A Product-Led Growth Strategy for Enterprise

There’s been some buzz in the enterprise world around product-led growth (PLG) for enterprise. What’s previously been considered a strategy for startups is starting to infiltrate the Fortune 500 world, and enterprises had better take note. Strap on your seatbelt and keep your arms inside the ride at all times. We’re about to take you on some unexpected twists and turns that will make you feel like you’re on a roller coaster.

In this post, we’re going to talk about product-led growth in a way you’ve likely never encountered before.

We will show you how this strategy can be retrofitted into a customer journey map and leveraged for growth at the enterprise level. We’ll also talk about how to leverage employee experience data loops to drive product-led growth for enterprise via increased user experience, so that you can further align customer experience (CX) and employee experience (EX). After all, being product-led for certain companies will mean different things at different times. What remains constant, though, are the extrinsic EX variables unique to your business. By better correlating product, growth, and retention with each other — and perhaps even getting to the holy grail of statistical causation along the way — enterprise companies can see tremendous movement up the S Curve of Business.

Before we get into that deep dive, let us get one thing out of the way: while product-led growth might seem like a new idea, it’s actually built on a bunch of old ideas that, in turn, have been building up to the modern-day idea of what product-led growth is for a long time. Marketers and product people are really good at taking old theories and slapping fancy new names on them. They then announce to the world that a “new strategy is born.” In many ways, product-led growth is no different.

We are, of course, being a little facetious here. Still, the RocketSource team really does believe that the things currently evolving within the growth, marketing, and operations fields today are just small nuances that can drive really big changes if adopted. Therein lies the problem for enterprises that want to stay competitive against an upstart in their industries: they actually have to adopt some of these strategies to be effective.

It’s easy to talk about new strategies. It’s a whole other thing to actually get buy-in and restructure an enterprise organization to grow like a startup.

Let’s start this conversation about how to gain organizational adoption by addressing the elephant in the room and answering this foundational question: what is a product-led growth strategy for enterprise and why should you care?

What is Product-Led Growth and Why You Should Care

When it comes to growth, there are several different approaches companies can take.

Sales-led growth is the traditional model wherein a sales team pounds the pavement, knocks on doors (whether virtually or in-person), and transforms leads into eventual buyers.

Marketing-led growth happens similarly, but rather than using a sales team, it uses marketing engines (including content marketing) to consistently move buyers through a customer journey towards the sale.

Product-led growth is a little different. This methodology and strategy positions the product as the primary driver of growth for a company.

That product-led growth definition is a broad statement on its own with a lot of complexities baked into it. To help peel this definition back another layer, check out how The Product-Led Growth Collective defines this strategy:

Product-Led Growth is a business methodology in which user acquisition, expansion, conversion, and retention are all driven primarily by the product itself. It creates company-wide alignment across teams — from engineering, to sales and marketing — and focuses on the product as the largest driver of sustainable, scalable business growth.

Rather than investing massive funding and resources into advertising, product-led growth companies focus more on strategic investments within product development. The goal is to create an experience so sublime that users can’t help but share the product with others, thus increasing the word-of-mouth coefficient and spurring organic growth.

While sales and marketing are still relevant and critical, having a product-led growth strategy in place allows you to play the long game. Not only does it give you a foundation for a more durable product strategy, but it also saves on costs, broadens your reach, gives you faster feedback loops, and allows you to take a product-first stance. There’s a lot of benefit to each of those elements.

When you put product development ahead of marketing, you’re able to develop a more strategic-growth approach. Not only is this a more cost-effective way to drive growth, but it also allows you to get feedback faster and then use that feedback to continue developing a product the market will use. In other words, putting the product first allows you to drive the word-of-mouth coefficient faster, which spurs organic sales and growth rather than relying on a sales or marketing engine alone.

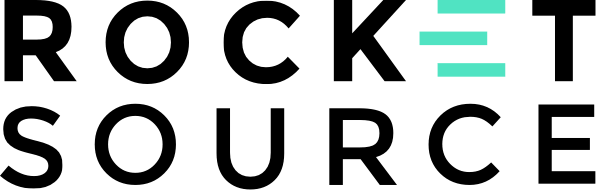

To further demonstrate just how effective this strategy is, take a look at the tremendous growth product-led companies have experienced in recent years.

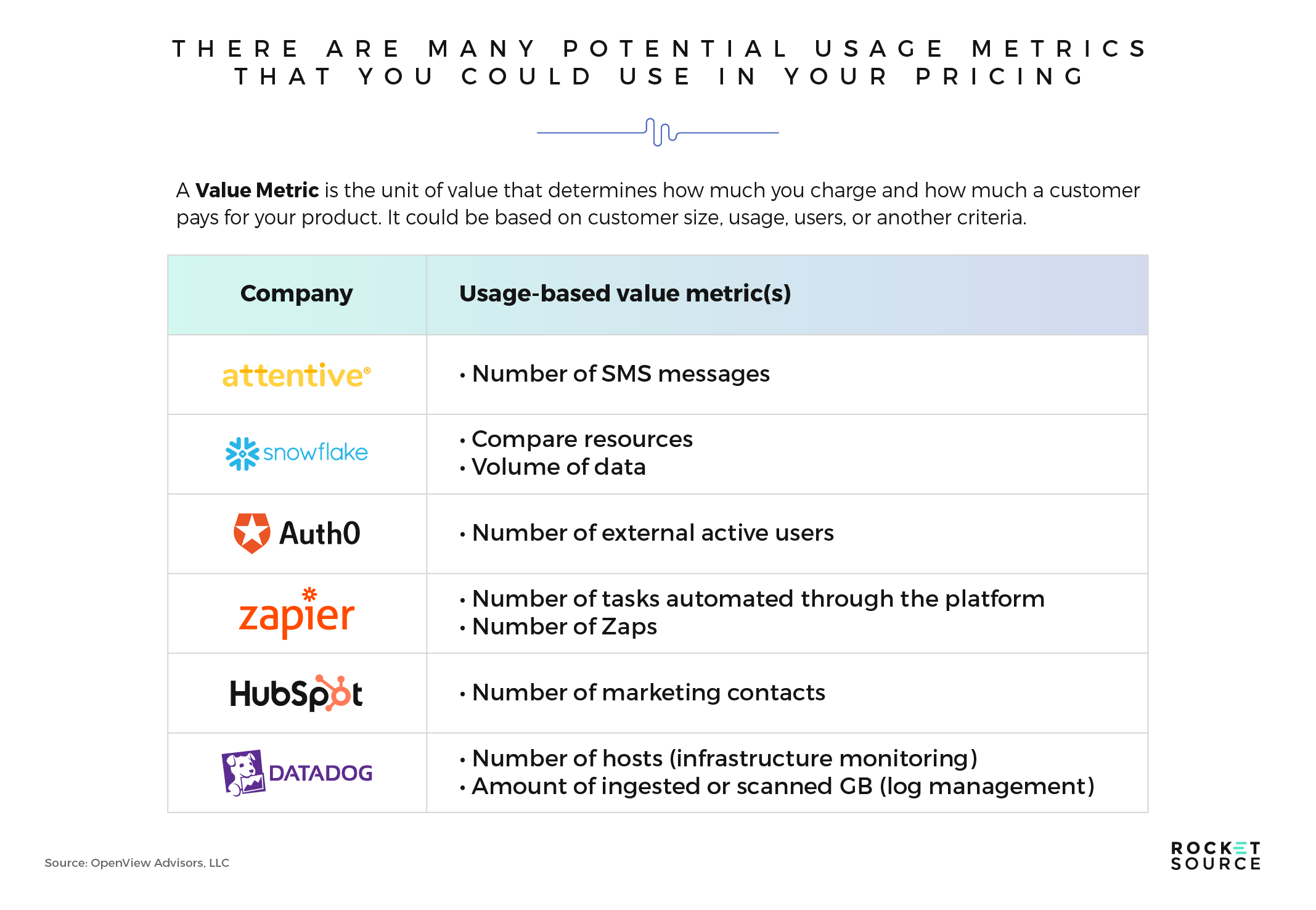

One thing you might notice when looking at the companies listed here is that they all tend to be Software as a Service (SaaS) companies. Shortly after the “invention” of product-led growth, the idea became one of the biggest trends in the software world. OpenView Partners picked up on this concept and have continued to shine a light on it ever since. This company has essentially coined and owned the term product-led growth for the past eight years. Heck, they even have a tab on their website dedicated specifically to it that includes a noteworthy sub-heading on usage-based pricing.

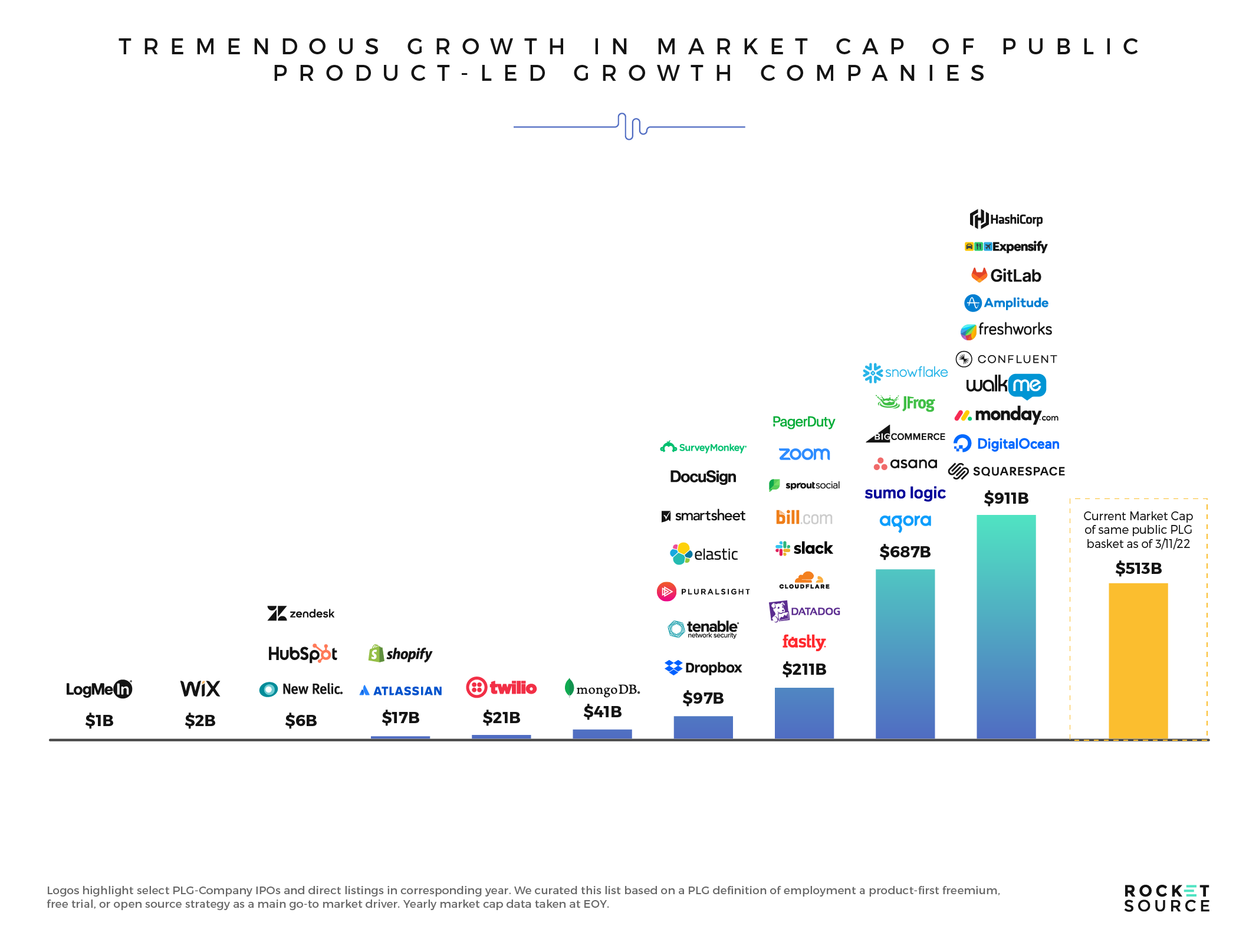

The reason this is relevant is that usage-based pricing tends to be thought of as the crux of product-led growth. The more a customer loves the product, the more they’ll use it. The more you can charge for that usage, the more profitable you’ll be. It seems simple enough, right? OpenView Partners defines this process as an end-user-focused growth model, which relies on the product itself as the primary driver of customer acquisition and expansion — something enterprises strive to adopt too. It looks a little something like this:

As you can see from this Product-Led Growth Playbook by Product-Led graphic, growth happens when the customer is able to experience the product first-hand. Users can experience products through a freemium model or free trial. Companies are able to acquire customers faster when the customer can actually feel the end experience. Adding a payment portal between that experience and the customer can stunt product adoption. It’s easier to say yes to trying out a new product when the registration and onboarding process is fast and simple. Once using the software, the customer is likely to become more entrenched and recommend the app to other customers. In other terms, product-led growth strategies encourage organic word-of-mouth for bringing on new users and retaining existing ones.

It’s uncommon to talk about product-led growth outside the context of SaaS companies, which is why we want to bring it into the world of enterprise here. To that end, keep an open mind about product-led growth as you read this post. This strategy is not exclusive to industry or product type. It’s also not exclusive to the go-to-market side of the equation.

