are willing to pay for your product. Watching transactional data, NPS scores, CSAT scores, CES scores, supply-and-demand data, churn rate, MRR, and more breaks you free from playing the guessing game and can help guide you in making changes. However, these data sets can get complex quickly, causing more confusion than clarity. That’s where qualitative and experience data comes into play.

Conversations with customers are just as helpful as customer journey analytics. Qualitative data comes from asking elegant questions of the people who are buying from you to dig in deeper to their emotional and logical triggers, per the StoryVesting framework. Hearing someone speak openly about your product can help you uncover the emotions they’re trying to address, as well as their perceived high-value features or benefits. Once you have this data in hand, you’re able to dig deeper into some rich analyses that will serve as a guide as you transform or revitalize your pricing strategies.

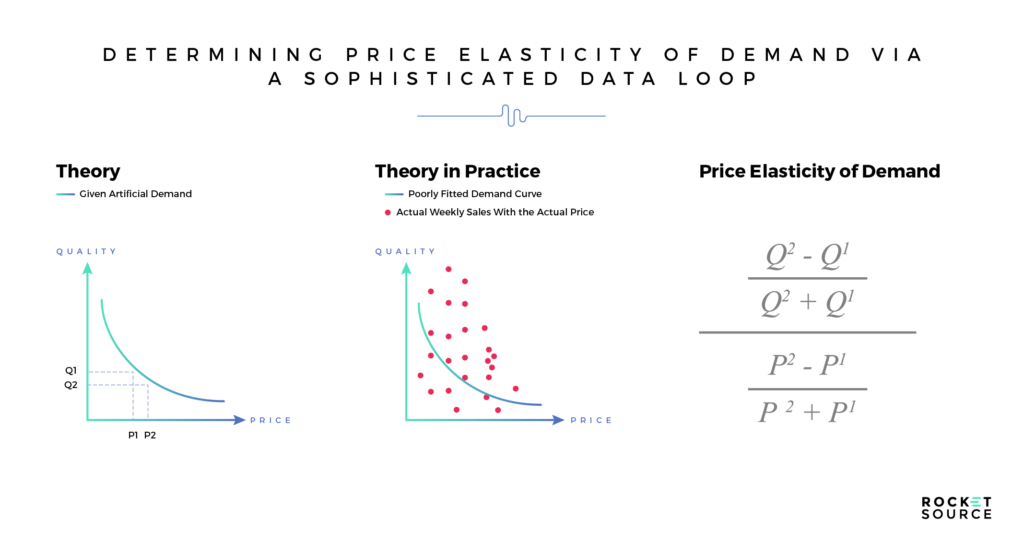

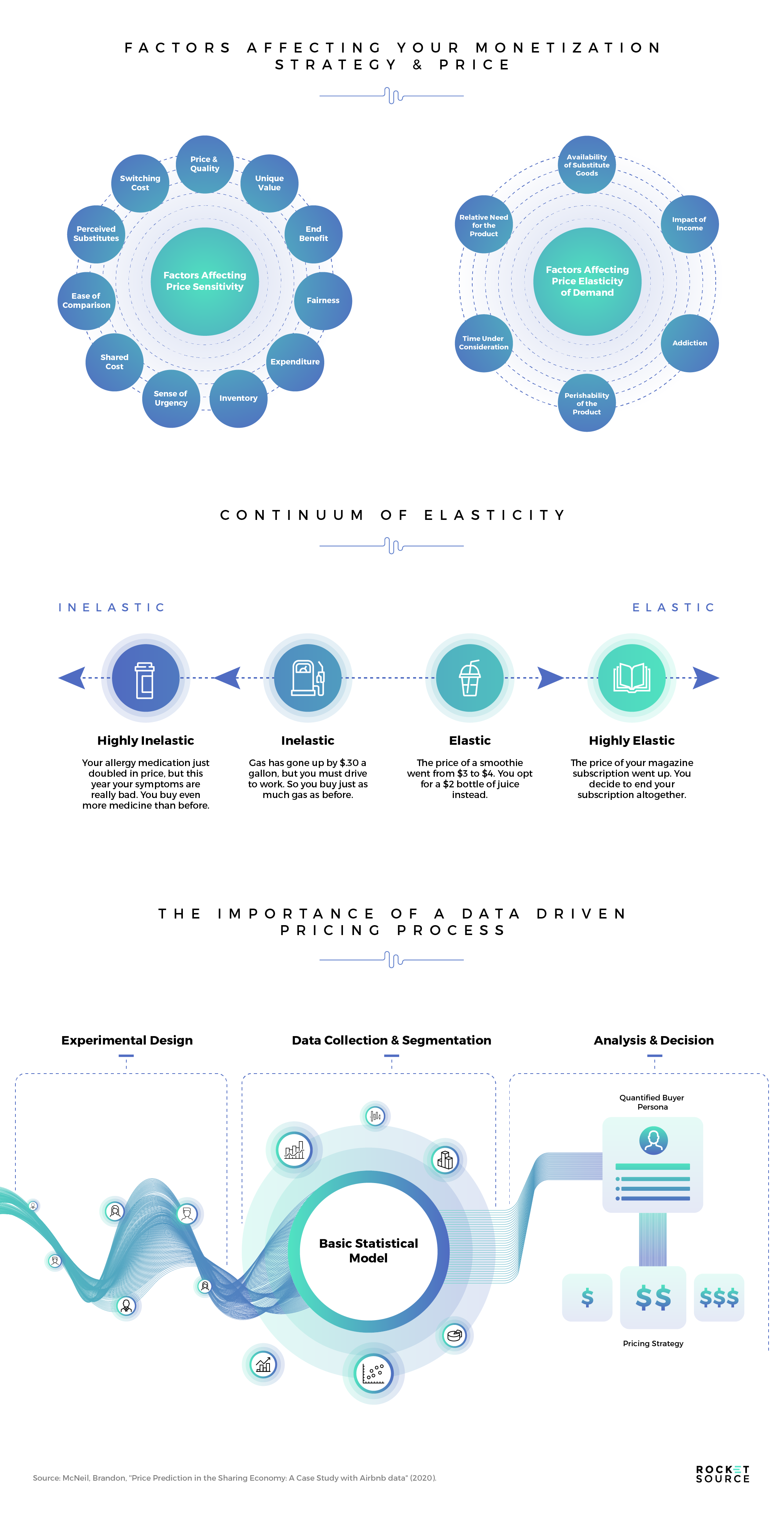

I lean heavily on two types of analyses during this process — price elasticity of demand and conjoint analysis. Let me break down how I leverage each along the StoryVesting framework here.

