A project’s internal rate of return (IRR) determines how profitable a specific project or investment can be for the organization. By resetting the net present value (NPV) to zero, teams are able to look at the specific return stemming exclusively from the project, rather than overall impact on the company’s trajectory.

IRR is often used when discussing where to invest, what initiatives to pursue, and why new strategies should be considered. Because this metric is often used across all departments in the organization, IRR is a common data point considered when looking at investment options with similar characteristics. Usually the highest IRR is considered the best, but enterprise decision making cannot hinge on one singular metric. There’s more at play than IRR alone.

Calculating Internal Rate of Return to Make Strategic Decisions

To understand how to tap into IRR and go beyond this singular metric, it’s important to identify how it’s calculated and the story its telling.

IRR is calculated over three steps:

- Start by setting net present value of money to zero

- Solve for the discount rate

- Adjust time periods to understand the average cash flow over time

With this approach, teams are able to see the specific financial return from a project. When comparing multiple projects, knowing what the return of each will look like can help the best investments rise to the top.

Your Internal Rate of Return Lets You Look Longer Term

Short term investments typically look at return on investment (ROI) when considering if it’s worth pursuing. However, IRR is an ideal metric to calculate when looking at longer-term initiatives because it takes into account longer term trends that ROI can’t include that relate to the extended time frame of a project. Because time is a factor in the formula itself, as shown above, leaders can see the potential future value of an investment rather than what it’ll yield in the short term.

It’s important to remember that, although time is taken into consideration, other factors may come into play. That’s why using IRR can be helpful but cannot be the end all, be all approach to strategic decision making.

Internal Rate of Return Alone Isn’t Enough

Our co-founder, Buckley Barlow, created the StoryVesting framework based on years of research around what drives a company’s success. The name stemmed from the two core areas he saw as most critical: (1) an origin story to guide every decision and keep teams loyal and (2) vested team members to bring the story to life through consistent, strategic decision making.

When considering a metric such as IRR, it’s crucial for teams to remember that this is only one decision-making data point. While it’s valuable to lean on IRR to understand what can be expected from an investment, it’s equally important to tap into StoryVesting to ensure that the team stays on course toward the bigger organizational why, while simultaneously staying aligned with the market demands. In leveraging both, organizations can practice better experience management (XM) strategies and keep on course toward their North Star Metric.

Use Cases for Transformers in Enterprise

Transformers have taken the development world by storm. While there are advantages and challenges to leveraging this technology, proper deployment can yield outstanding business outcomes.

Bolster the Customer Experience

Transformers are paramount to customer experience where chatbots are used. Rather than relying on natural language programming (NLP) to parse text together, transformers allow AI to speak more conversationally, improving the customer experience where chatbots are used.

Improve the Hiring Process

Because transformers are able to analyze text and images at a deeper level, this type of AI can help human resources departments find top talent and retain top talent with more ease. By going beyond basic keyword searches in resumes and feedback forms, HR can extract better insights to build the workforce.

North Star Metric Alignment

Today’s business world moves at breakneck speed. With model training, you can dump vast amounts of data into a model and quickly get insight as to how to continue moving up the S Curve of Growth. These insights shape decision making, keeping teams on the same page and moving in sync toward the organization’s North Star Metric.

Stay Relevant

Organizations that leverage model training effectively are better equipped to spot patterns in consumer behavior and make critical changes to align their products with the market needs. In doing so, they’re able to stay relevant and continue moving up the S Curve of Growth.

Customer Experience (CX) Terms

- 360° Degree View of the Customer

- Agentic AI

- AI Ops

- Annual Recurring Revenue

- Behavioral Economics

- Behavioral Insights Matrix

- Behavioral Triggers

- Bow Tie Funnel

- Brick-to-Click

- Business Impact Analysis (BIA)

- Cognitive Computing

- Cohort Analytics

- Content Mapping

- Convergence / Divergence Bands

- Conversational User Guidance

- Customer Data Profile

- Customer Experience (CX)

- Customer Friction

- Customer Insights Map

- Customer Journey

- Customer Journey Mapping

- Customer Satisfaction (CSAT)

- Customized Ratios

- CX Intelligence

- CX Led Growth

- CX Metrics

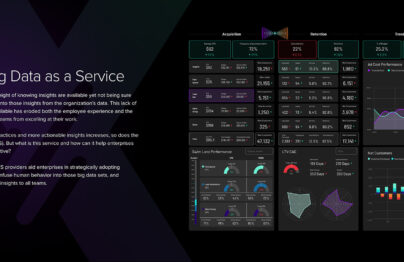

- Data as a Product (DaaP)

- Data as a Service (DaaS)

- Data Culture

- Data Driven

- Data Engineering

- Data Fabric

- Data Governance

- Data Humanization

- Data Hygiene

- Data Looping

- Data Mapping

- Data Mining

- Data Modeling

- Data Monetization

- Data Swamp

- Data Visualization

- Data Warehouse

- Data-Centric

- Descriptive Analytics

- Diagnostic Analytics

- Digital Asset Management (DAM)

- Digital Transformation

- Dirty Data In Dirty Data Out

- Domain Specific Models

- Embedded Intelligence

- Empathy Mapping

- Employee Data Profile

- Employee Experience (EX)

- EPS

- EX to CX Data Mapping

- EX to CX Mapping

- Experience Management (XM)

- Foundation Models

- Gap Analysis

- Generative Adversarial Network

- Generative AI

- GEO

- Hallucinations

- Human-Centered Design (HCD)

- IRR

- Journey Analytics

- Large Language Model

- Machine Learning (ML)

- Managed Agile Services on Demand

- Model Training

- Modified Hoshin

- MRR

- Neural Network

- North Star Metric

- Party Data

- Pathway to Purchase

- Predictive Analytics

- Product-Market Fit Mapping

- Real Time Design Looping

- Revenue Acceleration

- RevOps

- ROAS vs. ROI

- S Curve of Growth

- Stack Impact Analysis

- StoryVesting

- Table Stakes Testing

- The 3 P’s

- Transformers

- User Experience (UX)

- User Insights Map

- User Interface (UI)

- Vector Database

- Voice of the Customer (VoC)

- Voice of the Employee (VoE)

- Word Cloud Generator Sentiment Mining

- X Analytics