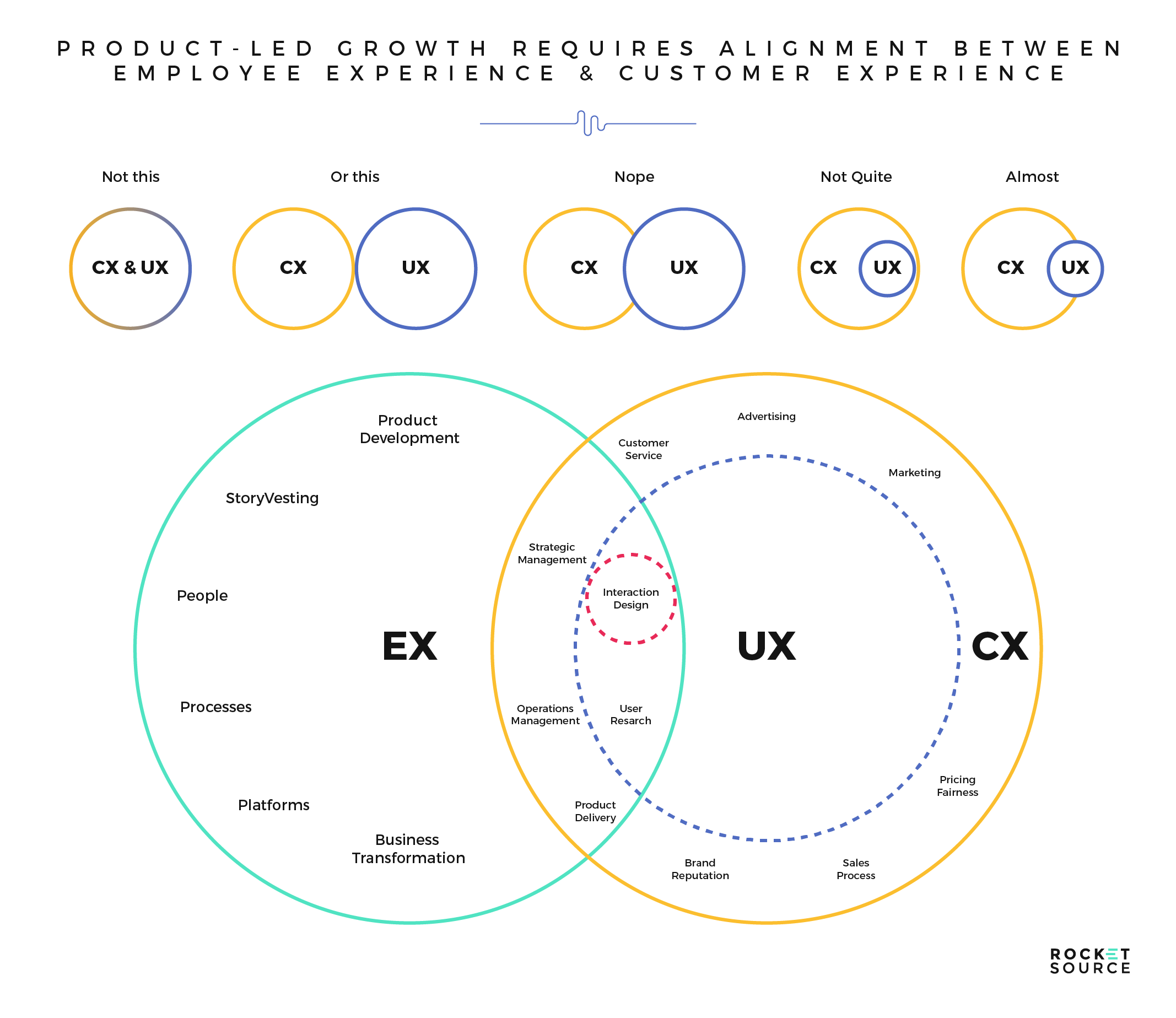

True product-led growth strategy focuses on how the process and mindset of product-led companies can drive incremental growth via sophisticated and beautiful data loops rooted in EX and UX/CX alignment.

These strategies are powerful and absolutely robust enough to expand beyond the startup world. Yet, few others have talked about this strategy from an enterprise lens.

What is Product-Led Growth for Enterprise?

Way back in 2014 (which is a lifetime ago in digital years), SaaS startups started to really take note of the product-led growth approach. Since then, some of the biggest companies in the world have adopted a a product-led growth strategy.

But let’s make something clear: while there are certainly many SaaS product-led growth companies out there, this strategy can extend well beyond the SaaS industry. These lines are increasingly blurring as enterprise-level organizations realize the benefits that product-led growth can deliver beyond the SaaS world. More companies are noticing that we’re living in a product-led era. Consumers, not department heads, are the loudest voices in the room these days, which has made it easier for products to get adopted by teams at a more organic level. That organic adoption through basic team recommendations has spurred tremendous growth.

Kyle Poyar, a Market Strategist at OpenView, speaks to this clear phenomenon:

“Growth in a PLG business comes from consistently fine-tuning the product experience to optimize the rate at which new users activate, convert, and expand in the product. Ideally, these improvements start to compound over time, allowing PLG businesses to accelerate growth as they scale (unlike traditional SaaS businesses). Customer feedback is critical to prioritize the areas that will make the biggest difference to your customers.”

OpenView Partners uses product-led growth as a go-to-market strategy rooted in consumption-based pricing. This pricing model gives the customer the ability to pay only for what they use. The theory here is that by paying only for what they use, the customer is then better able to clearly see the value for that product and eventually replace traditional software platforms with it.

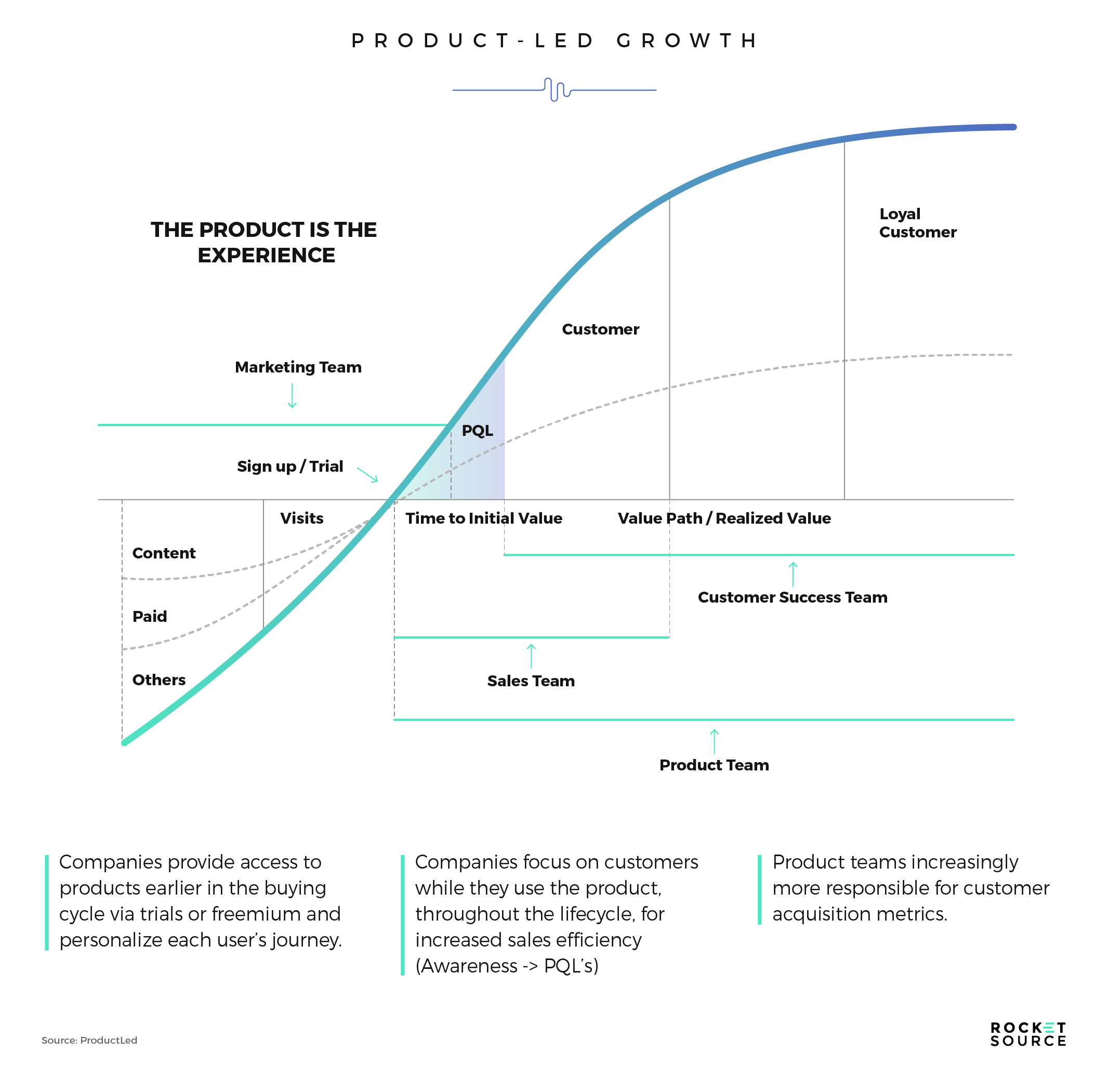

Many SaaS businesses have shifted away from the traditional sales-led growth models to usage-based pricing simply because of how consumers and companies alike buy software today. As evidence, consider enterprise tech stacks.

Not too long ago, executives were the only ones who made decisions relating to company tech stacks. In recent years, those decisions have shifted and are now increasingly being made at the managerial level. For example, think about an HR manager who uses Google Meet to have virtual happy hours with her best friends after work. She’s so entrenched in the product that she brings it into the office and recommends Google Meet over Zoom for remote team meetings. Word spreads about the benefits of Google Meet over Zoom, and soon the entire organization has adopted a new platform.

These new consumer and employee behaviors are a big reason why many companies have adopted a pricing structure that centers on value rather than a standard-tiered approach. Rather than just looking at features and integrations, more organizations are looking at how likely a platform is to actually be adopted. That adoption is rooted in value, which has led to an increase in value-based pricing.

Value-based pricing is similar to usage-based pricing. The more value the end-user gets from the product, the higher the price. By clarifying the value to the end-user through free trials, micro experiences, or sample sizes, the enterprise can make the product feel stickier, which drives higher lifetime values (LTVs). The same concept holds true for organizations outside of the software world too. By showcasing the value within the product and allowing the customer to experience that value first-hand, you’re able to build viral coefficients, which refer to the number of new users the average customer has the potential to bring your product.

While there’s a whole lot of truth to user-generated growth, knowing how to track the viral coefficient is hard, to say the least. It requires clear North Star Metrics and a value metric to determine how you reach your customer. What’s so hard about this is that there isn’t a single metric that answers this pivotal question: how much value is enough to get your customer to stick around longer?

Here you can see how value metrics vary wildly depending on many factors, including usage and users. Over time, using metrics like these means that the LTV ratio becomes shorter and ultimately makes the metrics ineffective. That’s often because the data being collected around those metrics is only a small piece of the equation.

We’ll take a little bit of a deviation here to say something that tends to shock a lot of the people we talk to about product-led growth.

Customer feedback is only one part of the product-led growth equation.

Do a quick search online, and you’ll see article after article talking about the importance of customer feedback in product-led growth. While it’s undoubtedly important data to collect, what’s even more critical is gathering employee feedback. Employee feedback aligned with customer feedback allows you to prioritize the areas where your product is dominating and where it could be improved. That alignment is ultimately what makes up the bigger picture and allows your product’s user experience to be so sublime that it goes viral.

Customer Experience (CX) no doubt means that the end-user rules the growth game. It’s everything. We say that in all earnestness. But — and this is a big but — if you don’t have vested employees who empathize with your customers, use the product, and understand every layer of a growth framework like StoryVesting on the Employee Experience (EX) side, then you will struggle to have any CX initiative make an impact.

We have seen this first-hand. At RocketSource, we’ve worked with many companies that talk about CX, but their EX is so poor that they can’t seem to get their CX initiatives off the ground. Having a laser focus on understanding how EX correlates with CX when it comes to any product-led growth strategy is a huge differentiator.

Here’s why.

Everything is so digitized today that it’s created an expectation among consumers that they get to have more control over their customer journey. We’ve reached an inflection point where we are literally witnessing the rise of the end-user. The market for just about everything — from software to streaming products and membership-based enterprise organizations — is continuously evolving. Companies that use software to power their products will have to embrace that end-user experience like they never have before.

Ultimately, though, it’s not just about the end-user experience; at least, not entirely. It’s about the alignment between the EX and CX. We’ll get into what that looks and feels like further in this post, but for now, know this: product-led growth for enterprise is an innovative approach because there’s so much emphasis given to the end-user. However, the more you peel back the layers, the more you’ll start to see potential problem areas.

When you think about leveraging a product-led growth mindset for an enterprise, you have to mind your Ps and Qs a little more than if you were to leverage this mindset for a startup.

When you put too much emphasis on the end user and particular segments of your user base, you can end up digging holes in all the wrong areas for your product. By trying to appease fringe segments, you end up wasting time and money by not developing the features that will actually drive product-led growth. You have to get granular about who comes first. And, more importantly, you have to get even more focused on how everyone’s experiences align with each other. Taking that approach allows you to map what your team AND end-users are experiencing at each touchpoint along their journey.

We’ll break down that perspective shift in more depth down below. The goal, for now, is to really understand how you can innovate on product-led growth strategies if they are adopted and wielded correctly. Perhaps the first step towards accomplishing that goal is to look at what product-led growth for enterprise isn’t before showing you what it looks like in action.

What Product-Led Growth for Enterprise Isn’t

Sometimes, clarity around a new strategy comes when you look at what isn’t included versus what is. Pulling back the curtains on what product-led growth is not will help identify the nuances behind what this strategy really is and how it works at the enterprise level. Here are a few examples of what people often associate product-led growth with and why those common associations don’t correlate to growth at the enterprise level.

Product-Led Growth is Not Product Manager Led

A lot of companies assume that product-led growth means that the product manager will spearhead all of the actual growth. This doesn’t mean, however, that one amazing product manager will singlehandedly be able to pull off hockey-stick growth through the product alone. Thinking about that role through this lens is too simplistic. In actuality, great products emerge from empowered, vested, and fully cross-functional teams. It takes a team and a group effort to really dig into the data and understand the desires of end-users.