Price Elasticity of Demand and Your Monetization Strategies

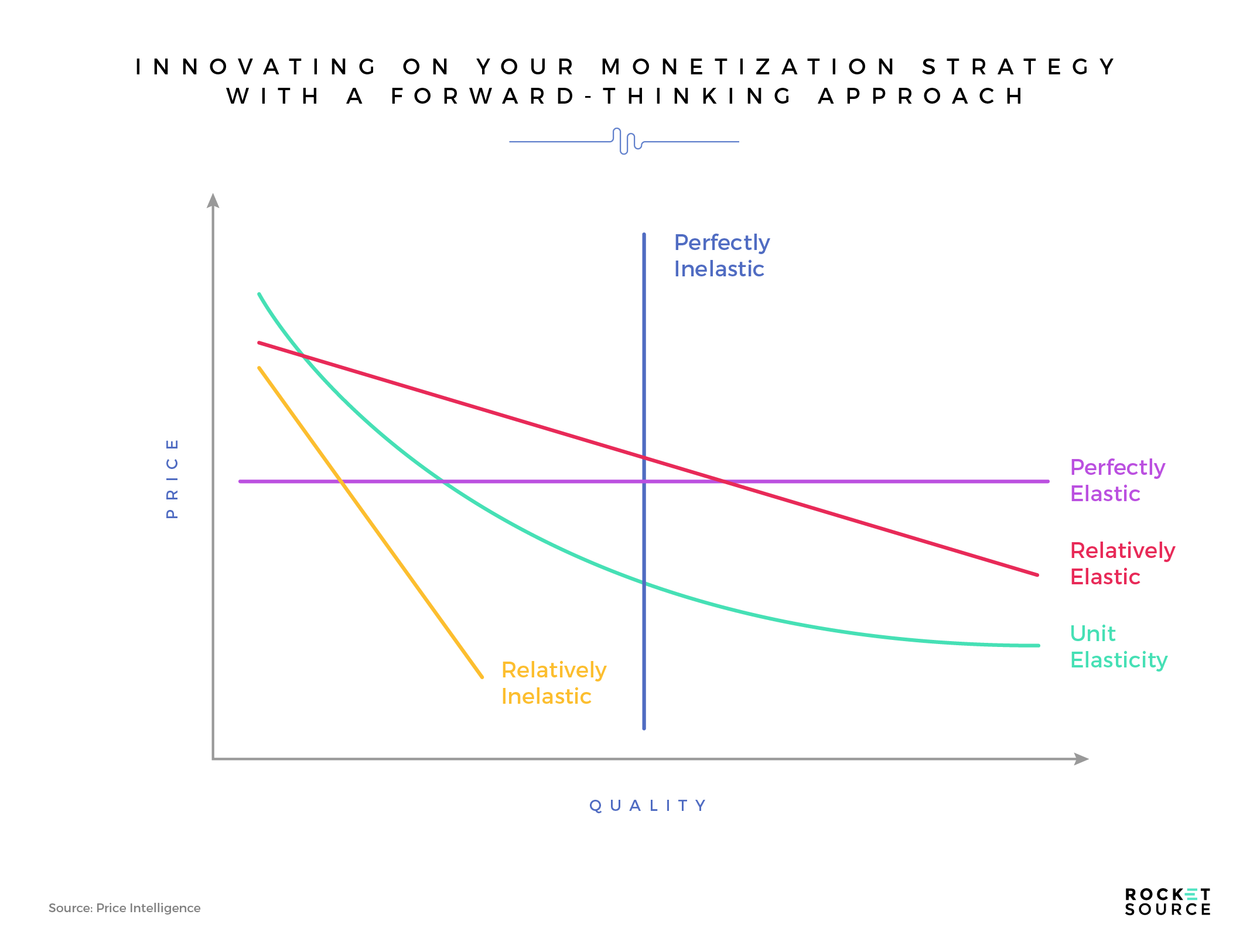

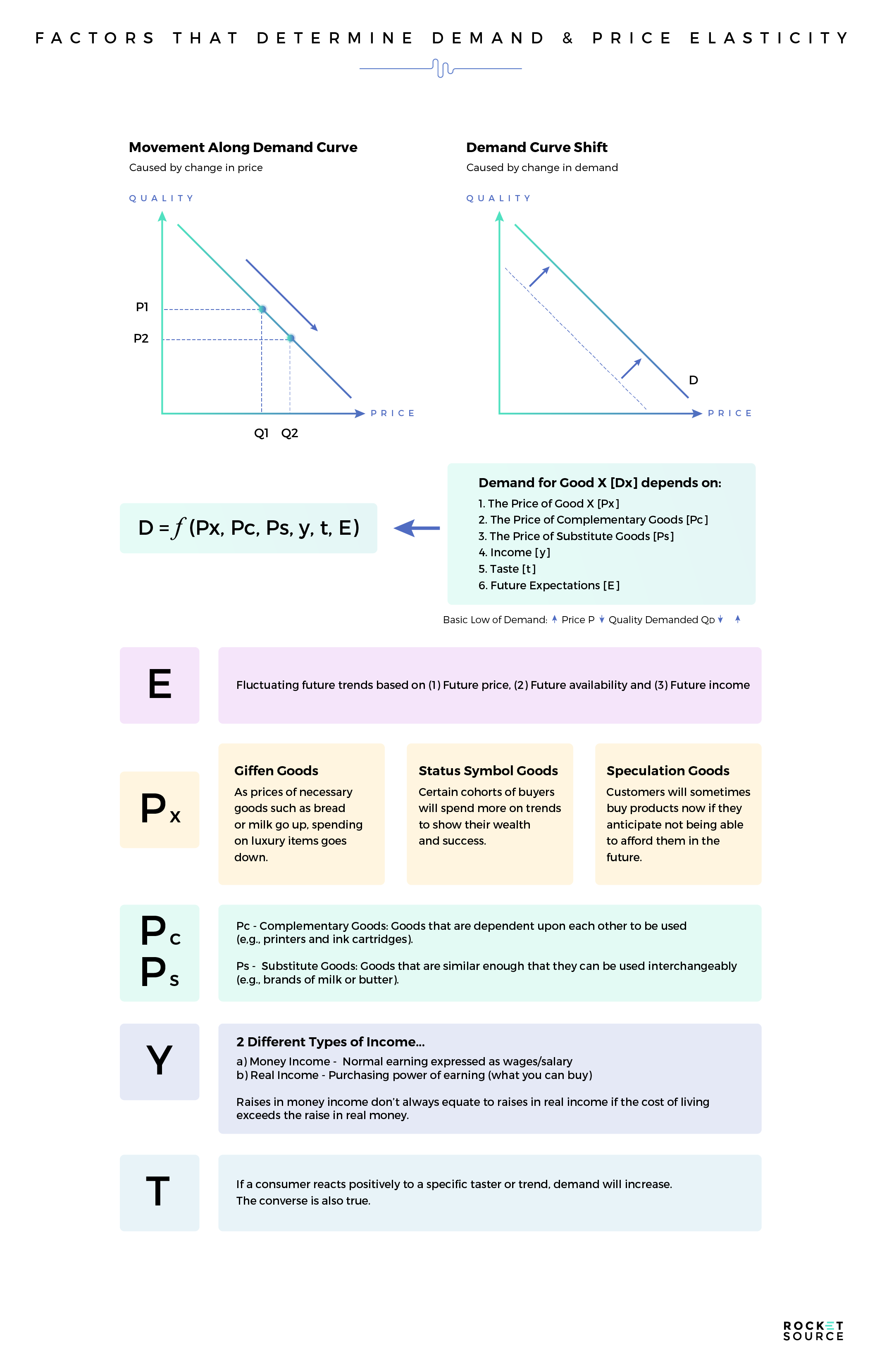

For years, I’ve used price elasticity in macroeconomic theory. I’ve also leveraged this equation to get my hands dirty on the ground in micro tactics. If you’re not familiar with price elasticity, the 30,000 foot definition is this — price elasticity is the incremental change that can affect demand in a product. It’s the following equation, which tells you how likely a person is to buy based on fluctuations in the price:

Price Elasticity of Demand (E) = (% Change in Quantity Demanded) * (% Change in Price)

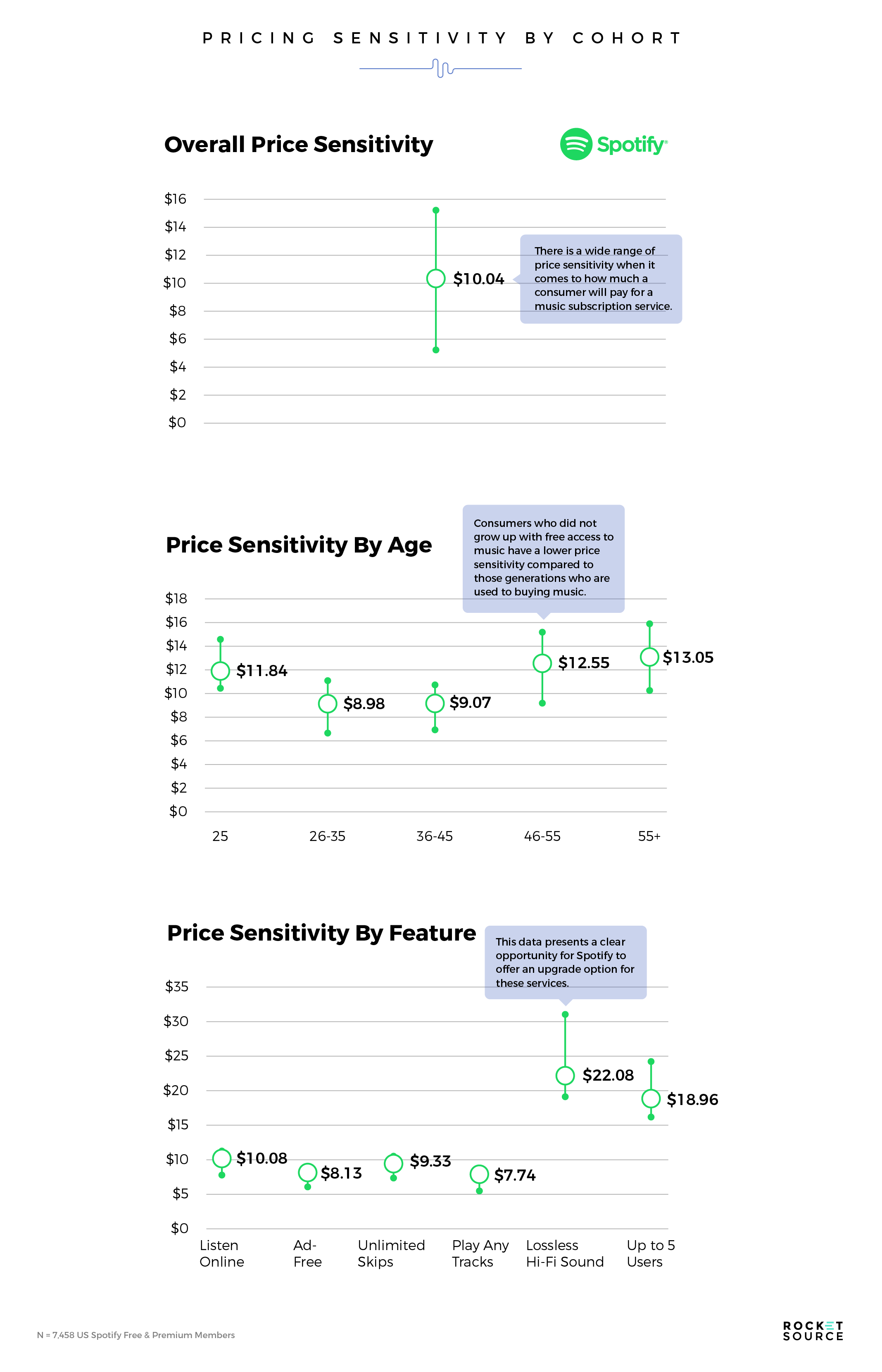

The more elastic a price is (the higher the value of E), the more likely it is that demand will shift with pricing changes. The more inelastic a price is, the more customers will be willing to buy at any price point. Typically, luxury goods are very inelastic, meaning a small incremental change in price won’t have a dramatic impact on demand, whereas products with lower price points, such as Netflix or Spotify, will see a dramatic shift in demand with a few dollars difference.

While the equation looks straightforward on the surface, certain baked-in nuances can help with price optimization. When you’re dealing with critical mass, multiple competitors have the ability to make the price more elastic. While your deliverables can go up or down in value, price typically goes up. That increase in price requires additional value to avoid creating a big disconnect between your customers and your brand.

As I mentioned before, human behavior is complex — far more complex than being able to predict how a customer will respond based on price alone. Knowing the factors that impact a person’s willingness to buy across various price points will help you know which monetization levers to pull. One of the first things I do in creating a data loop to better understand price elasticity is nail down comparative macroeconomic pricing strategies based on competitors and everything else within the pricing demand strategy, including income, taste, and future expectations.

As soon as I have this in place, I can really get granular. I work hard to get down into the internal triggers, motivations and belief systems using tools like the rhetorical triangle to ascertain how people truly reason with price. From there, I can connect that reason to the emotional trigger to see if there’s enough elasticity to potentially increase price. If there are enough value propositions based upon demand, price can safely be increased. The value proposition to demand on a macroeconomic basis must satiate the market’s desire for that product.

Price is just one element in a bigger picture, however. The company must be able to deliver on the product itself, as well as on the experiences both before the price is presented and after the customer buys. That’s why the customer journey is so dang important. Price is just one inflection point, but it happens to hold the longest tenure in people’s brains. To hammer this point home, think about conversations that take place at a party. People like to talk about the price they paid, the discounts they received and so on. Price is such an interesting component of the buyer’s journey because, for critical mass and critical inventory products, such as gasoline, impulse buys, or food, it’s one of the most relevant parts of that journey. It’s very difficult to make a change without seeing a high loss of demand.

Price is still important for more inelastic products, but the added layers contribute to the overall experience (beyond price alone). Apple is a prime example of a luxury brand that can typically charge whatever it wants without the market flinching too much. That’s because there’s so much care that goes into the experience that price becomes a backseat driver for their product.

Yes, pricing is a process. That’s why, at RocketSource, we often lean on price elasticity (as well as other analyses) by setting up a sophisticated data loop via the StoryVesting framework and then taking the temperature of the market in various ways.

By surfacing new pricing loops, analyzing buyer behavior via more sophisticated price elasticity equations (like the one represented here, which features numerous interconnected factors), utilizing the Customer Insights Map, and closing data loops with reliable statistics, we’re able to start creating and testing pricing strategies. There are so many ways to skin this cat, too. From boots-on-the-ground behavioral control group testing to split traffic testing, and through plenty of other analyses, you can start to see how multiple offers will fare in small niches with varying price-to-value propositions.

PE of Demand works fine for a specific type of Product, particularly tangible ones, but when it comes to SaaS and intangibles, we need to massively modify the generalized idea of PE of Demand/Conjoint Analysis. This involves mapping out intangible outcomes to the intangible good to better understand how each monetization lever and pivot LITERALLY affects the most important metrics in your business:

Here’s an example of how this can play out. Imagine you’re showing one group of customers all the value they get with a price. Then, you do a split test to show another cohort the same price with less value included. Now imagine that the conversion rate was the same regardless of the elimination of one value component. Sometimes, what a company thinks is a value proposition doesn’t make a hill of beans’ difference for the ultimate purchase and retention of that customer.

Back to those sophisticated data loops. If you want to raise prices, whether to compete or to cover costs, you need to know how impactful the things you’re offering under an umbrella are to that end experience. If they’re not additive enough, they’ll just be seen as increasing costs without increasing value. For example, if you’re using Intercom chat, which is very expensive, but your customers are finding the same level of value in that chat system as they would a knowledge bank, you know you can remove the chat feature to save money and keep your price lower.

Many companies have a knee jerk reaction to increasing price, but that’s the power of using price elasticity and other analyses, including StoryVesting, to determine the price-to-value proposition.

It’s important to continue keeping a close eye on these monetization strategies over time. If, after three months of adjusting, your CSAT, CES, and NPS scores are still the same, you’ll know more about your elasticity of demand. Some of the most important metrics you can use to deal with pricing impact come from comparing and contrasting at each micro touchpoint.

Comparing and contrasting the data you’ve been collecting quarter-over-quarter and year-over-year will help you understand how these changes are impacting your bottom line and your retention strategies. At one of those micro touchpoints, such as the removal of Intercom chat, you might see that your CSAT scores are 10% lower than they were the previous year. However, zooming out again, you might actually determine it’s worth cutting the service because, for the cost savings, you’d actually be able to reinvest that revenue into a retention program, making the 10% hit in satisfaction easier to swallow. In this case, a small negative impact could be turned into something much more positive by reallocating those saved funds and shifting the messaging on the retention side to simultaneously boost the lifetime value of the customer.

Monetization levers, as in this example, can be used to fuel a company’s sophisticated pricing strategy to figure out whether adjustments are worth it in the long run. However, a simple shift in pricing is more complex than meets the eye. To understand how much incremental pricing can shift a person’s thinking, it’s equally important to understand the price-to-value proposition. This begins by uncovering the right value metrics to use when pricing.

Determining Your Value Metric as the Foundation for Price-to-Value Propositions

Optimizing your price for retention and acquisition requires understanding what you’re charging for from the outset. This is often less straightforward than it may seem. As you know, pricing is very complex, and choosing the wrong value metric can be the difference between selling and retention, between your customers becoming repeat buyers or scratching their heads and then turning their attention to your competition.

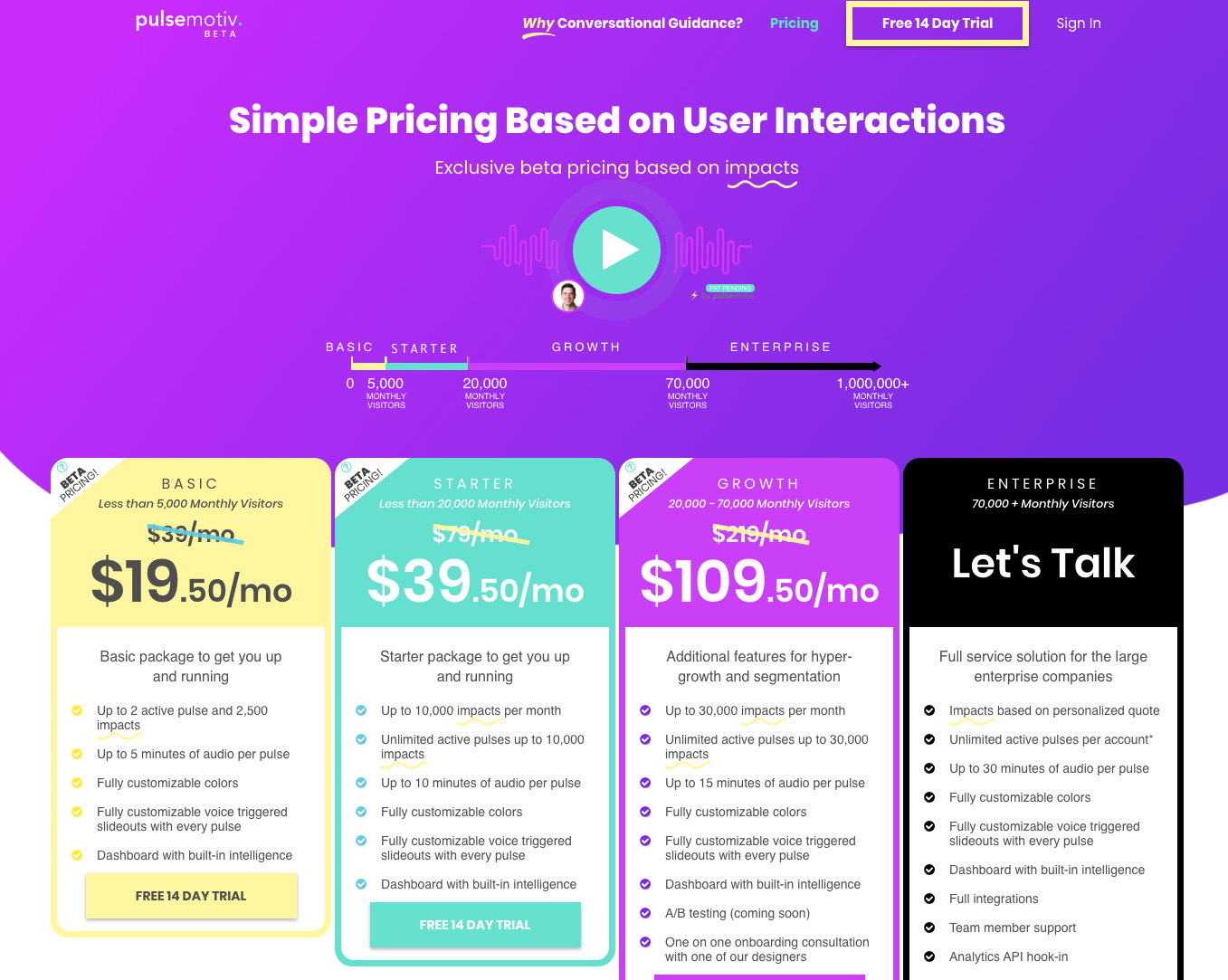

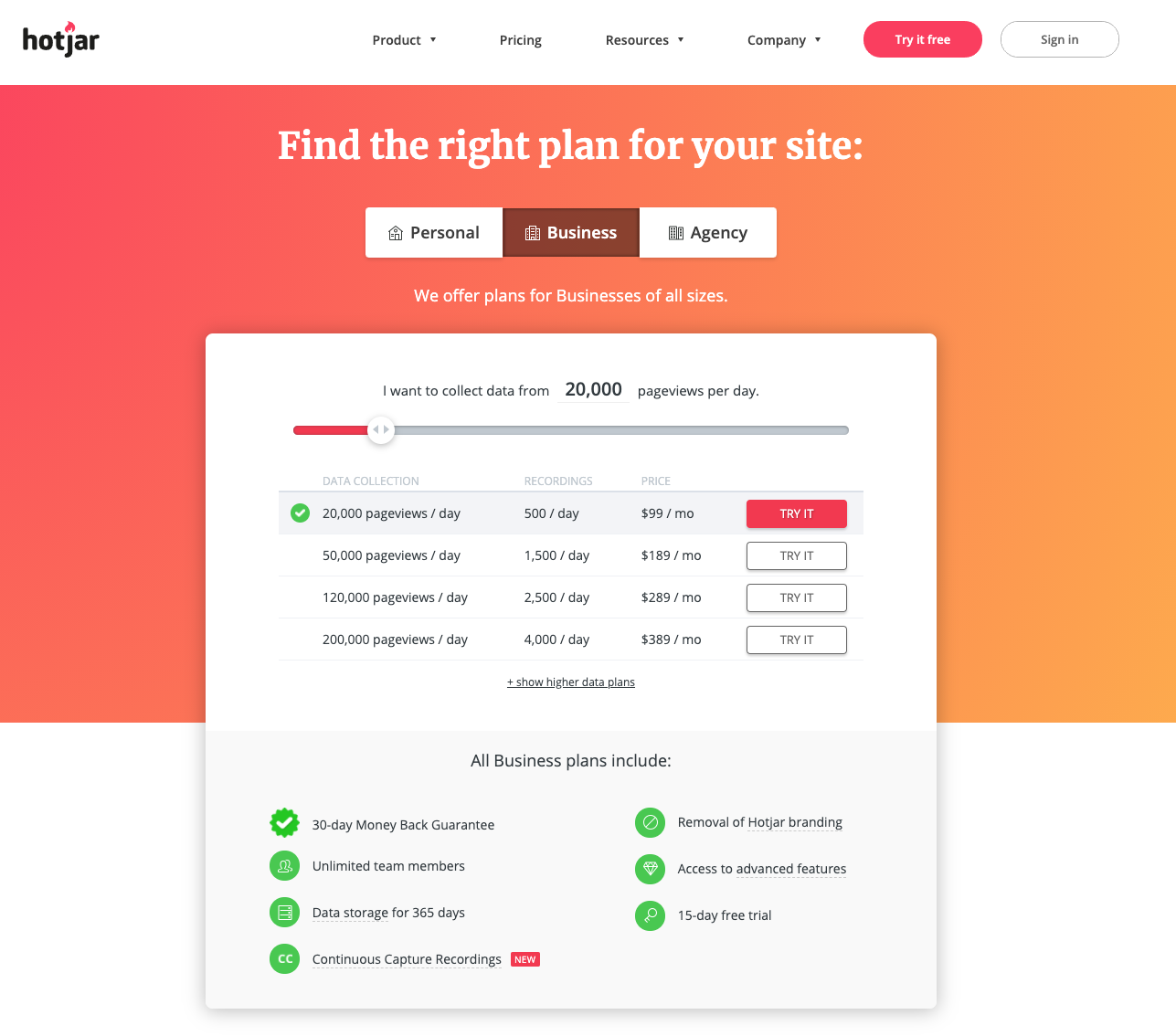

Your value metric is how you charge for what you sell. It can have a tremendous impact on your sales because it helps to answer the problem your customers want you to solve. One of my favorite examples of a company that understands perceived value and has applied it to their pricing strategy is Hotjar. Take a look at this screenshot from their pricing page:

The Hotjar team has clearly determined that pageviews are the biggest value metric to their audience. Potential Hotjar customers make the decision to buy based on whether or not they’re getting enough traffic to their site. How much they’ll pay is dependent upon how many visitors they see each day. Below this, Hotjar demonstrates the added value across all plans using other attributes that might be attractive but aren’t enough to make or break a decision to buy.

Determining a value metric isn’t quite as easy as one might think. There are often many value metrics available to each company, and multiple metrics can come into play when designing a pricing strategy. With so many ways to create pricing that drives customer acquisition and retention, things can get complicated very quickly.

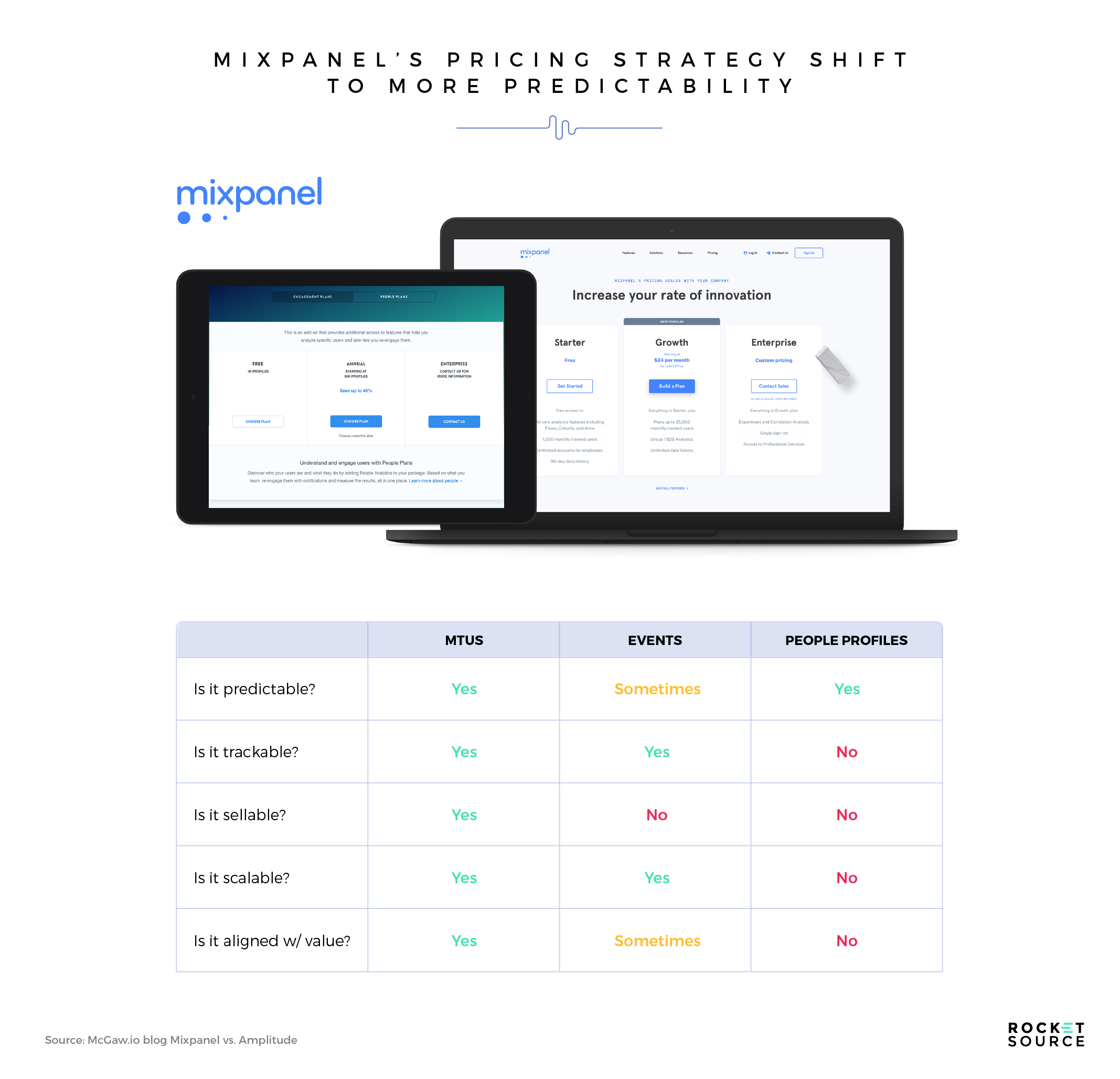

Remember importance of the micro-moment on the customer’s journey at which price is presented? Any kind of friction in the customer’s mind could cause them to take a giant step back. When your pricing strategy makes it difficult for customers to predict how much they’ll actually pay, they’ll struggle with the logic behind whether your product is right for them. Mixpanel, a company I use and love, found this out the hard way last year as they shifted to a new pricing model.