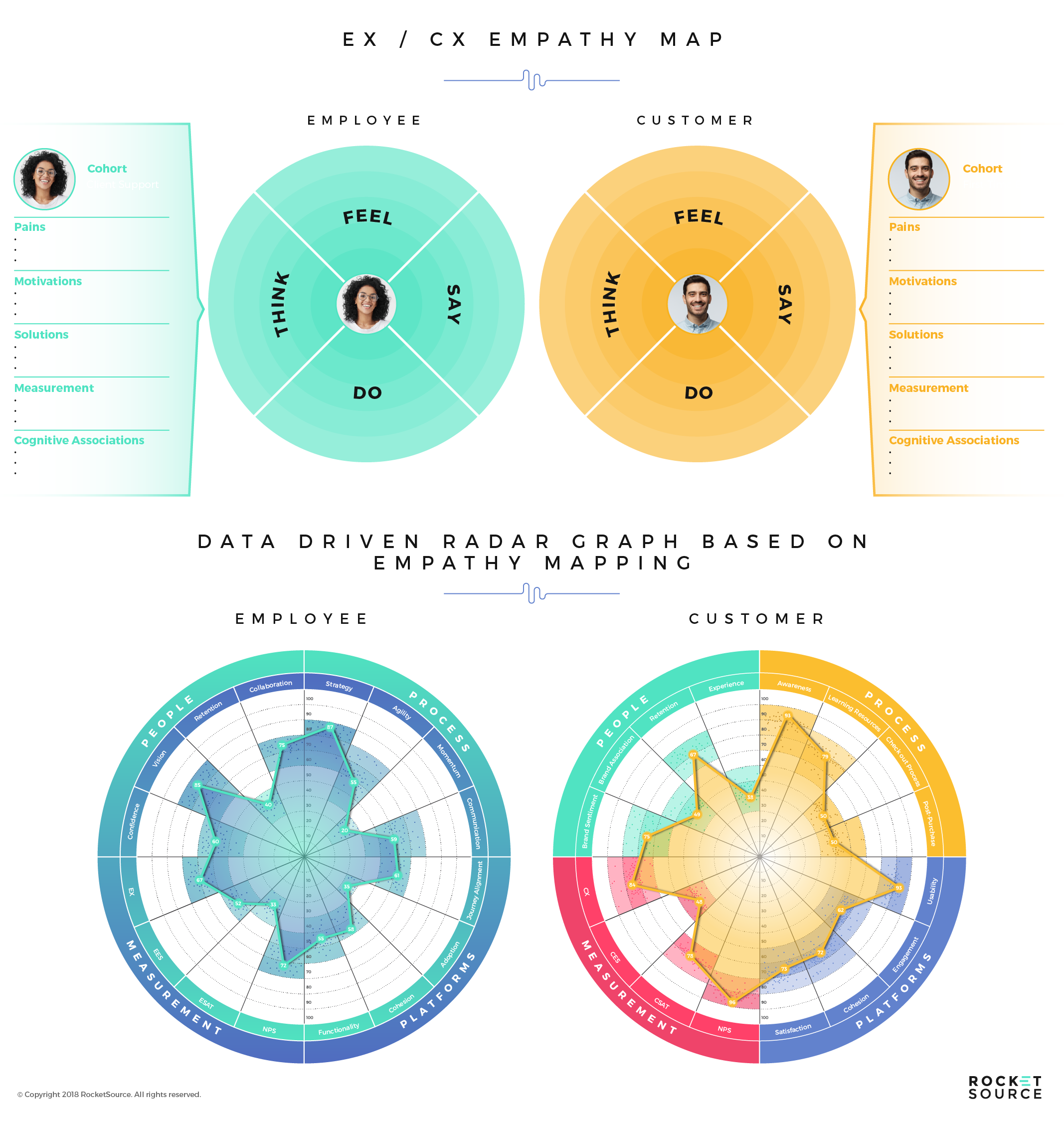

Instead, product teams must work across all departments to make informed decisions via enhanced data loops while also adapting to market changes. That data stems from the convergence of EX and UX data that ultimately drives EX/CX alignment. Working alongside teams and managers from other departments allows for the type of cross-pollination that will let an organization of any size to bloom.

One way we approach this cross-functional alignment between the user and employee experience is by creating an empathy map. An empathy map will let us see how teams are adopting and embracing new platforms and processes. This approach isn’t your standard, surface-level think/feel/say/do map. We go deep by gathering data and running intelligent feedback loops to take a more insights-centric approach. Our goal is to really understand the experience in and around the products being delivered to the end-user. This is what our results typically look like:

Using radar graphs, we’re able to map feedback data. By creating visualizations of these data points, we can identify areas needing improvement both internally and externally. In doing so, we’re better able to equip our teams to create products that customers love. That deep empathetic approach cannot happen in a silo under the product manager alone. It has to span the entire organization so that every element, employee, and experience works in harmony to develop a more aligned end product.

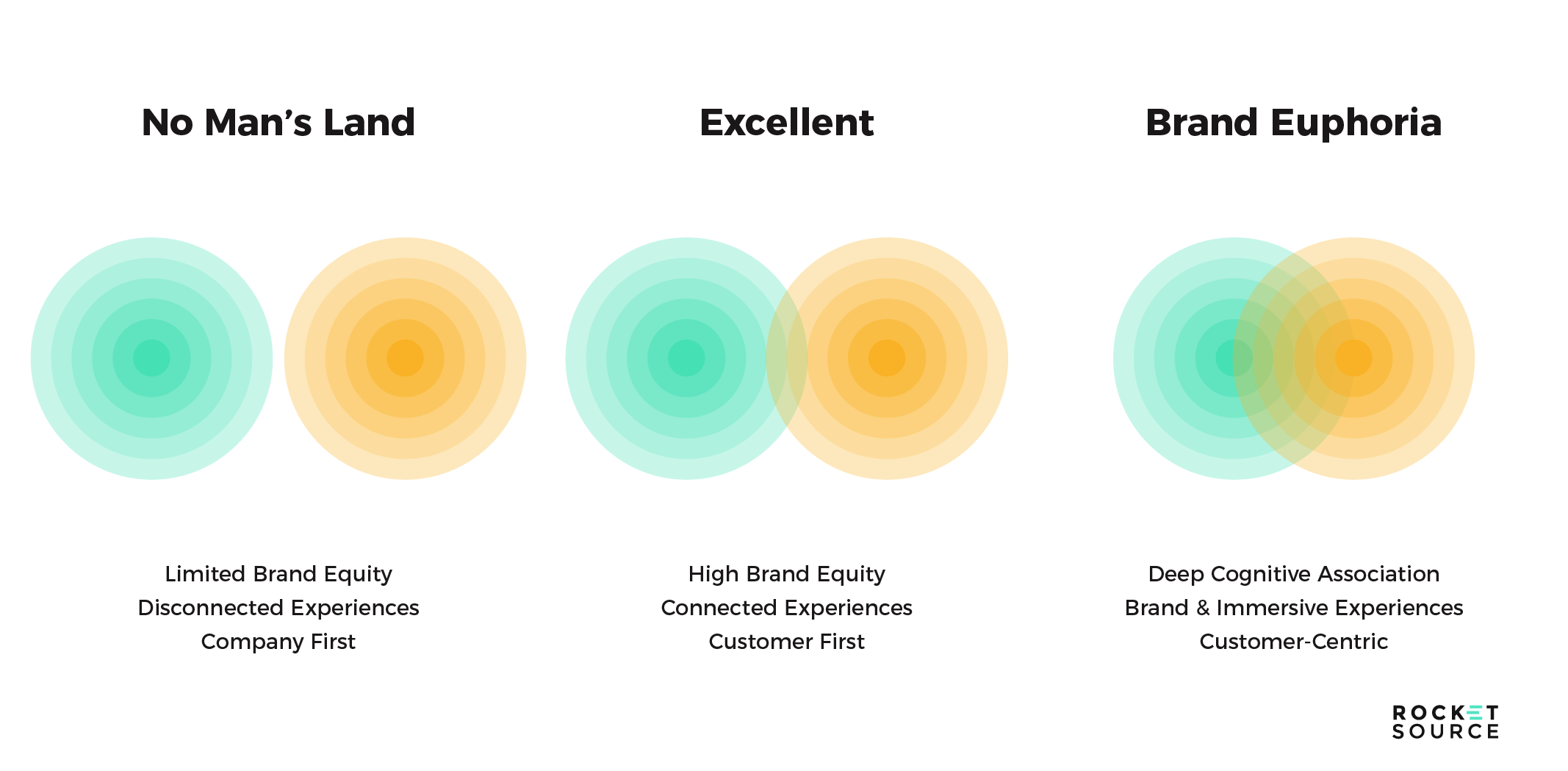

Product-Led Growth is Not UX Led

Although having a beautiful user experience (UX) is crucial for product-led growth, it’s not the end goal. The ultimate goal in product-led growth is actually to bridge the divide between no man’s land, where employees are vastly disconnected from what the end-user wants and needs, and brand euphoria, where the employee’s experience is directly intertwined with the customer’s experience. Brand euphoria is the holy grail of where things should be in an enterprise.

Users immerse themselves in a brand the more aligned they feel to their deep-rooted emotional needs. That immersion forms cognitive associations that are hard to shake and can shape their decision about whether or not to buy from a specific organization for years to come. Rather than focusing on user experience alone, putting a focus on those immersive experiences rooted in a deep cognitive association of the brand will have a much greater impact. This subtle perspective shift in how you approach a product-led growth strategy can make all the difference. It puts less emphasis on feature sets and speeds, and more emphasis on how the product integrates into the lives of your end-users.

Product-Led Growth Does Not Equal the Death of Marketing and Sales

While product-led growth may be a crucial growth lever for startups and enterprises alike, it’s not the only growth lever. For enterprises, every layer of business is unique. You can wield growth by leveraging intersections of numerous business units, from data and engineering to, yes, marketing and sales too. Case in point: Tesla.

Tesla sells cars, sure, but what they’ve truly innovated on is the end-to-end experience. The way you buy a Tesla, how you sign up for the Tesla, and even how the updates are pushed out automatically are all part of the experience. Sure, Tesla’s product is a car, but Tesla as a brand has a lot more going on. The car alone won’t sell itself. It requires a great marketing and sales team to scale the enterprise.

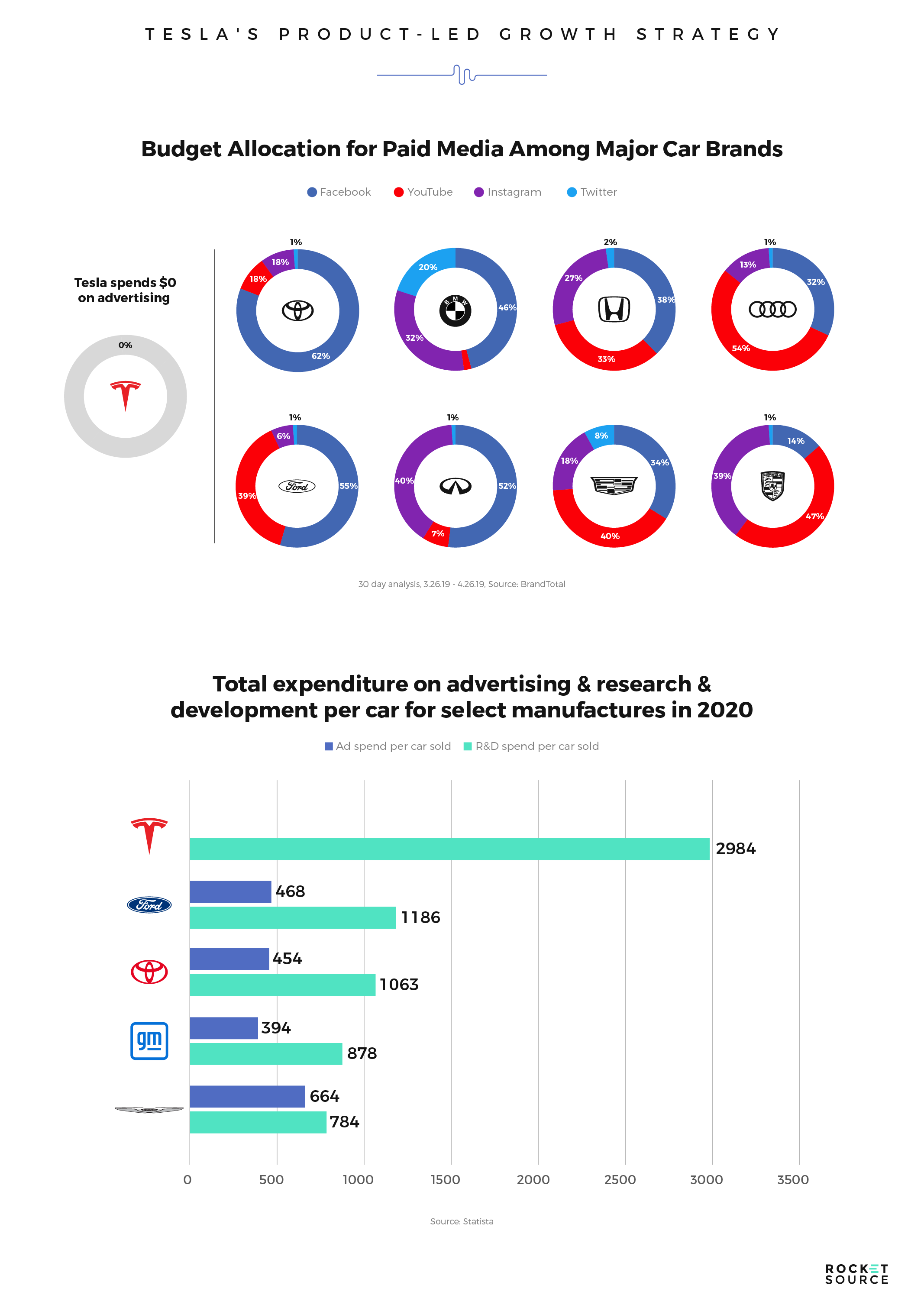

But, if you’re at all familiar with Tesla, then you know that they boast a $0 advertising budget.

How can it be said that marketing and sales aren’t dead when Tesla isn’t spending on advertising? Wouldn’t their $0 advertising budget seem to imply exactly that? It’s because Tesla is also using a cross-functional sales and marketing team driven by R&D, their CEO, and his unique network of social followers. The one-and-only Elon Musk (love him or hate him) makes tweets that the world of enterprise isn’t used to seeing. Elon Musk has amassed over 97 million Twitter followers, which has given him a microphone unlike other CEOs have or want to leverage to grow their brand. Sure, there are a lot of nuances baked into Elon Musk’s online presence, especially with recent acquisition talks and various controversial posts, but that doesn’t mean there isn’t a lesson here.