In 2019, this SaaS company recognized that their pricing model was causing confusion for their customers because buyers couldn’t predict how much they’d pay each month for the service. It could be $100 one month and $100,000 the next. Although that’s an extreme example, you can see how hard it would be for customers to account for this price fluctuation when trying to forecast revenue and costs. After much analysis, Mixpanel decided that Monthly Tracked Users was a value metric that would resonate with their customers because it aligned with revenue generation and was easier to track and forecast.

Value metrics are just one part of the pricing equation, though. Getting customers to buy and then stay with your brand for the long run requires understanding the price-to-value proposition that will hit all the emotional and logical points head on. To better understand how customers make complex buying decisions, I run a conjoint analysis.

Using Conjoint Analysis to Evaluate Monetization Strategies

Finding the value metric is only the first step. How you use that metric to position a product or service across a new revenue model requires digging deeper. Specifically, you’ll need to uncover which attributes to include in your pricing strategy to get your prices right. I’m a huge advocate of conjoint analysis to do this.

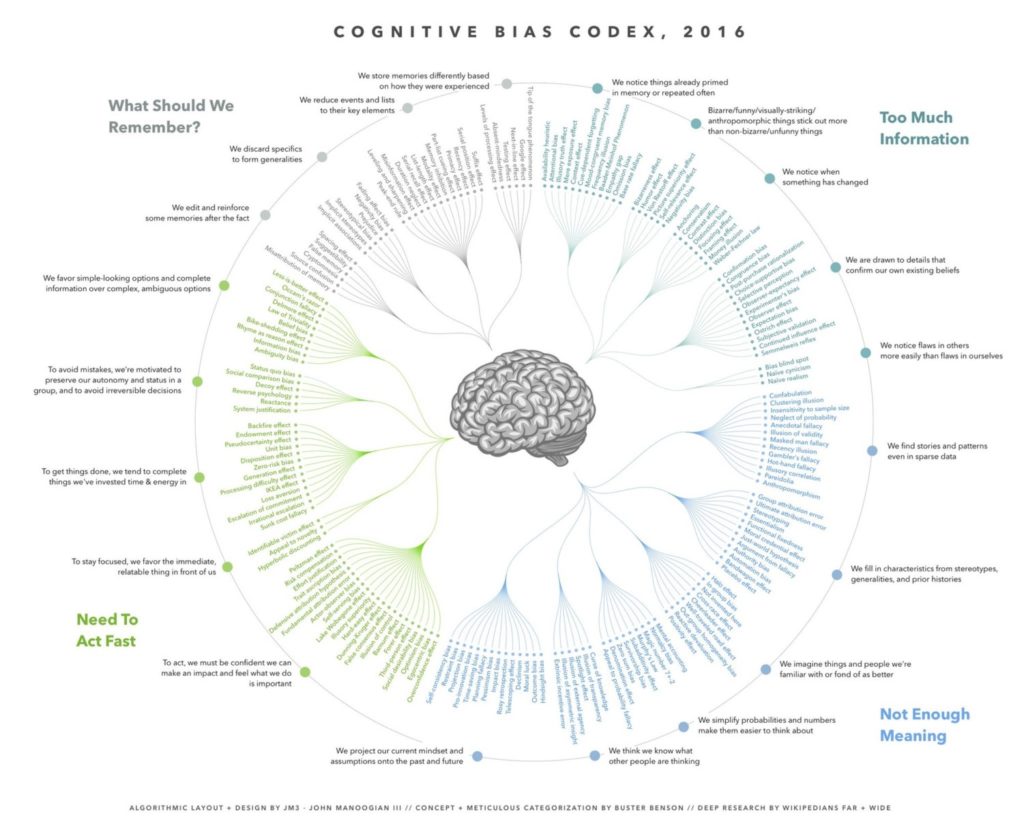

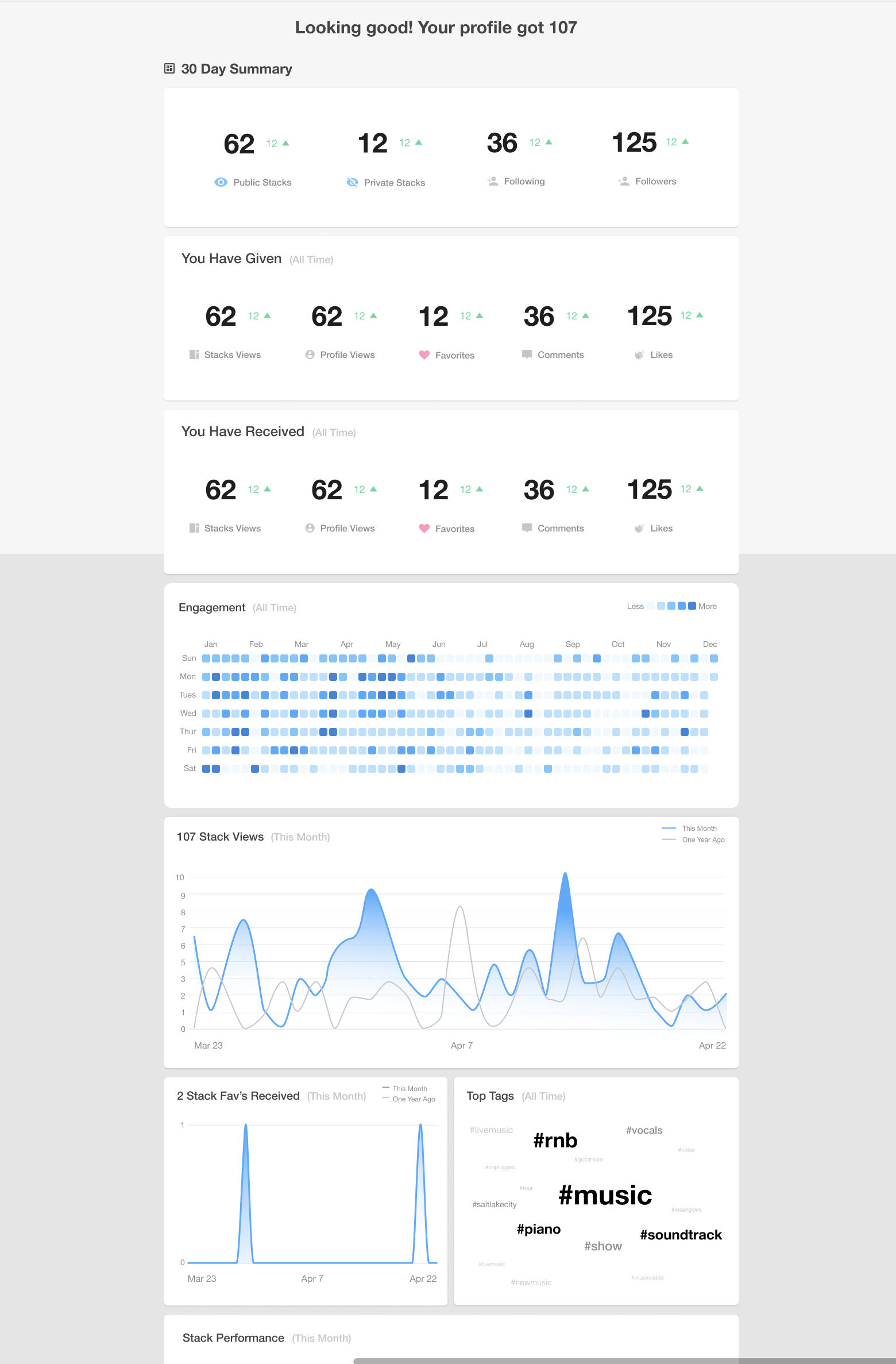

Conjoint analysis is an advanced approach to market research in which companies leverage surveys to understand how value is perceived and how purchase decisions are made. A conjoint analysis leverages data gathered through conversations, surveys and feedback to better understand: Traditional rating systems don’t quantify product or service attributes, but rather rely on strategists to sift out insights and make assumptions. I like this approach because it allows you to dig deeper into a wealth of qualitative data, determine the reasoning for your customer’s choices, and then simulate the buyer’s thought process when deciding whether to buy from you. Conjoint analysis is one of the most effective ways I’ve found to use quantitative measurements in a mathematical formula to make more insights-driven decisions. As you can imagine, conducting a conjoint analysis to uncover your own value metric isn’t as easy as it might seem. If you choose the wrong value metric you could lose potential revenue, confuse your buyers, or create an artificial ceiling on your monthly recurring revenue. There are a variety of ways to run a conjoint analysis to determine your value metric. For the sake of this post, let’s look at two styles of conjoint analysis that we’ve used to uncover value metrics and innovate on revenue models with our clients — choice-based and Hierarchical Bayes. Choice-based conjoint analysis (CBC), also known as discrete-choice conjoint analysis, is probably one of the most popular approaches out there. In its simplest form, an organization presents several features or attributes and asks the respondent to choose between them. The goal is to determine which points make or break a specific price in their mind while simulating an actual buying experience in which the customer is met with several features and trade-offs. I like this approach because it doesn’t contribute to decision fatigue. If you’ve ever run a survey or been part of one, you know how much decision fatigue can dirty the data. Instead, with CBC analysis, you’re able to assess very quickly what a person likes and doesn’t like, getting cleaner data based on the same knee-jerk emotional and logical reactions the customer will have when making real-life decisions. Hierarchical Bayes (HB) analysis is similar to CBC analysis, but is used when there are a larger number of preferences to evaluate. Rather than presenting respondents with two choices and asking them to choose between them, HB allows respondents to evaluate each attribute based on importance level. Here’s a nice visual of what this looks like from Qualtrics’ breakdown of types of conjoint analysis: In this example, you can see that the respondent is able to fine-tune the specific attributes that are meaningful to them. This type of analysis allows companies to glean more insight from smaller amounts of data to better understand which metrics matter and then laser in on the value metrics that will make the biggest impact on their audience. One of the most powerful ways we’ve used conjoint analysis at RocketSource is with our very own product, Platstack. If you haven’t yet read how we got to product-market fit with Platstack, please do. I go in-depth about how we gathered and analyzed qualitative data to know if we were onto something. Spoiler alert: we were. One element I don’t talk about in detail in that post, however, is our strategy to monetize the app. More specifically, how we approached the revenue model via StoryVesting using conjoint analysis. One of the most powerful data loops I conducted while developing Platstack centered on features and attributes. I wanted to know that what our development team was spending their time on mattered to our end users. I also needed to know that some of those features and attributes could eventually be rolled up into pricing parity, where the user would be willing to pay for certain features so that we could shift from a freemium model to premium one by offering XYZ features. To unpack the hundreds of conversations we were having with potential users, I assigned a rating — a quantitative measurement — to those features and attributes. Then I segregated the attributes and presented them to an n50 pool of alpha testers, asking each tester this question: Would you pay $4.99/month for only one of these features or would you require all of these features to be present to subscribe? I found very quickly that in certain instances and data loops, only 10% of users would pay for one feature. That wasn’t enough to charge for a single feature, so I knew we needed to have all three features working together in harmony to eventually charge $4.99/month on a subscription basis. I closed this data loop in my data cycle by adding additional features and attributes. I then went back to those same users and asked them the question again. Would they pay for one feature or would all the features need to be in place to pay? The goal was to get inside their minds to understand how they thought of the value propositions using this product. Through the StoryVesting framework, I wanted to see: This process is one of the hardest things to get right because purchase decisions are so dang complex. Too often, organizations generalize ideas about paying and about marking things up. This approach is too basic given how the human brain works, so product owners have to get clever with pricing strategies and understand how they roll up into larger revenue models. In a conjoint analysis, knee-jerk reactions are compelling because what seems like a quick decision on the surface is actually highly complex. Take a look at this cognitive bias codex showing the variety of neural pathways that are ignited as a customer compares various offers: When you see just how complex the purchase decision process really is, it’s clear why organizations spend a fortune trying to find the best customer journey and monetization path. Monetization is undoubtedly a growth lever, and positioning it correctly at the foundational level is critical. If you don’t get this foundation right, when you start pushing other growth levers across acquisition and retention, your approach will be too loosey goosey. All your efforts will be for naught because you’ll have forgotten how to put together revenue models and pricing strategies that sync across the user’s experience with all of your brand’s offerings in that micro-moment move from emotional to logical reasoning. Consider Apple versus Android. Apple has honed in on the emotional and cognitive triggers of their customers to create a gorgeous experience through its design and functionality. This customer experience has allowed them to be sustainable and charge higher prices than anyone else in their space. Android, on the other hand, hasn’t been sustainable because they’ve been driven by comparative logic alone. They charge for attributes and features alone rather than pricing their products based on pathways and experiences like Apple does. Apple’s approach causes customers to gravitate away from choices based on price alone, thus pulling market share from the competition. With Platstack, it’s been challenging to determine how much value users place on features. There are so many other factors — location, cohort, and more— that contribute both to whether a person buys and whether he stays on board. We’ve gone through a tremendous amount of difficult iterative strategy, research and data wrangling just to determine how much someone will pay for a product and how long someone will stay to increase the lifetime value (LTV). Remembering those pathways and experiences is critical. You must consider the entire brand experience — how buyers interact on your website, the people they’ll interact with, how they find your offers in the first place, and what’s included in your product — when building revenue models and adjusting pricing strategies. For me, looking at the experience as a whole is a much more conducive route to adjusting pricing and doing a fair value conjoint analysis. While you can outlay all sorts of methodologies, it’s really nice to be able to steer those decisions within a framework using sophisticated data loops to make robust decisions. I’ve said it before and I’ll say it again: although acquisition is important, retention is critical to your long game. Perhaps unsurprisingly, companies that lean into price optimization and regularly analyze their strategies to monetize realize far more LTV from their customers than those who only focus on acquisition. The way to understand LTV or, more specifically, the cost-of-acquisition (CAC) to LTV ratio (CAC:LTV) is by setting up sophisticated data loops and then adjusting where needed. Sometimes when I say the term data loop I’m met with furrowed brows, so before I get in too deep I want to clarify what I mean. A data loop encompasses the entire data collection, science, and visualization process, from gathering data to gleaning insights. The goal of any data loop is to continually keep a pulse on what’s happening in all aspects of the market — with customers, employees, or just about anything else you want to track. Pricing in particular is often treated as a set-it-and-forget-it element in the business model, with companies failing to leverage data loops to continually optimize their prices. That’s a big miss if you ask me, and the data backs this sentiment. As evidence of why I’m such an advocate for iterative pricing, look at the impact continual pricing analysis can have on the bottom line: In a SaaS pricing strategy study by Price Intelligently, you can see that companies that conducted an annual pricing review saw a blip in bottom-line growth. However, companies that approached price optimization on a continual basis saw significant increases in bottom-line growth by boosting their LTV:CAC ratios. In addition, the time it takes companies to pay back their CAC happens almost immediately when price optimization is taken into account. Tracking the right metrics across the customer journey will shed light on how well you’re paying back your CAC and what your LTV:CAC ratio looks like. If it doesn’t match your expectations, that probably means that what you’re doing is focused more on the acquisition side of the funnel, leaving massive opportunity on the retention side. Here’s an example of what those metrics might look like across the entire customer journey, as well as the estimated value associated with each one: There are many metrics you can track and analyze across the customer journey, depending on your monetization strategy. What’s important is that you’re consistently closing out the data loop on the retention side of the funnel so you can see where the bigger numbers enter in and how they will help you shorten the payback period. By the time you actually implement a pricing strategy, you want your customers to stay in your funnel as long as possible so you can increase LTV. If you’re going to spend $2 million on product development, you have to be confident that you’re going to get $5 million back. That’s why pricing today has to focus on the entire customer journey, as well as word-of-mouth and the viral coefficient. Word-of-mouth marketing is important, so let me address it as a way to close this data loop. It takes so much labor and time to figure out the perfect revenue model and pricing strategy that you want to be sure that, at the end of your efforts, you’re able to get people talking. Price is one way to do this. People love talking about what awesome new thing they just bought. As evidence, think about the things that are cool to you and how you talk about those with your friends. Chances are, you talk more about the value and benefits first. Price is secondary in that conversation. Figuring out how to generate word-of-mouth starts with monitoring customer habits. To do this, we’re innovating on a data visualization dashboard that lets you quickly and easily spot trends year-over-year. We firmly believe that data visualization is key to helping executives and organizations gain additional buy-in on just about any initiative. Strategies for monetization are no different. We know shifting pricing strategies or uprooting a revenue model isn’t easy work. There are some pretty significant growing pains built into these shifts, but visualizations like the one above can help ease these challenges. In this simple data visualization audit, you’ll be able to see exactly what individual users or specific cohorts are doing and how often they’re doing it. Watching those buyer behaviors is powerful because it allows you to put them under a microscope and address them in your advanced pricing analysis. You can highlight product lines or channels against price sensitivity to DAU or MAU and really analyze what’s happening in the market with your particular business. These visualizations are powerful additions to your organizational buy-in initiatives. Right now we’re tinkering with how to use this type of visualization inside our Platstack dashboards. Here’s what we’ve come up with to date: This dashboard showcases total user engagement across an entire year on a specific channel. Taking this approach helps us better understand how pricing changes, revenue model changes, and more could affect the community as a whole, yet it’s drilled down to just one specific user. This approach is far easier to digest and decipher. It says a lot about time periods versus specific consumer behaviors and allows you to measure various elements such as engagement, time on app, number of times logged in, etc. As you determine your costs and aim to lower the CAC:LTV ratio, it’s important to look at these data loops and visualize your data in a way that’s quick to digest. These visualizations of complex data loops are powerful ways to quickly and easily gain organizational buy-in, giving you more room to really get innovative with your revenue models and pricing strategies and blowing the competition out of the water. By now I hope it’s clear that if you want to innovate, you need a heck of a lot more than a bump in price or a flashy sale. Think back to when Blockbuster was being demolished by Netflix. It wasn’t because of the one-off costs. It was the act of combining price innovation with how customers found and consumed content. Netflix created new and innovative ideas in pricing, and the results speak for themselves.Choice-Based Conjoint Analysis