The way you spend on marketing and advertising shifts when you’re a product-led growth company, but it doesn’t disappear completely.

Many companies aren’t structured like Tesla to infuse a product-led growth strategy across all departments. That’s because traditionally, marketing has been one silo, sales has been another silo, and product-development has been yet a third silo. Too many times, employees, especially technical employees, think that marketing is basically advertising. No, no, and no! Product-led growth is just one growth lever to use. Marketing, advertising and sales can’t work independent of one another. Marketing isn’t just branding and fluff, just like sales isn’t only about cold calls. When you run a product-led growth enterprise, the need for these departments doesn’t dry up; it shifts to becoming more of a cross-functional conversation.

Instead, as you push and pull your various growth levers, you can start to develop new ways of reaching the consumer through marketing and sales. By shifting your perspective to be one more like Tesla uses and leveraging marketing as a word of mouth driver through a focus on the end experience instead of advertising, you can start to bring the departments closer in alignment around the product itself. Even today, when we talk to enterprises, there’s an idea that marketing is advertising. That’s just not right.

Big product-led growth firms, investors, enterprises, and startups all look through this lens — the product itself is what drives the growth component. Technically, that growth loop happens via the basis of a Word of Mouth (WoM) coefficient. We’ll need a whole other long, long post just to unpack how to best measure WoM, but here’s what you should know for the sake of product-led growth strategy:

Word of Mouth is essentially how awesome the digital experience is from onboarding to usage to you name it, which is ultimately what drives the growth of the product to these flywheel effects and growth loops with only limited paid marketing.

Yes, WoM is typically predominantly used in the startup phase. It’s there that you will often see the CEO of an organization all over Twitter showing people how the product works. Through all this chatter, they’re aiming to drive demand gen content marketing awareness at the top of the funnel. This awareness is what spurs more people to keep moving through their journey with your organization, adopting the product, seeing how it works, and so on to drive the WoM coefficient, but that movement only happens after there’s some sort of marketing put into the mix, even if that marketing is simply done by a CEO going on Twitter and sharing info about the product.

You can’t ever grow a product-led growth product, even at the startup level without some sort of marketing.

In the startup world, content marketing is the name of the game. That’s what makes this so confusing at the enterprise level. In order to grow at the enterprise level, the marketing strategy looks very different. There must be some marketing behind the product to scale it, yet many enterprises don’t use a lot of advertising dollars. Instead, they leverage WoM differently by having articles written about their products and services, and then leverage those write ups and earned media across other media. We often work with enterprise level organizations to sync current media with potential media, which is a strategy that can be used across all industries.

Take one big enterprise membership client we’re working with now as a prime example of how we’ve synced these media types to build WoM. This client is currently creating content on YouTube. We’ve SEOed that content to drive up the click through rates and watch time journeys on YouTube by doing more than simply adjusting some thumbnails and keywords. Instead, we’ve leveraged this content to create the right journey specifically for that product.

To put this into a different context or perspective, think about Dropbox. Do you remember the first time you heard about Dropbox? For many, the experience so sublime and innovative, they wanted to share it with others — and, Dropbox just so happened to have a nice referral program in place to spur shares. The viral focus has helped them continuously grow their business, and last year alone they saw a 12.7% year-over-year revenue growth.

Yes, advertising falls under marketing, but marketing encapsulates so much more than just ads. Marketing is tasked with helping foster product virality and word of mouth growth. Product-led growth is just one driver to push that word of mouth coefficient.

Product-Led Growth Doesn’t Mean You Bot Everything

Look around and you’ll find countless examples of artificial intelligence-driven and automated marketing. Retargeted ads. Automated onboarding. Chatbots for customer support. Many enterprises are starting to swing the pendulum to make their products 100% self-guided. While there’s certainly a place for a self-guided experience and simplification through digital experiences, it’s important to find new ways to soften the digital experience and strengthen LTV.

By correlating LTV with a more human touch, you can generate higher word of mouth coefficients by better understanding the reasons behind why every single user stays with your brand and continues to use your services. That’s something you can’t purely bot. There has to be a balance between automation and human touch.

Product-Led Growth Doesn’t Mean A Top Down Approach

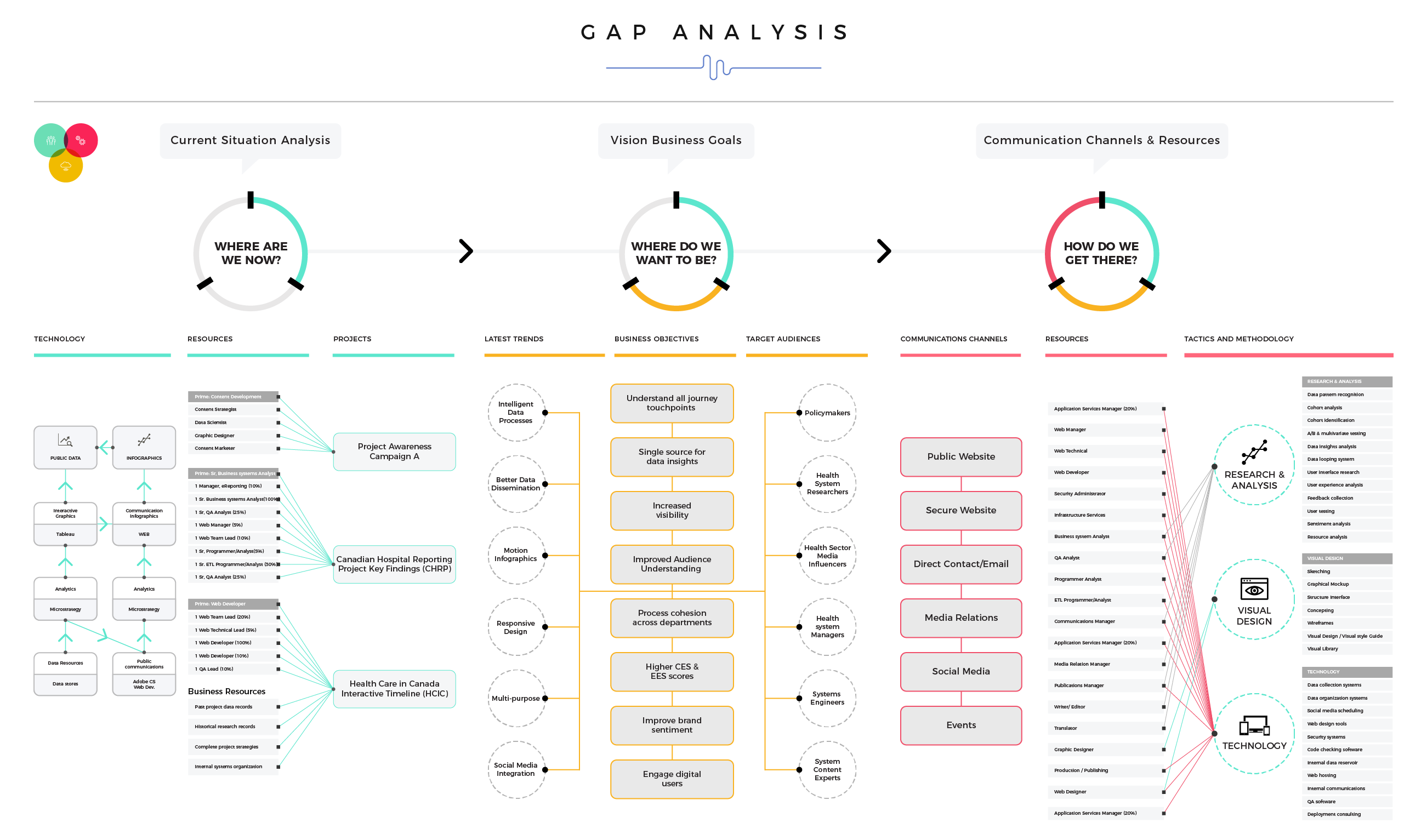

It’s been said before and we’ll say it again — cross-functional teams have never had it so hard as they do today. While it’s easy to talk about at a high level the intermingling of teams, the strategy is very difficult to implement, especially at an enterprise level. Shifting how teams work together requires a deep analysis and understanding of where gaps exist within the organization. To strategize how to best achieve that approach, we deploy a gap analysis for our clients.

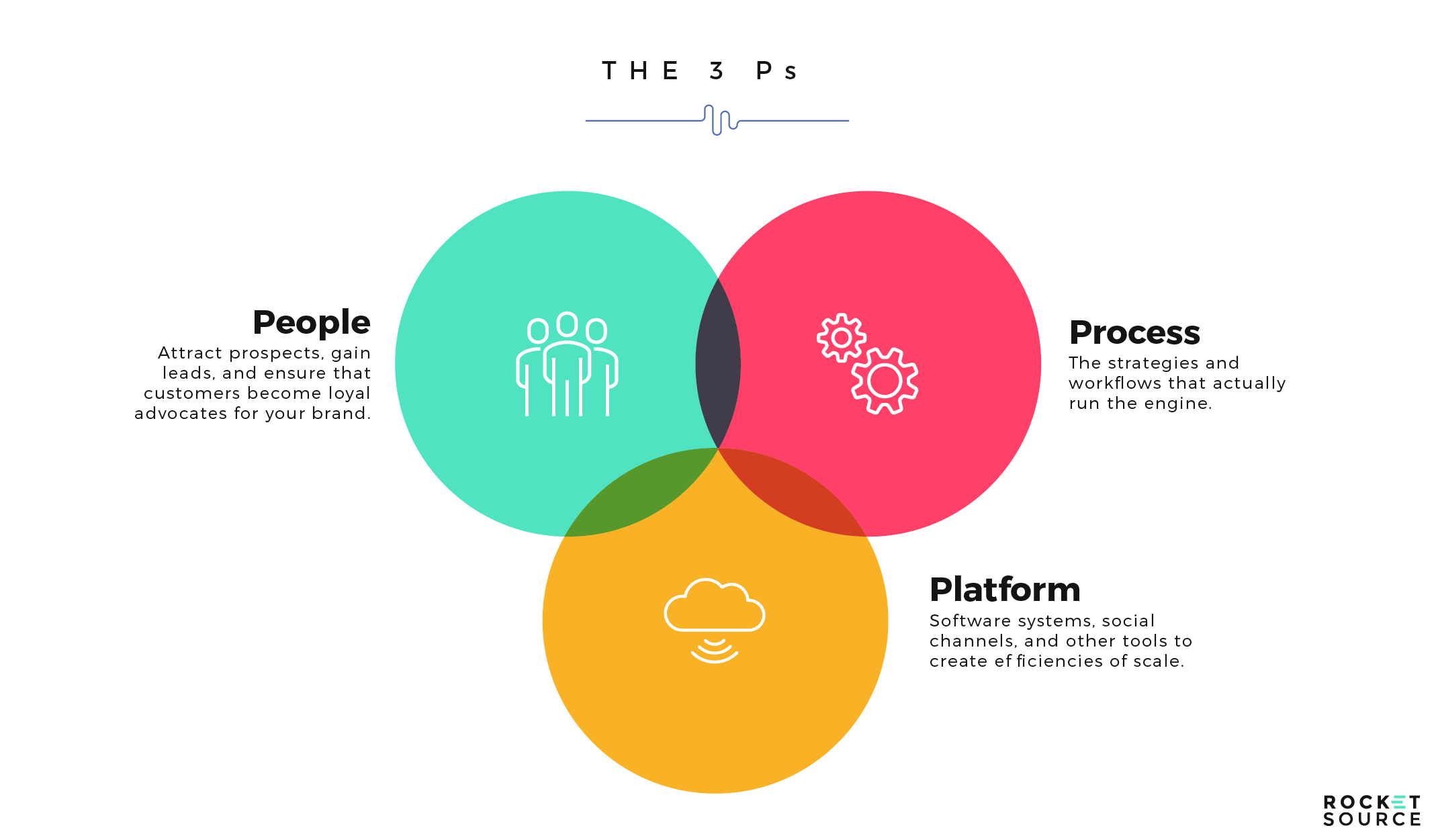

As you analyze the way people move together throughout the organization, you can start to see where the experiential gaps exist. The way each team works together is fluid and overlapping, so it becomes critically important that the people, processes, and platforms, or 3 Ps, you have in place supports this strategy. Cross functionality starts to break down as teams move from a standard marketing process to a very rich and agile product-led growth initiative because the hierarchy of decision-making shifts, as does the way work gets done. Without having each of those areas dialed in, you’ll struggle to shake the cobwebs off a traditional organizational hierarchy and move towards a more agile product and project management plan.

Product-Led Growth Isn’t Just About Usage Based Pricing or for SaaS

Product-led growth is much more about the process than any line of code. Industry doesn’t matter as much as how you develop the product or service you offer. Still, there are some elements which can be borrowed from the SaaS industry for product-led growth. For example, every major company today that you can think of has some sort of recurring or subscription model built within their model to an extent. That recurring revenue requires that customers are using the product. If they’re not, then they’ll simply cancel and move on to a competitor that has a stickier experience. This approach is all about how you build that recurring or subscription process into your end data loop.

As we mentioned earlier, one approach that’s often taken to make recurring revenue feel better and keep customers around for longer is usage-based pricing.

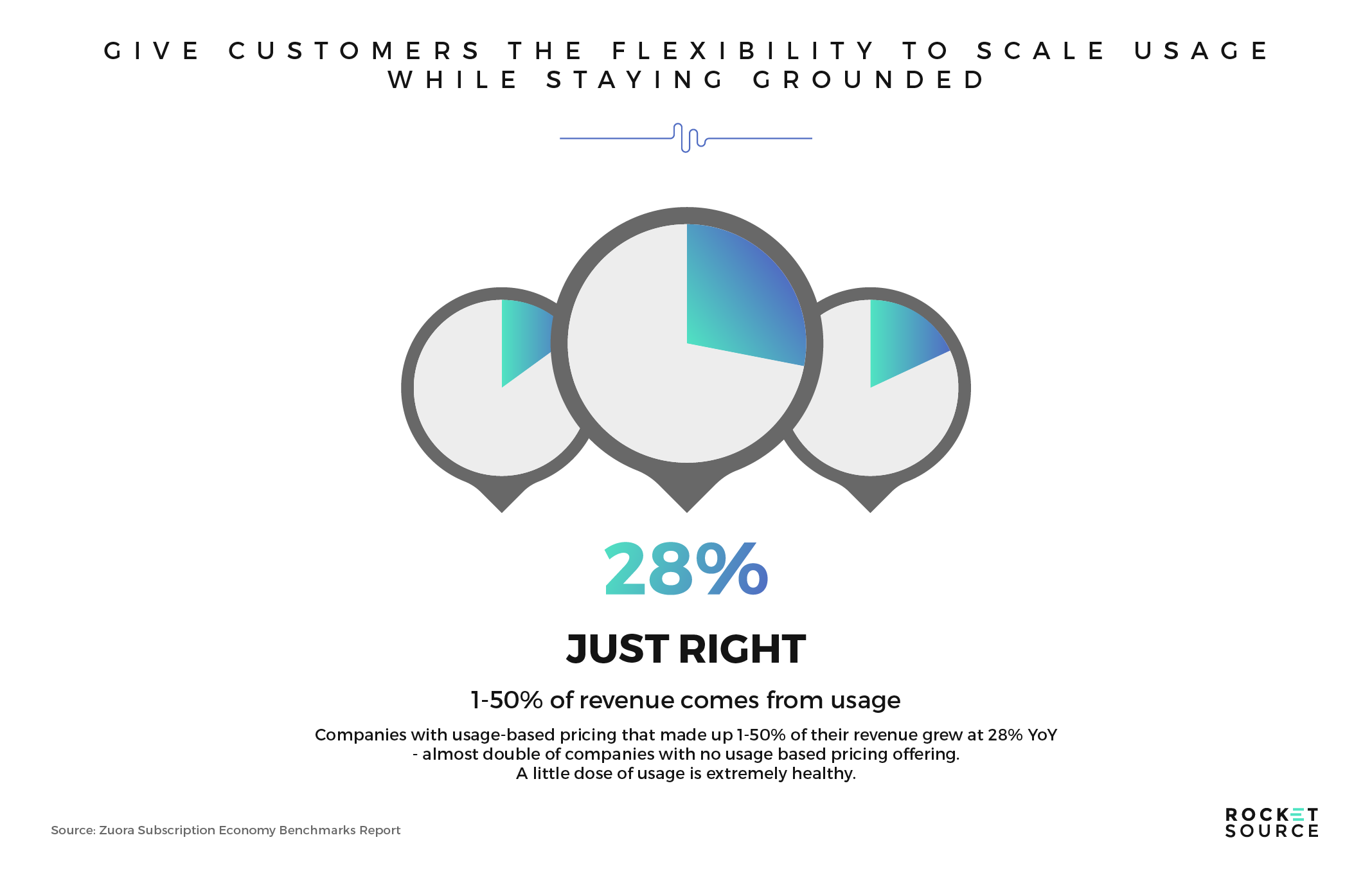

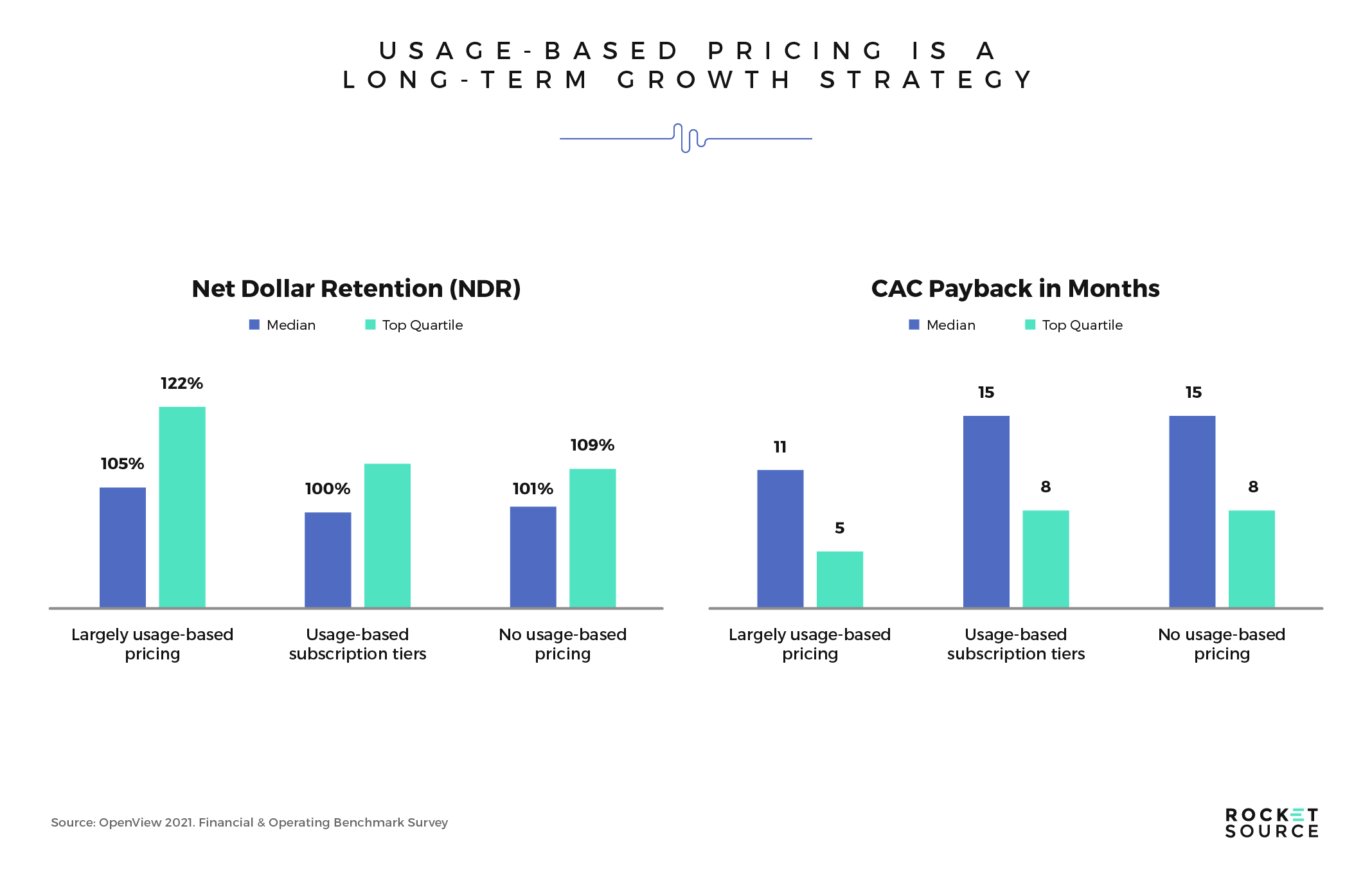

On average, companies that deploy a usage-based pricing approach through 1% to 50% of their revenue, grew 28% year over year. It’s hard to argue with those numbers. Usage based pricing on the surface is a solid long-term strategy.

Usage-based pricing models typically pay back their cost of acquisition (CAC) faster than non-usage based pricing models. While it’s clear that this could be due to the faster growth due to higher retention, we firmly believe there’s something deeper to this story. It’s here that we, at RocketSource, diverge from the crowd.

By now, you know that we believe usage-based pricing is innovative. Heck, we’ve even incorporated it and advised on it in the past. Still, we also believe that product-led growth isn’t about usage-based pricing alone. In fact, it’s not about the price at all. It’s about the way in which users perceive the value proposition. That value proposition is what determines the likelihood of users rallying around that experience. And, when users start gathering around a product, word of mouth coefficient and adoption of the product among their network grows organically and many times, exponentially.

Put differently, it’s a trickle up and trickle down effect driven by user experience, loyalty, and ultimately, brand ambassadorship. As market adoption grows, team members who might not have been willing to share the product, start to spread the word about what’s available without realizing it.

It’s for this reason that we do not define product-led growth around usage-based pricing alone. It’s also why we put so much emphasis on the customer experience, which is fueled by the team experience. It’s that aligned experience that drives the adoption both among employees within the business, and among customers through the product itself.

It’s clear that you don’t need to have a SaaS product to implement a product-led growth strategy. Our approach to product-led growth for enterprise can work across all industries and business models. Taking the fact that product-led growth does not equal product-manager led, UX-led, a lack of marketing or sales, pure automation, or usage-based pricing, you might be wondering what this strategy actually looks like at the core. Or, more specifically, how it plays out in enterprise. Let’s keep peeling back those layers.

How Does Product-Led Growth for Enterprise Play Out in Practice?

In the startup world, when in “go-to-market” mode, teams are being driven by one big thing — potential. What many don’t realize is that this potential is actually deeper than the possibility for what marketers refer to as, “up and to the right” style growth. The deeper potential, beyond product alone, is for product teams to work together in innovative ways. It’s potential for silos to break down, opening up the floodgates for sustained growth. The business itself becomes the product rather than the end deliverable becoming the product. Because the end experience is being touched by so many employees within the organization, the team is able to develop an experience that leads to deeper cognitive associations about the brand.

Still, too often, as our team at RocketSource gets deeper into the trenches with our clients who want to move towards becoming more product-led, we notice a glaring issue — they get too comfortable with the fact that they’ve achieved Product-Market Fit and sustainable traction. It’s these enterprises where we work hard to help them see product-led growth in a different light.