Hierarchical Bayes (HB) Analysis

Leveraging Conjoint Analysis Using the StoryVesting Framework

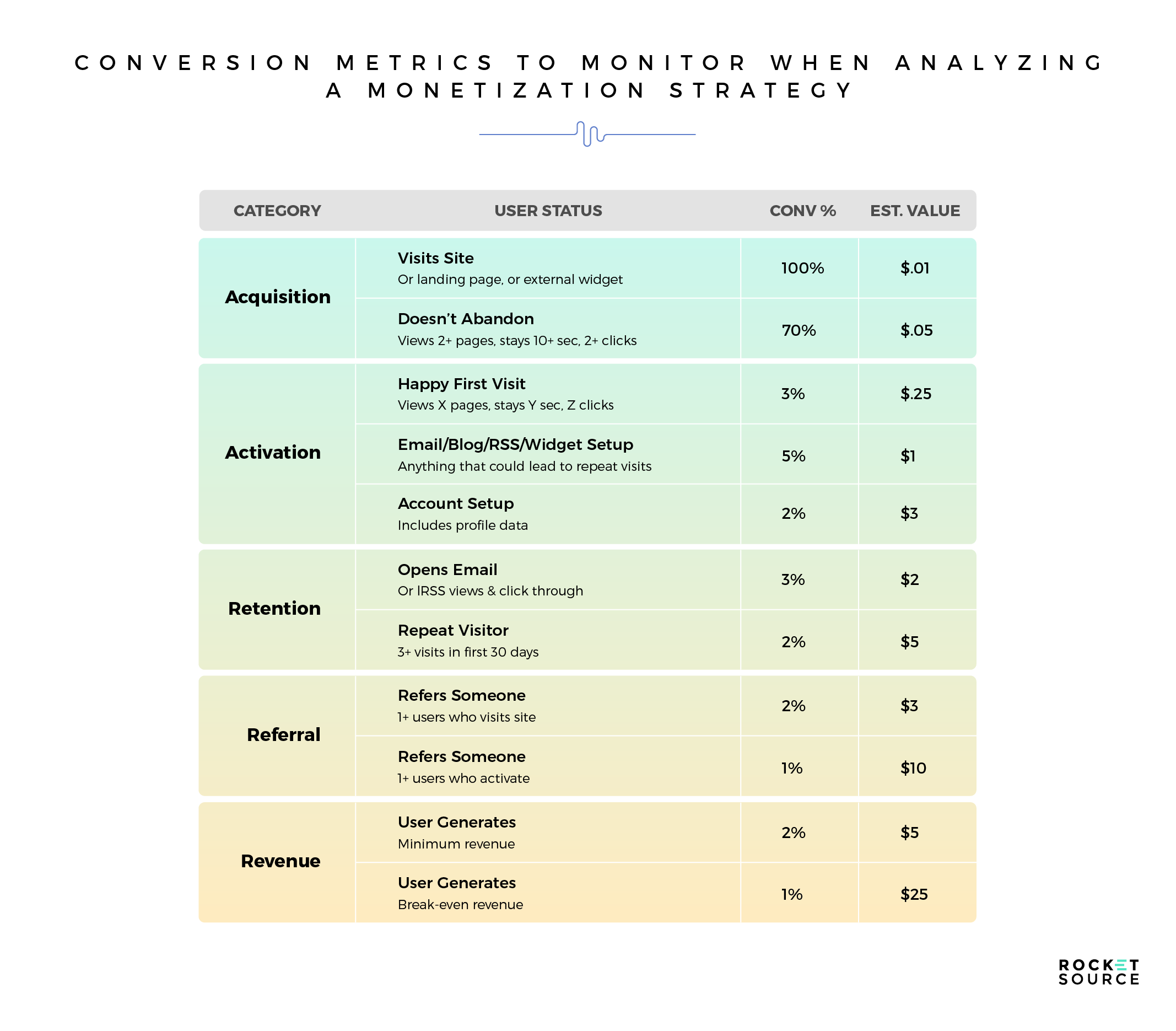

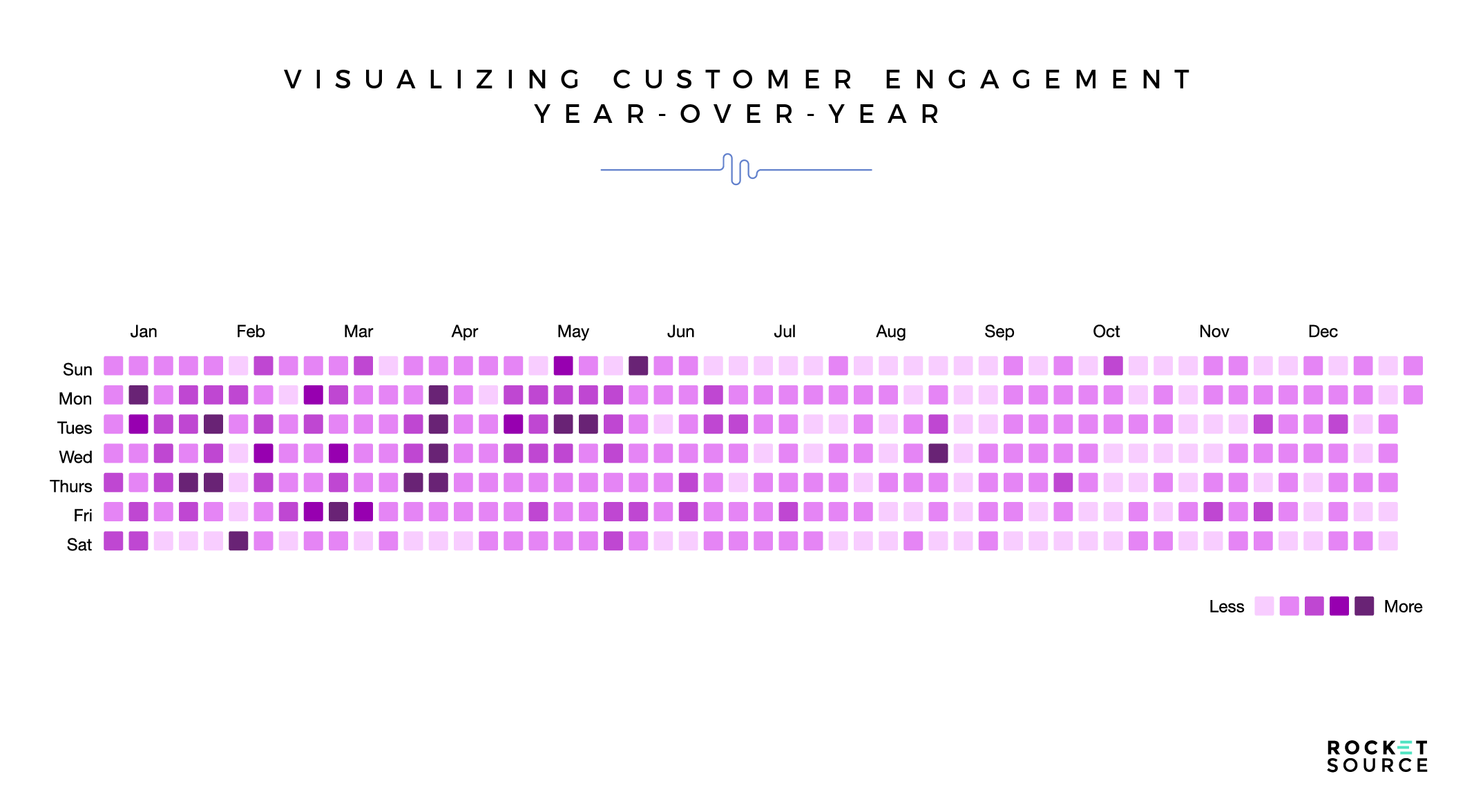

Deploying Sophisticated Data Loops to Better Understand Your Monetization Strategy