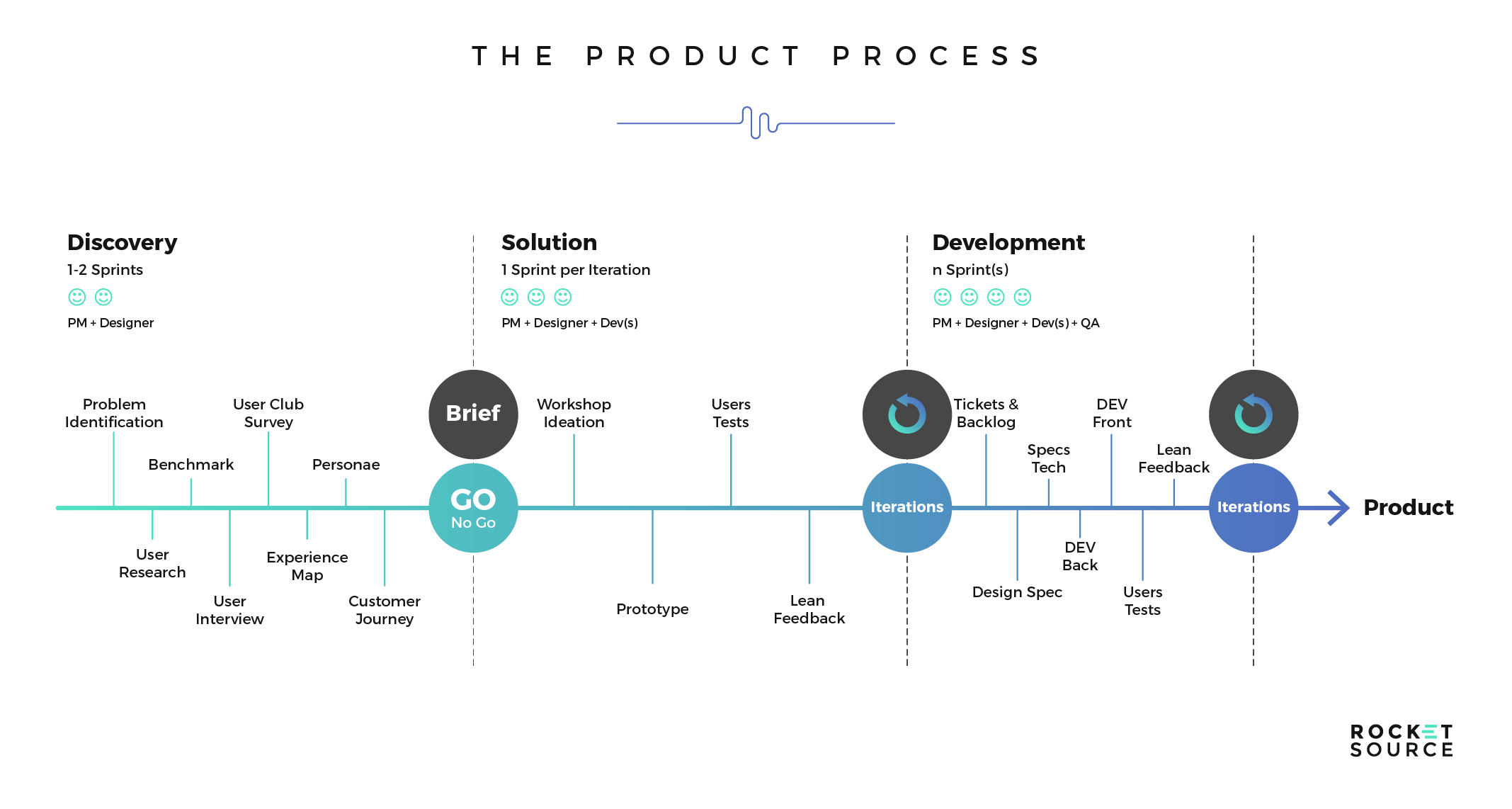

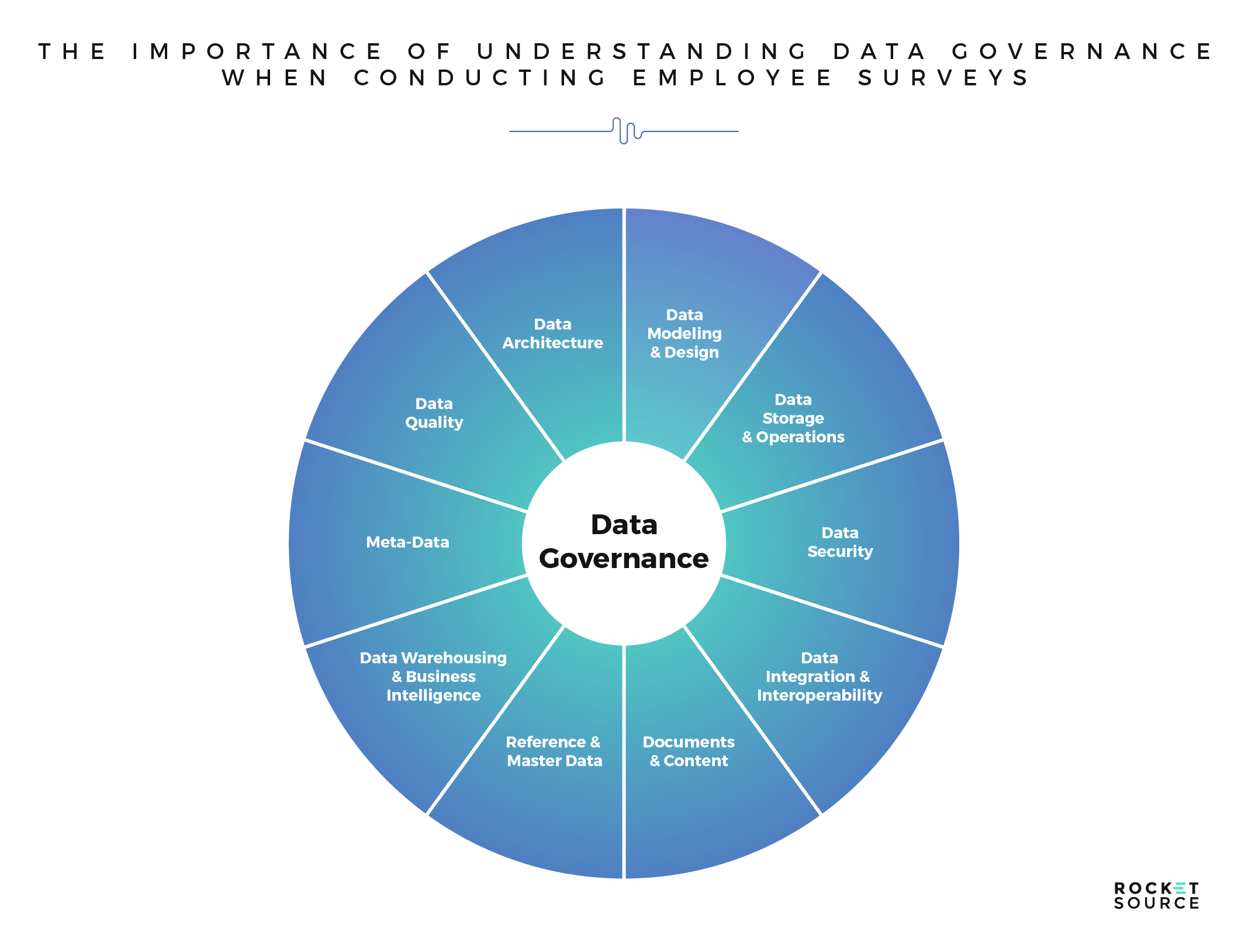

It is critical to your product-led growth strategy that your product managers can understand how to gather the right data to understand their internal alignment. If you’re a product manager and you don’t know how to run an EX to CX data loop, an EX to UX data loop, a UX data loop, a CX standalone or EX standalone data loop, then you probably shouldn’t be a product growth manager. Ultimately, it’s the product manager’s job to advocate for and have immense buy-in. This requires them to sync consistently with top managers, gathering intrinsic and extrinsic data, and then building models around that data to make sure it’s being prioritized so that the right features get built and the right product marketing takes place to drive LTV. This is what it looks like in practice.

When you run a product-led team, you’re constantly iterating on your product. You have to measure the loyalty of your customer base. You have to analyze how deep they go into your product. You have to segment and conduct robust data loops. Then, you must also put together a repository where everyone in your organization can access that data.

But you aren’t doing that for your customer base alone. You must also measure the loyalty of your employees to your product when thinking about your product-market fit and growth opportunities. You must analyze how deep they go into the products they represent, such as how often they’re using them, how well they understand the product, and what they know about the end experience. You must also have robust data loops around how your employees feel about the products you’re creating and how they’re using these products. Approaching big initiatives for digital sustainability, digital transformation, and more, through product-led growth, requires something much, much deeper — EX data looping. We’ll get into that in detail soon, but first, let’s look at why product-led growth is so different, and so much harder, for enterprise.

Product-Led Growth for Enterprise is Difficult

Product-led growth is so much harder at the enterprise level. Enterprises don’t have time to make mistakes, nor do they have the ability to be as agile as startups. Every fix takes longer. You must anticipate changes in the market because adjusting your strategy takes longer. Delivering value and a sublime experience becomes increasingly difficult the more people you put into the mix.

That’s a big consideration to make, and perhaps why many people don’t talk about product-led growth from an enterprise perspective. It’s hard and clunky. And, when you consider that product-led growth strategy stems from venture capital investing in new SaaS companies where daily/weekly/monthly active usage is crucial to survivability, it’s clear to see why startups have the upper hand when it comes to this strategy. Investors aren’t investing in the code at that point, but rather the product usage, which is easier to manage when you can move through changes quickly to increase the value of your product.

With that said, there are ways that enterprises can, and should, adopt a value-based pricing model that aligns with what the startup world often uses.

As you can see here, value-based pricing allows you to package and price your products more flexibly. They don’t rely on what the competitive market is doing as an enterprise does. Because this value-based and usage-based pricing is a strategy initially meant for startups, it takes some creative effort to showcase how this can be applied to enterprises. If you don’t have the same metrics that venture capitalists typically look for, or if you don’t refer to your customers as users of your product, it can be hard to differentiate this strategy for enterprise. With that said, we think we’ve done it.

When you think about how the user gets to the product, the experience they associate with that product, what they do for onboarding, and so on, you can start to think through the touchpoints that will create the best experience. Enterprises can break up their own customer journey into these micro moments and touchpoints to showcase the same sort of value at a smaller level throughout the buyer’s journey. Some common touchpoints in the user experience that align with this same approach of usage-based or value-based pricing, include:

- Checklists

- Percentages

- Progress bars

- High-fives

- Reaffirming the product’s value proposition

- Showcasing the people behind the product

- The promised land

These touchpoints showcase to the end-user how far they’ve progressed in their journey, or micro-journey, with the product. The idea behind touchpoints like these is to motivate users to continue to drive LTV in your product. You want to show their progress as a way of encouraging them to move through the steps in a way that will give them the best experience possible. No matter how well you design your UX/UI, you must account for the people not doing what you want or expect when they get inside your product.

The same concept applies to all other companies, but the method to that madness looks a little different. Without having a framework, like StoryVesting, to guide the approach along the bow tie funnel will make it even more challenging. These challenges are precisely what we help our enterprise-level clients solve when they approach us about product-led growth strategy for enterprise. Our starting point is consistently to leverage StoryVesting and the bow tie funnel. In doing so, we’re able to map various cohorts of users and the friction points that could cause a user to leave. Here’s what that journey looks like mapped out on our User Insights Map.

Our User Insights Map showcases what’s happening in your customer’s mind, the actions they’re taking, and the various experience levels at each touchpoint across the employees and customer’s experience. We go into detail about how to read an insights map like this in our co-founder, Buckley Barlow’s post about customer journey mapping. For the sake of this post, we want to point your attention back to the alignment between customer experience and employee experience.

Employees have such an intrinsic tie to that outward user experience because they’re the ones participating in the onboarding process, videos, development, and more. As you think about that overlap, it’s clear how it parlays into other verticals that impact the entire customer experience — not just the user experience. When your organization is larger than a few guys in a garage, you start to have more experiences to manage and tend to, which makes this type of experience mapping exponentially harder for the enterprise level.

Softening the Digital Experience at the Enterprise Level

Typically, the user experience deals with software. In software products, it’s all about the digital experience. Still, the customer experience can be blanketed beyond that realm of the user experience. For example, even though you have a digital, self-serve experience with a product, you can also have an analog experience to boost brand loyalty. Take ConvertKit as a prime example of a software company that does this well. They send swag to every new user that completes their customer onboarding process to extend beyond the digital interaction.

Unlike many companies that send random swag, which just ends up in the trash, ConvertKit’s swag is directly related to their CEO’s philosophies and core values. By adding a tangible, physical element to the experience, customers can feel more connected in a tactile way to the brand. Employees, simultaneously feel that connection, because they’re sending the swag that answers and honors the very values their product and work represent.

Another way to add an extra dimension of connectivity to the user experience is to add a human voice. We’re not talking about Siri or Alexa here. We’re talking about the voice of someone within your company to speak directly to the end customer. By simply saying something, such as:

“Hey, we’re software but we see you. You’re a power user of ours that has been with us for years, and we wanted to simply reach out to say thank you.”

That human recognition can transform a simple growth initiative that you’re hoping to achieve with a word-of-mouth lever. One employee’s voice can turn a basic user experience into a word-of-mouth customer experience lever. And if you’re that employee using his voice to connect with the end-user, you had better believe it will make an impact on how connected you feel to the brand. That’s because, when you’re watching an onboarding video or product video, invariably the voice you’re listening to evokes some sort of emotion. If the person you chose to do the onboarding video had a horrible monotone, the experience would be so bland and boring, that you’d destroy the word of mouth coefficient by a factor of 1.5 or even 2x simply because you chose the wrong human experience.

Every organization — from startups to Fortune 500 enterprises — will have some sort of customer experience in the future as they grow. That often means, some sort of physical interaction, such as sending swag or making a telephone call, or a knowledge base that moves beyond a chatbot to make the end experiences sublime. Those sublime experiences start with your employees.

Looking for more support on your enterprise product-led growth strategy? Let’s get on the phone and discuss.

Schedule Your Complementary Product-Led Growth Strategy Consultation

Product-Led Growth Starts With Your Employee Experience

If you think about CX as the all-encompassing alignment against EX, where UX just happens to be one element, then, you’re playing to win. The major differentiator between startups and enterprises is this — you must start to think about how you build word of mouth coefficients into your products by using product-led growth in your customer AND employee experiences. When those experiences are aligned, you’re able to deliver something so sublime, that the market can’t help but take notice.

Gathering employee feedback and data is a non-negotiable part of being a product-led growth enterprise.

One company that gets the importance of employee experience in product-led growth is Pendo. Pendo is one of the biggest product-led SaaS companies, and they help other companies become product-led too. As they talk about product-led growth, they also put a heavy focus on the employee experience.

With this EX-centric approach to product-led growth, Pendo prioritizes a focus on EX as well as CX and aligning the two—just like the approach taken by the StoryVesting Framework. Right on the homepage, they showcase why it’s so critical to get your employees onboarded, invested, trained, and engaged, and have them completely understand everything. In doing so, they showcase how they can help your employees get more vested with your products, which is essentially what StoryVesting is all about.

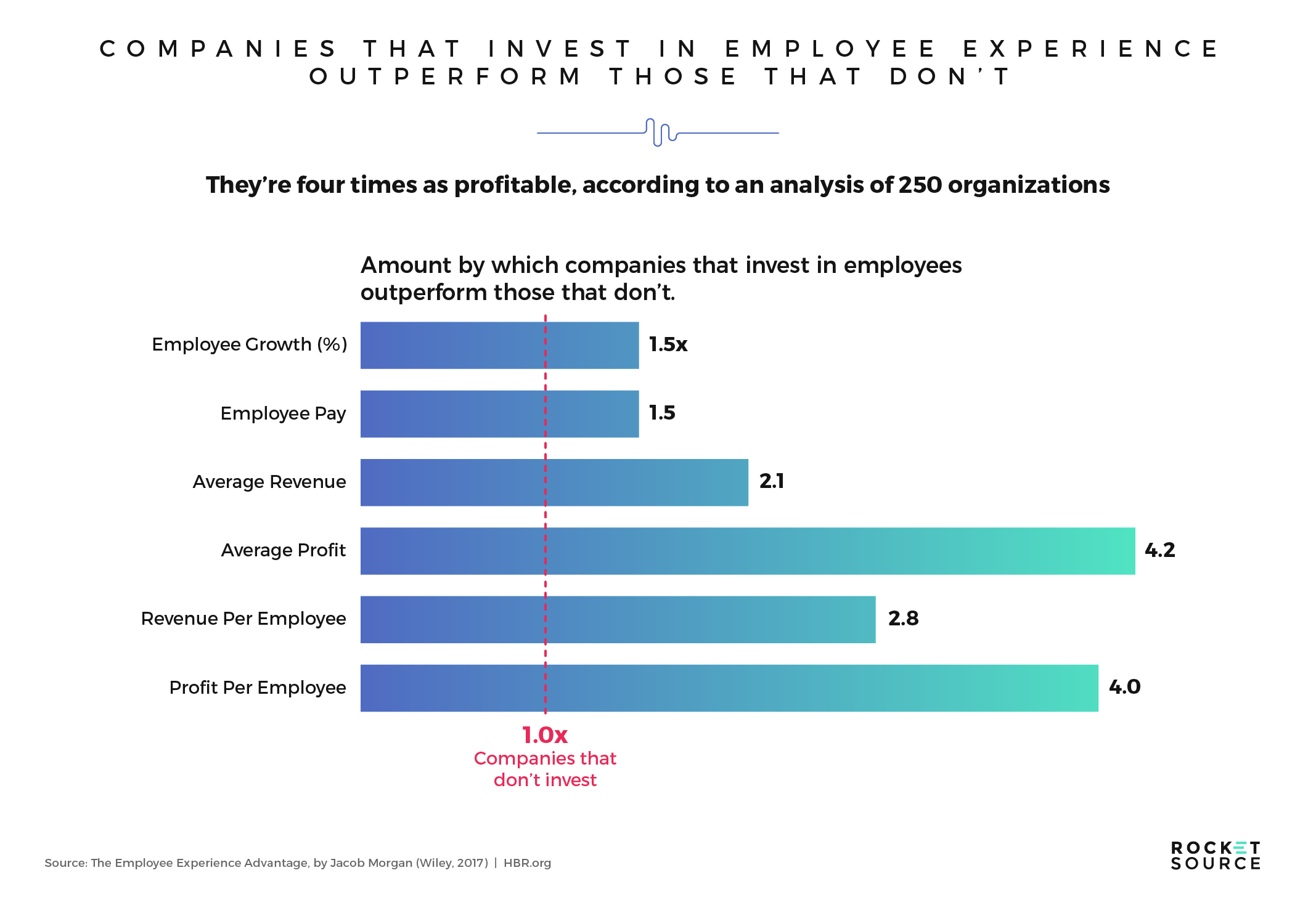

Consider the teams that drive the product experience. Marketing departments take credit for brand awareness. Product teams take credit for the user experience. Developers take credit for the frictionless code. We could go on and on, but you get the picture. Here’s the catch, though — as you look at deeper research, you’ll notice that it might be human resources departments that should be credited with some of this success. That’s because happy employees have been shown to be pivotal to driving happy customers.