An Innovative Monetization Strategy Can Improve Customer Experience

The Freemium Model: A Non-Negotiable

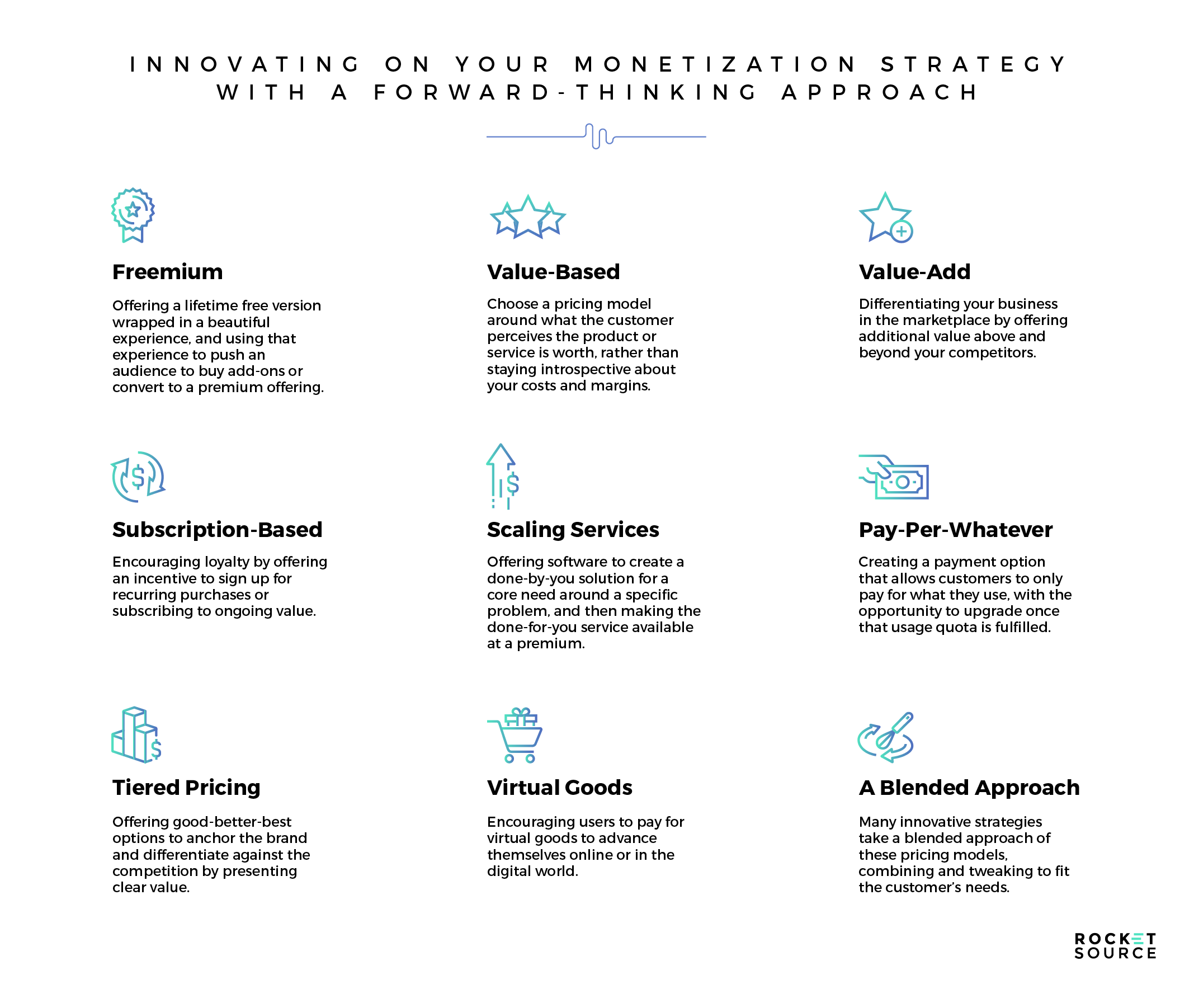

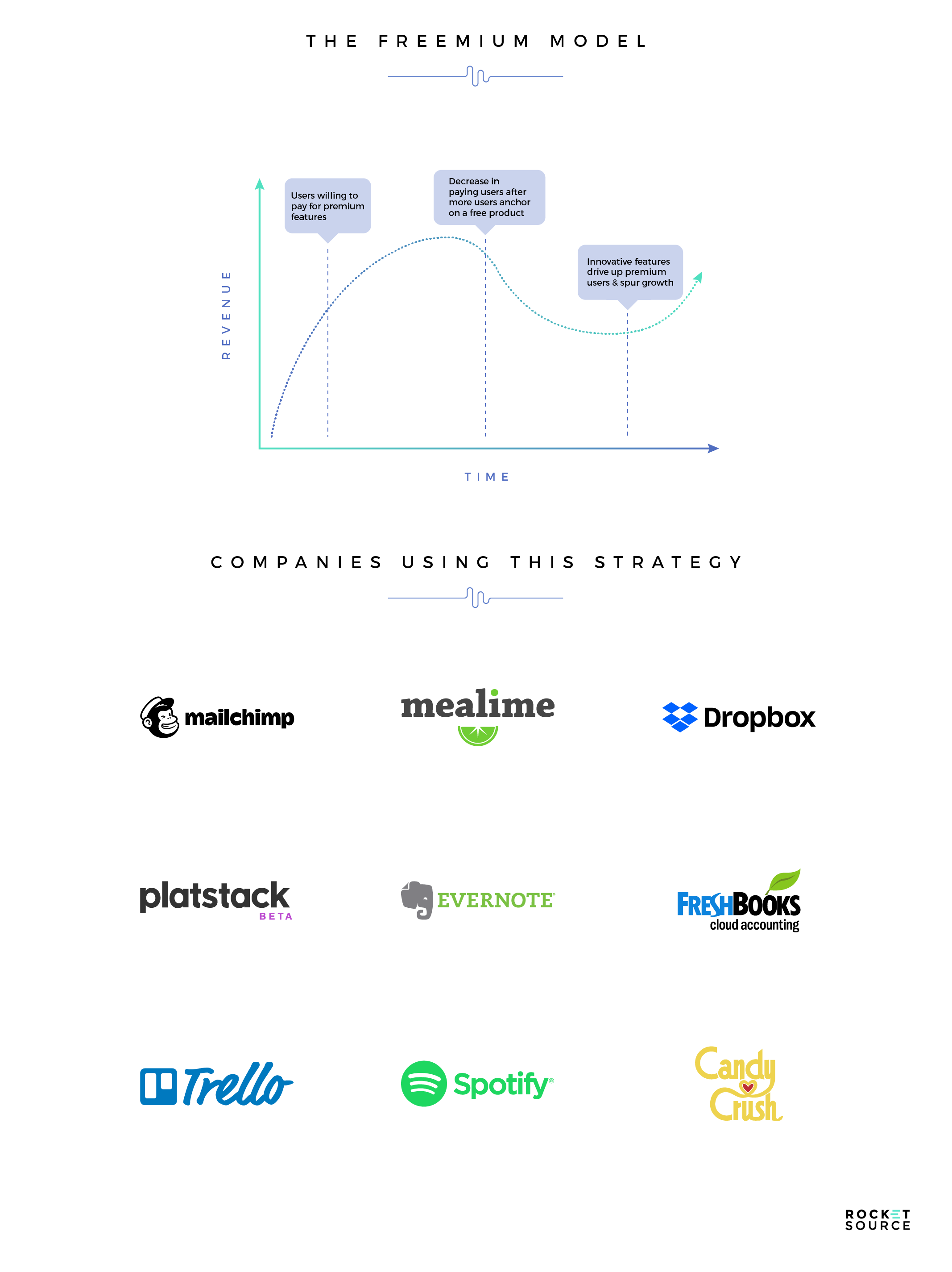

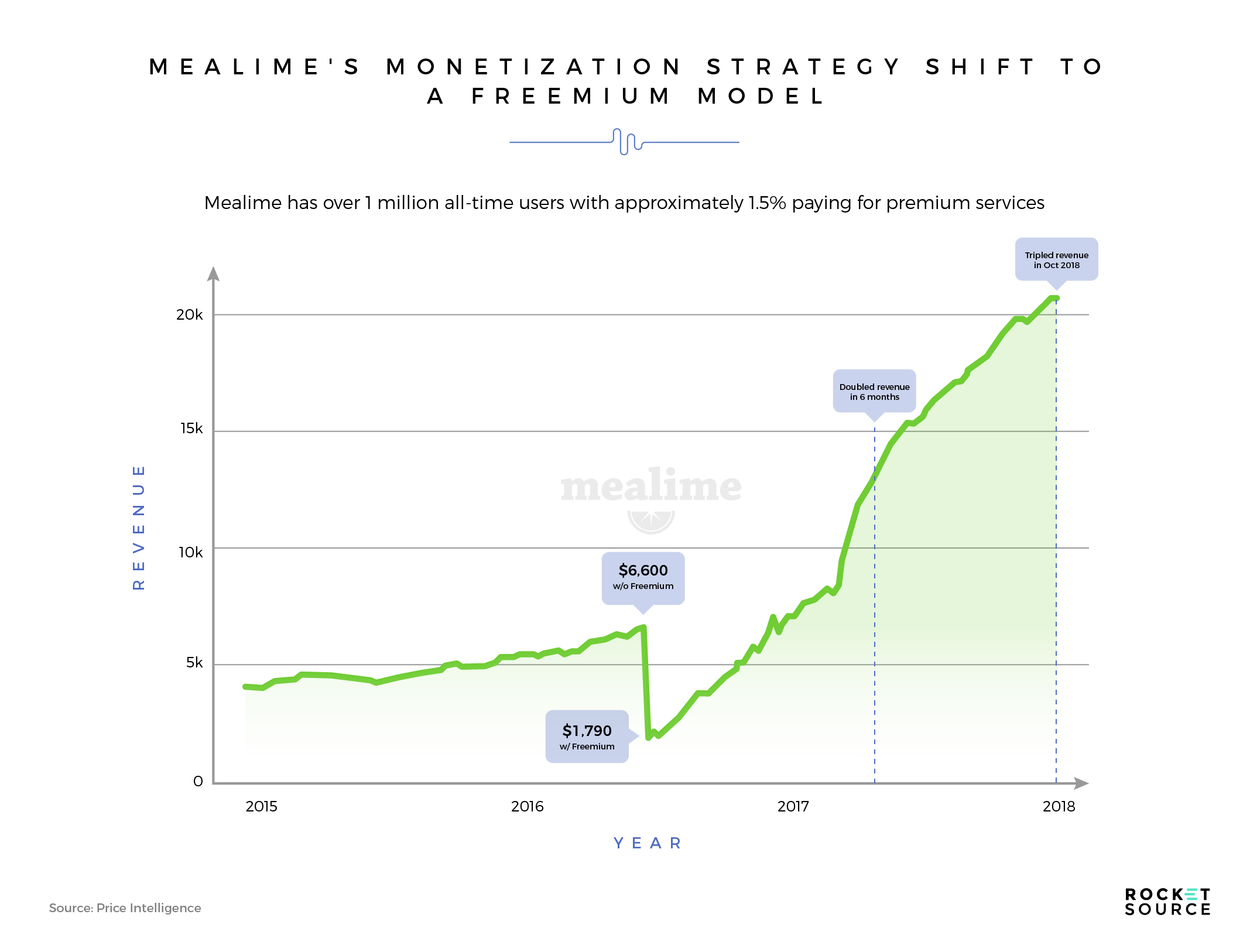

It’s safe to say that the freemium model has taken over the B2B world — so much so that you might be wondering why I include it first in “innovative” revenue models. If everyone’s doing it, is it really all that innovative? The answer is still yes. I’ll get to why in a second, but first let’s make sure we’re on the same page about what freemium means.