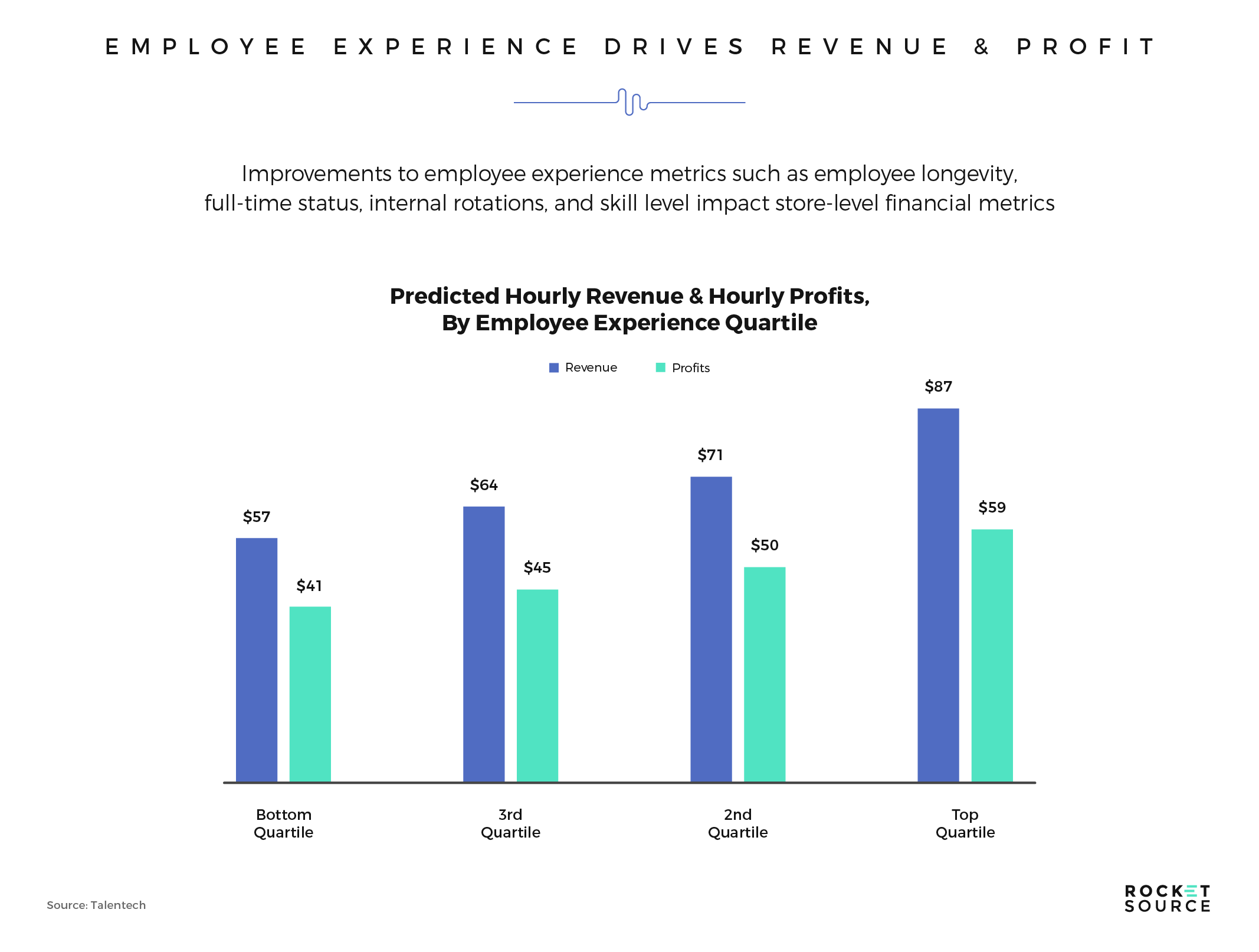

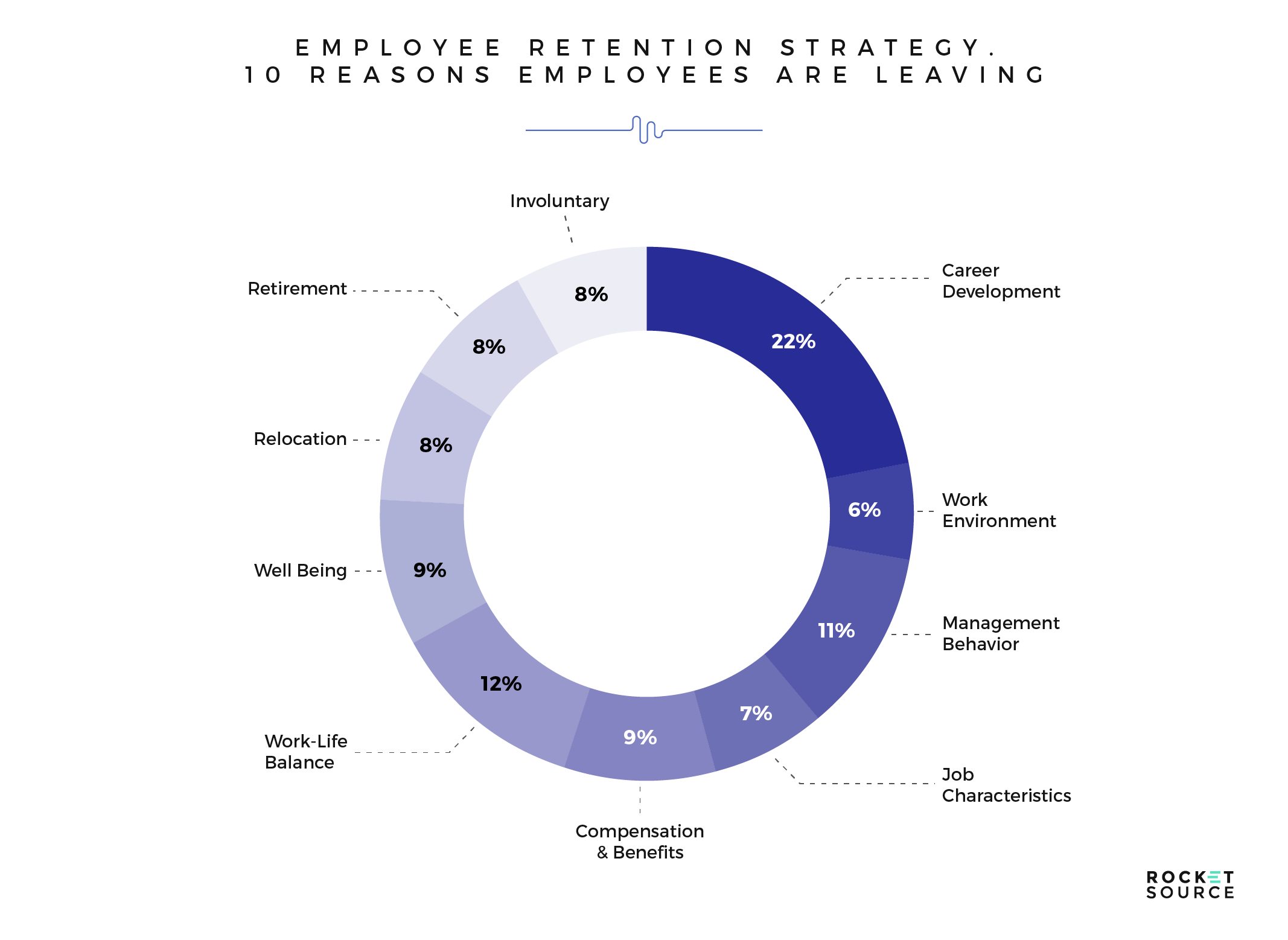

By this point in this post, you’re probably scratching your head wondering why we’re talking about employee experience so much when research shows that customer experience is what drives revenue growth. Well, as true as that may be, it’s only half the story. Check out this study by Harvard Business Review that showed how employee experience impacts your bottom line.

This study demonstrates how retaining top employees can move an organization from generating $57 per person-hour worked to $87 per person-hour. Better yet, these revenue increases aren’t tied to spending increases either. It is simply tied to improving the end experience for their customers by leveraging vested employees.

This is, admittedly, a simplistic example. There are many other factors below the surface that influence an increased ROI. And though this finds a strong correlation, there’s a larger story behind the actual causation between higher investment in EX, and increased ROI. Fully understanding potential causation is much more difficult than recognizing correlation. We don’t often see a lot of causal relationships between employee experience and ROI. Instead, what we do is whip up predictive layers of correlations and causations to better understand what’s happening throughout the employee’s experience and how it aligns with the customer’s experience.

If you’re using this EX data loop to track experience, you can start to identify patterns that will enable you to predict when an employee will churn. If that employee works in the product and you’re a product-led growth company, you will be able to predict the moments before your employee becomes unhappy. For example, you might know that many employees churn after one year of work. Knowing that a positive experience starts to subside around a year in the office allows you to start to implement incentives and strategies to keep them from leaving at that correlated milestone.

If you’re operating with unhappy employees on your product, you know that your product-led growth structure is broken. Driving this alignment requires regular and refined data looping to better understand what’s happening in the market and within your team.

Consider this visual representation of what an aligned employee experience looks like. Rather than focusing exclusively on the customer experience, you can merge the lens in which you view your team to determine how closely aligned they are with the customer’s LTV.

Product-led growth requires that your people are 100% invested—especially product people who are creating the buy-in, working with data analysts, and the development and marketing team. With robust data loops, you have a much better opportunity to ensure the employees who play this critical role get matched to an LTV metric that will allow you to understand their satisfaction levels, as well as have them take ownership of the customer’s LTV and satisfaction levels. This is the level of alignment that’s needed to truly drive a StoryVested organization.

Let us acknowledge the elephant in the room here — quantifying EX as it correlates to CX and UX is no easy feat. There isn’t a simple formula that allows you to correlate how EX correlates to revenue growth to the top or bottom line. But, if you’re not at least moving towards that alignment and how it’s playing out and impacting your UX and CX, you’re behind the curve.

Mapping the EX and CX Journey for Product-Led Growth

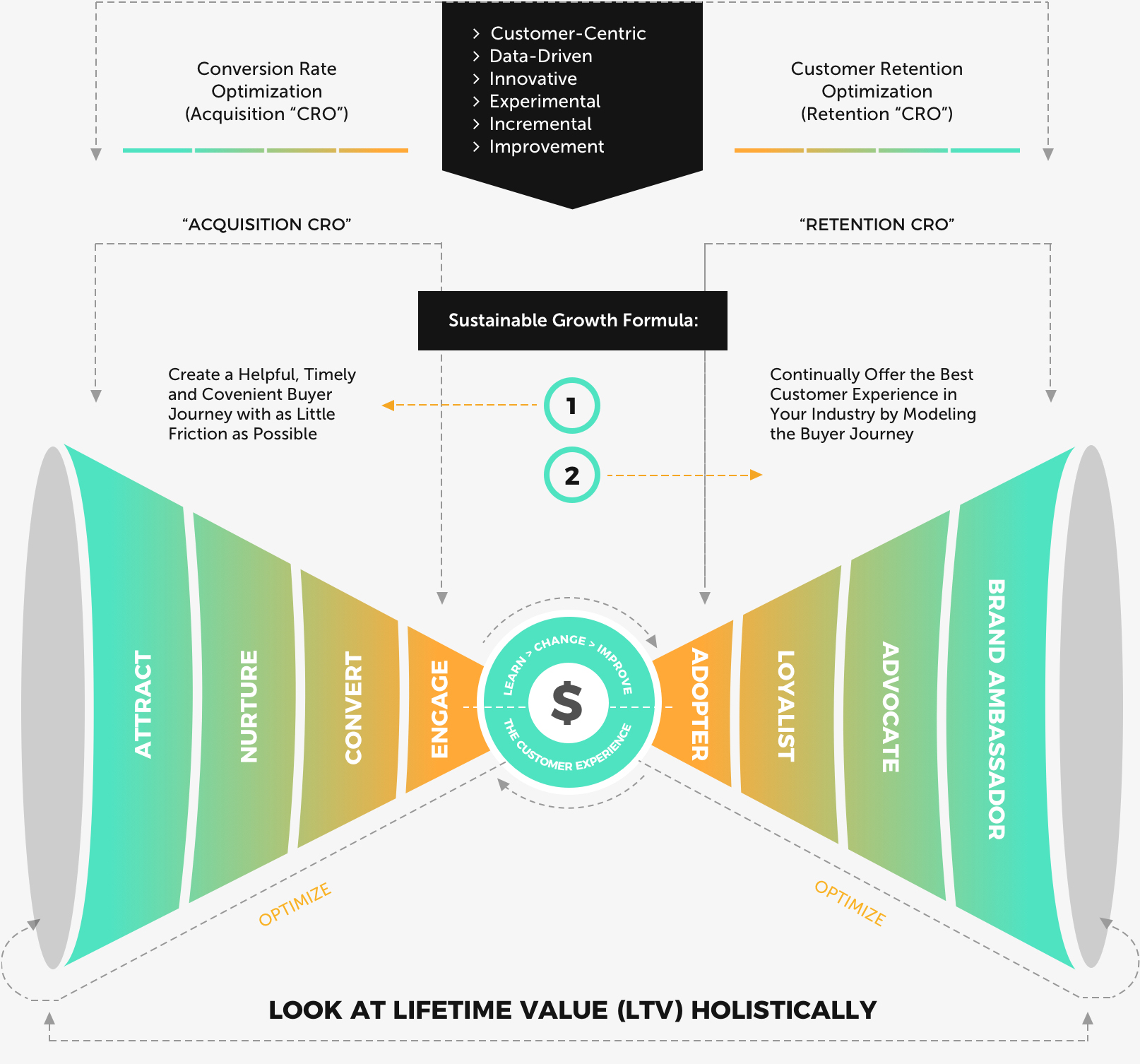

There’s something you must know about human behavior — it doesn’t happen in a straight line. Nor does it always stay the same. Still, there is a predictable funnel that every customer goes through when finding a new brand to buy from, through to making their first purchase, becoming loyal to the brand, and then ultimately, becoming a brand ambassador. We call this the bow tie funnel and it looks like this.