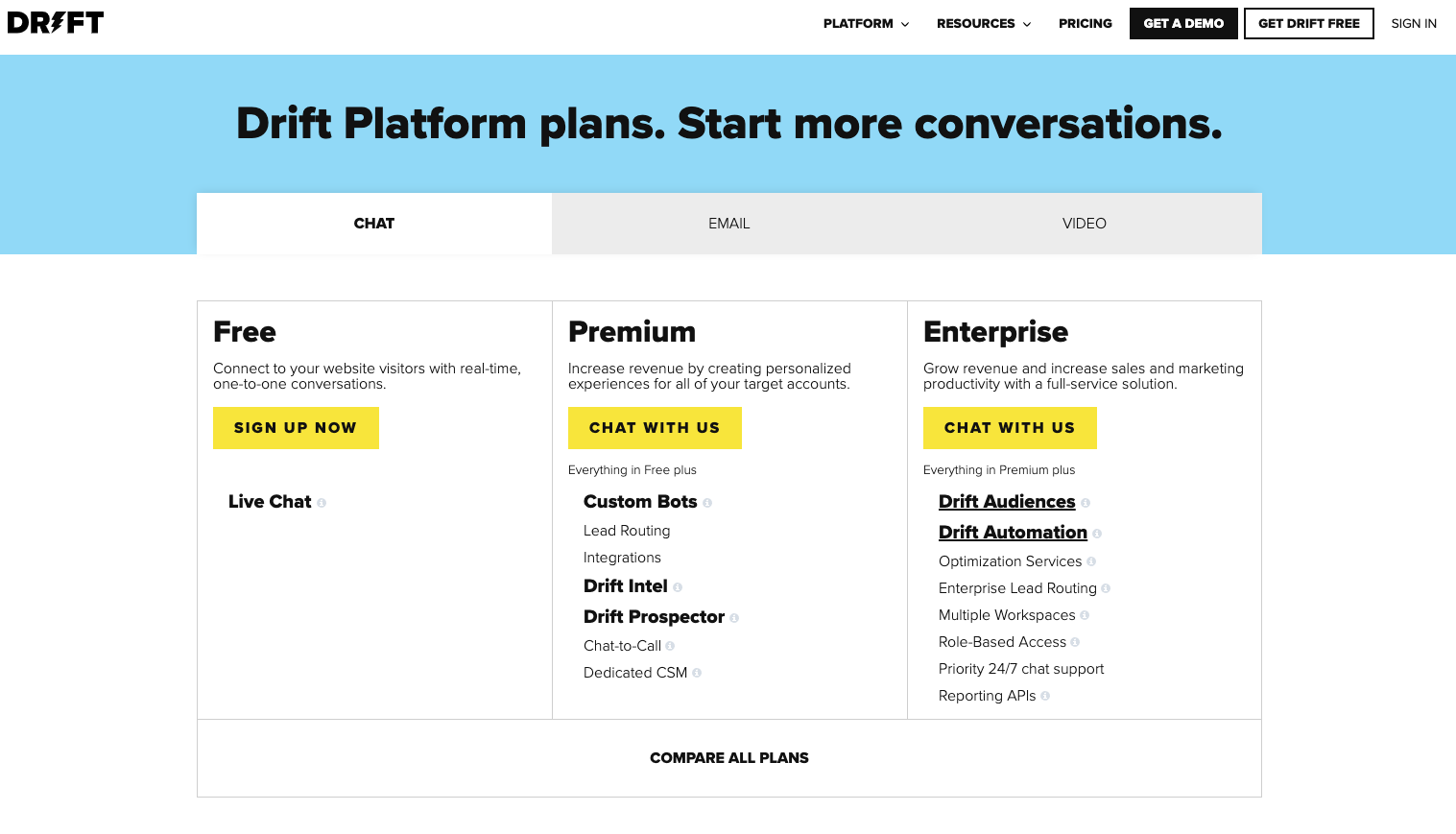

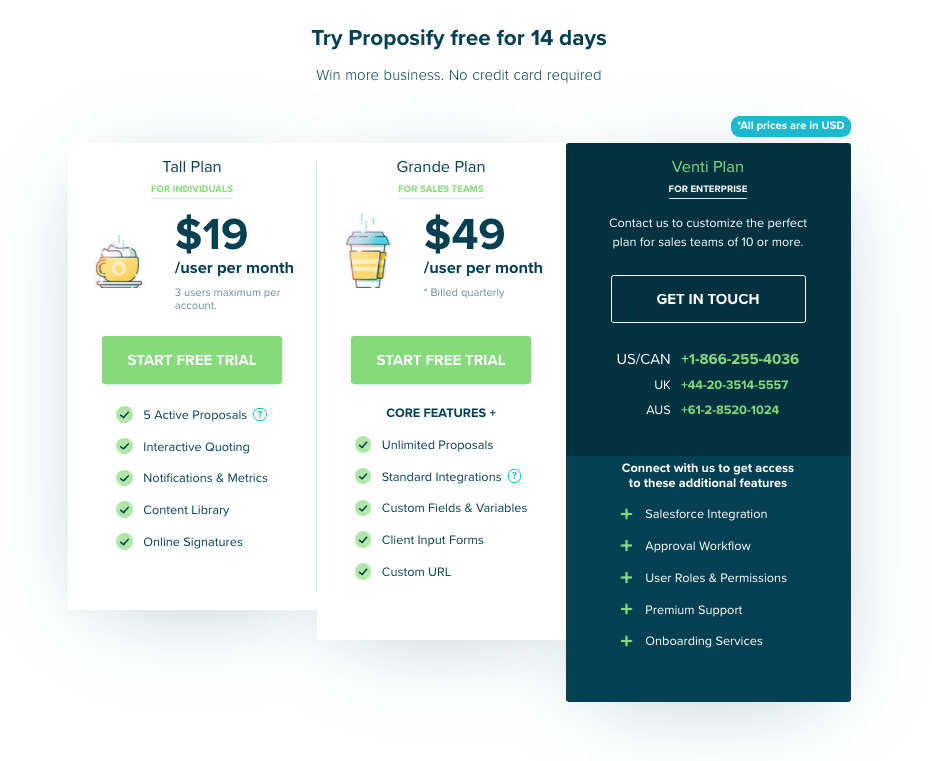

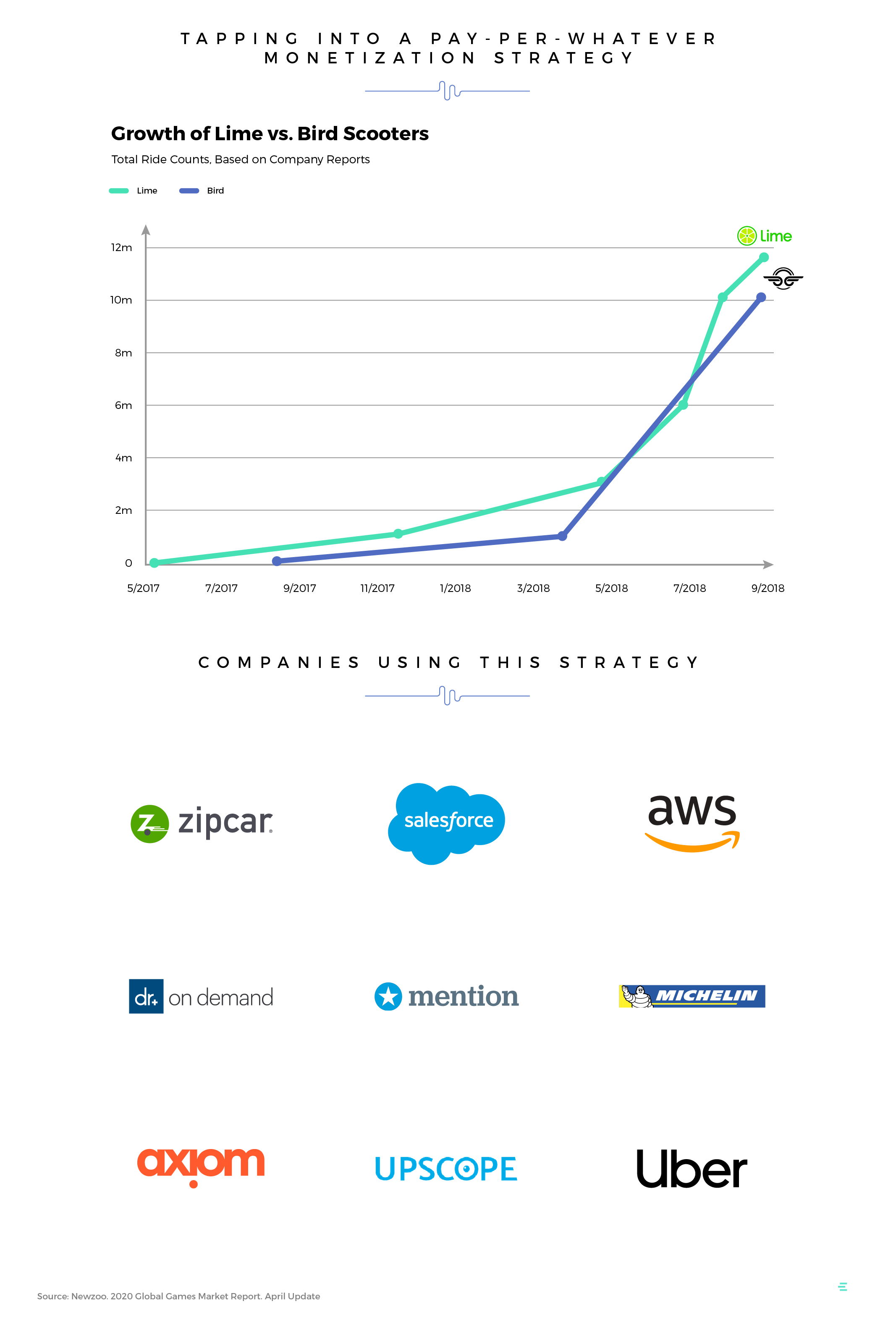

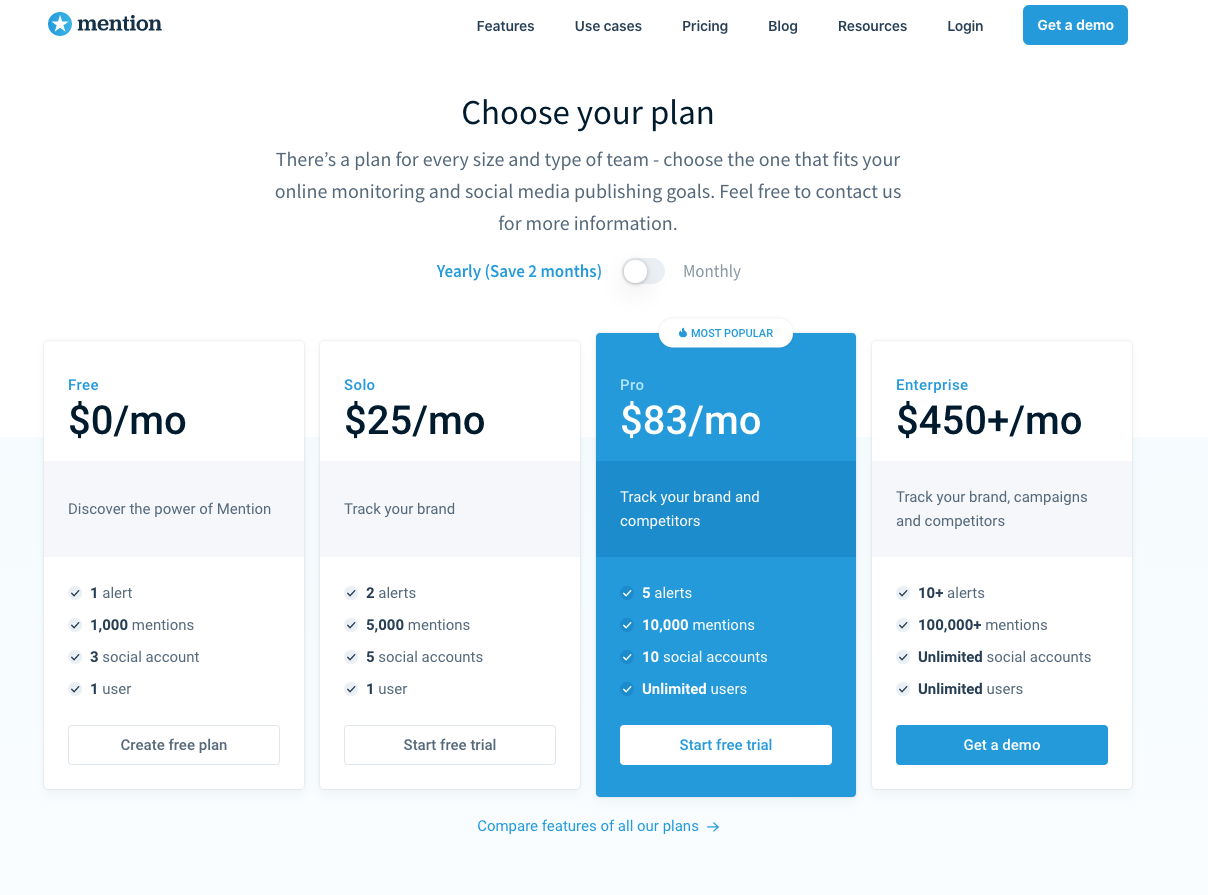

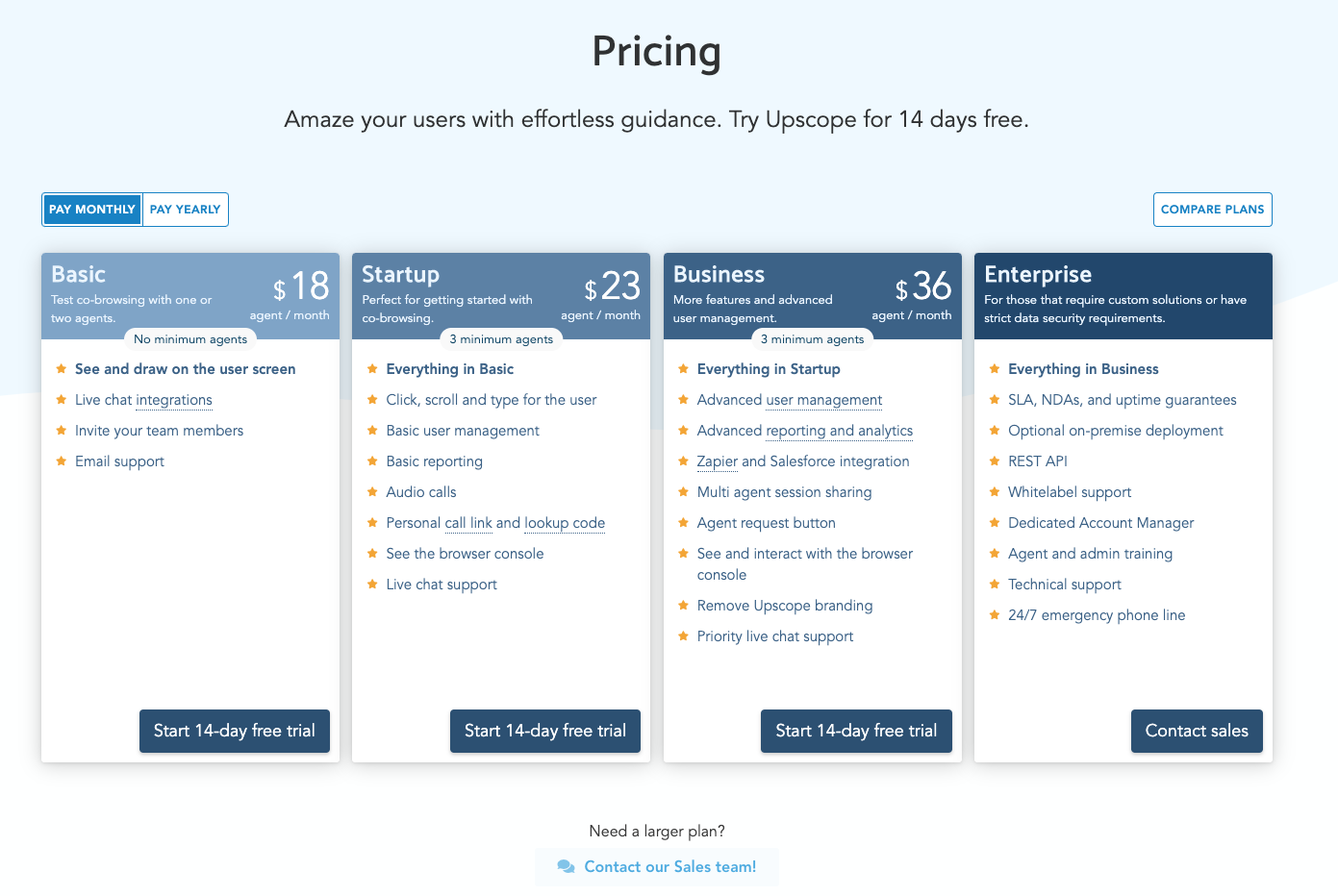

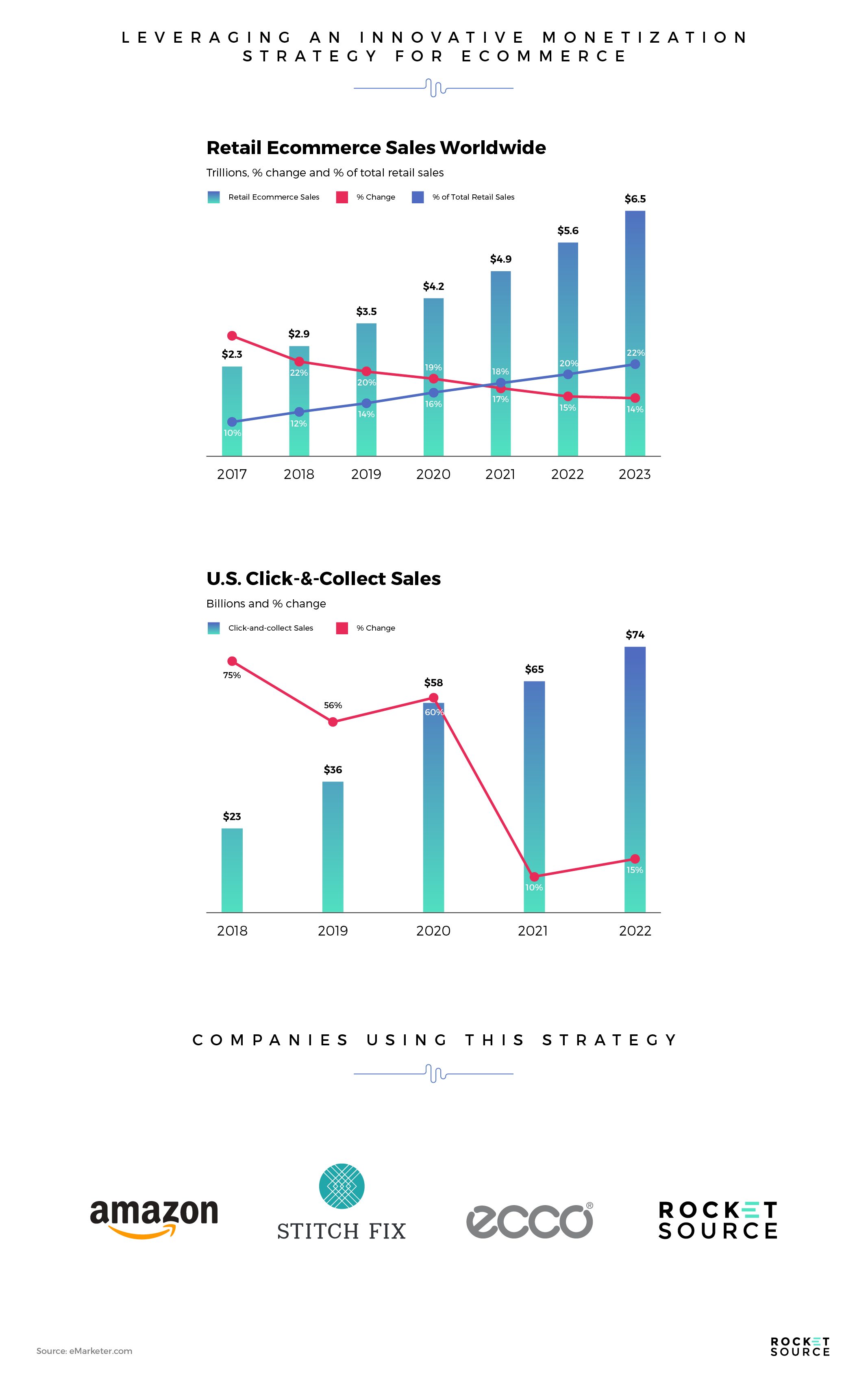

A freemium model is fairly straightforward. You, as a business, offer a forever-free option, allowing customers to experience your brand before making a purchase or upgrading to premium status. Take a look at some of the organizations leveraging this model:

These and plenty of other organizations have seen growth by offering a free version of their brand experience alongside a premium paid version. This is quickly becoming the norm, and businesses that shy away from it could lose out on a massive opportunity. The freemium model offers a way to get customers in the door by allowing them to sign up without worrying about payment. They can become entrenched in the brand’s ecosystem without worrying about being limited by a “free trial.” The innovation comes as brands decide which premium features to offer and how they can enhance customer experience, thus continually moving more free users to premium status.

The freemium model works well because consumers don’t think symmetrically when it comes to making a purchase decision. They don’t approach companies with an either/or scenario in mind, feeling forced to choose between free or paid. Instead, research shows that brands that continually offer new or higher-quality products for a premium price boost the customer’s perception of the brand and their willingness to pay.

But there are pitfalls to these freemium models. If brands aren’t careful, many customers will settle into the free product, making it hard to push them into the premium offerings. Moving customers to the point of purchase requires an empathetic response and monetization of available data. No, I don’t mean you should SELL the data from your data loops. I mean that you should extract insights from the data at your disposal to make strategic decisions that will shake buyers out of the comfort of a free product.

To illustrate why this is so important, let’s revisit what I did with Platstack.