If you’re not yet familiar with the bow tie customer journey funnel, you’re encouraged to read more about it in our post dedicated exclusively to that strategy. For the sake of this post, here’s what you need to know about this funnel as it relates to product-led growth strategy. Like the traditional marketing funnel, the experience starts when a customer is attracted to a solution that will solve a very specific problem they’re experiencing. In a perfect world, the customer would move seamlessly from feeling a pain point to buying from a business, and then living happily ever after, but that’s not how the world works.

A product-led growth funnel deviates from the traditional upright funnel because the experience extends well beyond purchase, encompassing the processes and experience with the product itself.

Reaching that brand ambassador level is crucial for product-led growth because it’s what helps boost a product-led growth strategy. Word of Mouth skyrockets in that stage. So does the virality of the brand.

But how do you get your buyers to that stage? How do you nurture them from just becoming aware of your brand to shouting your brand’s name from the rooftops? That’s the age-old question, and one we take very seriously, especially when it comes to product-led growth strategy. To reach that end, our team has created a robust User Insights Map (UIM) to map our product-led growth strategy across the buyer’s journey.

Mapping Product-Led Growth

It doesn’t take a background in psychology to know that humans are not predictable beings. We ebb. We flow. We have conversations that shift our thinking. We scroll at night on our phones or tablets, then pick up that search again the next day on our laptops. We’re distracted by social media and new trends. Knowing how much is tugging at our attention around the clock, it’s clear that it’s time organizations stop treating the journey people experience as a one, two-step progression from finding a business to buying.

Product-led growth strategies for enterprise require that you dig deeper and get into the behavioral nuances around how people are using your products both internally and externally. Rather than building rigid sales journeys, you can build workflows and use cases to meet customers AND employees wherever they’re at on their journey, and see how that directly impacts the product you’re creating.

Yet many organizations still use a rigid customer journey map as their guide post. At RocketSource, we’ve evolved that map into a User Insights Map to address the complex journey of modern employees and modern consumers. As you saw above, it looks like this:

We’ve teased it higher up in this post, and now it’s time to get into the nuances behind this map. If you’ve seen our Customer Insights Map, you can probably see plenty of similarities. To show you how versatile this map can be for enterprise-level businesses wanting to adopt a product-led growth strategy, we adapted the User Insights Map to a new industry — a streaming service product.

If you haven’t yet read our co-founder, Buckley Barlow’s in-depth post on how this map came into existence and all the nuances inside of it, we highly encourage you to check out his post on customer journey mapping when you can. Click that link and open the tab, then squirrel it away. For now, we want to focus on a very specific part of this map as it relates to product-led growth — the convergence/divergence bands, which we use to measure customer and employee experience alongside each other.

The Eye-Opening Insights on Product-Led Growth From Convergence/Divergence Bands

In order to understand convergence/divergence bands, you have to know where they came from. Stick with us for a second, because we’re going to give you the backstory to how our convergence/divergence bands were developed. These bands were inspired by Buckley Barlow’s experience on Wall Street. To help you get inside our brains as we developed them out, we’re going to deviate to the stock market which will offer more context around a tool that has proven to have some serious predictive power. Don’t worry. We will come back to product-led growth in just a little bit, but you need the context to see where we’re headed first.

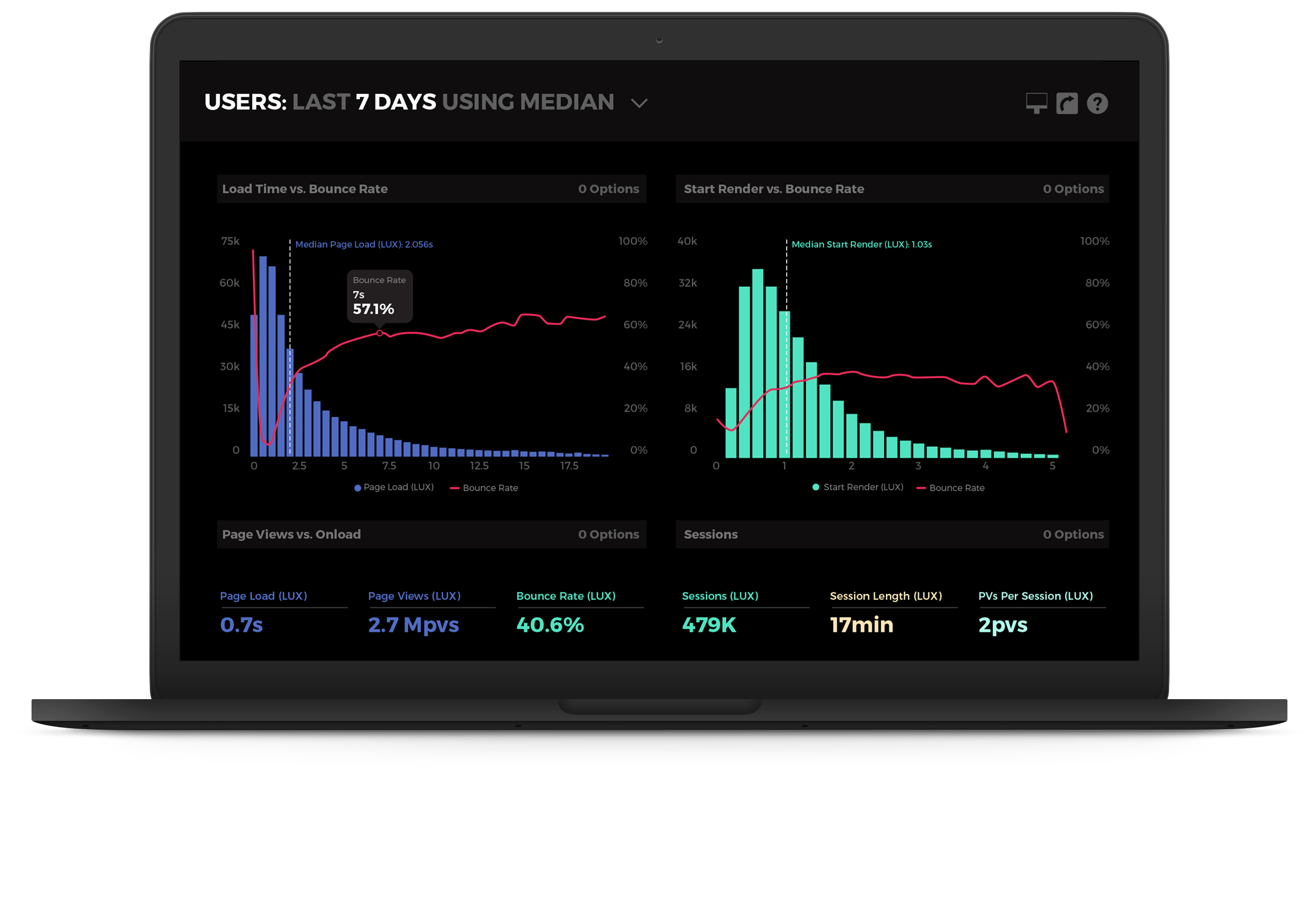

If you’ve ever talked to some of the best hedge fund quant traders, you’ll know how skilled they are at spotting sentiment and momentum patterns in data algorithmically. They do this in order to find and resolve imbalances in price. Algorithms like the one you see here look for imbalances via depth of market, order flow, and volume.

The same can be done to find and resolve imbalances in experiences as it relates to a product. This concept of pattern recognition applies to business analytics, rooted in qualitative and quantitative sentiment and momentum patterns. Buckley saw this because, before breaking into tech in his mid-20s, he worked on Wall Street in Capital Markets. Every single day, he would trade billions of dollars alongside some of the best traders and quants with incredible trading records who had PhDs from MIT, and other prestigious universities. Yep, you’d better believe he learned a lot from them — and experienced the personal weight of the Dunning-Kruger effect.

He shared with us something that stood out to him about this experience, though. While he saw plenty of order flow and price action terminals, what he rarely saw used was retail technical analysis tools, like the Ichimoku Cloud of other indicators that you see all over YouTube these days. His desk had four monitors that instead covered price action and fundamentals via Bloomberg and other terminal data. He loved it and really dug in. The data streaming across his screen was super-advanced, hard to read, and yet it was critical to the performance of the trading team.

This concept of monitoring advanced behavioral data in the market holds true with business and journey analytics too, and so he brought it to RocketSource. Basic survey data might be easy to collect, clean, and visualize, but, what we’re seeing in the market with the biggest and fastest-moving brands on the planet is in stark contrast to the mass market. The biggest and fastest-moving brands are the ones that are leveraging behavioral employee and customer data loops to make more informed decisions about their products and end experiences.

Behavioral data-driven CMOs/CXOs/CIOs/CEOs know that plotting basic survey data on a correlated histogram or doing data mining to get to some immediate AI initiative, just doesn’t cut it any longer. (Sorry to those Data Engineers and Analysts out there but it’s NOT your fault that you’re wasting your time MOST OF THE TIME).

Instead, cross-functional teams are taking the time to build better qual to quant loops both internally and externally and then matching events within the employee and customer journey against both imbalances (friction points) and opportunities (moat-building and/or revenue-enhancing). It’s this premise that led our team at RocketSource to develop a more detailed, and highly unique approach to developing our User Insights Map to break away from the typical rigid journey you’ll often find today.

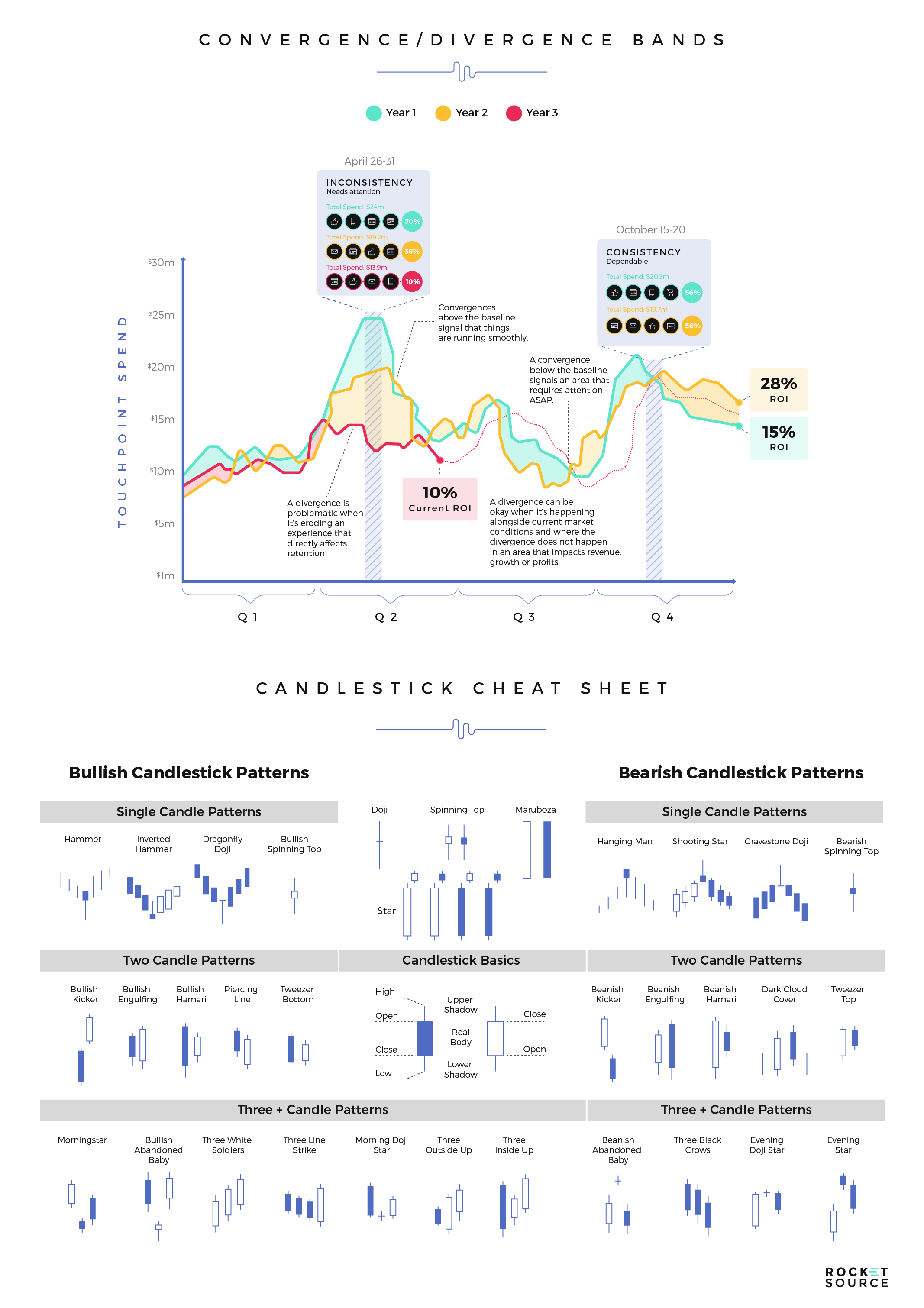

If you keep a pulse on what’s happening on Wall Street like we do, you might have stumbled upon or used a little tool called Bollinger Bands before. These bands track various trend lines across a moving average to predict what will happen in the market. The goal is to help traders and investors know when it’s time to take action. Here’s an example of what Bollinger Bands look like from Commodity.

On Wall Street, Buckley used these Bollinger Bands to make some serious waves. When he moved into the corporate world, he knew he wanted to bring them along to leverage that same predictive power. The way they’re able to foreshadow events by converging or bringing two trend lines together, or diverging, or seeing a gap between trend lines, is a quick way to visualize deep behavioral data and react before problems occur by distinguishing and predicting wide differences and narrow alignment between two experiences.

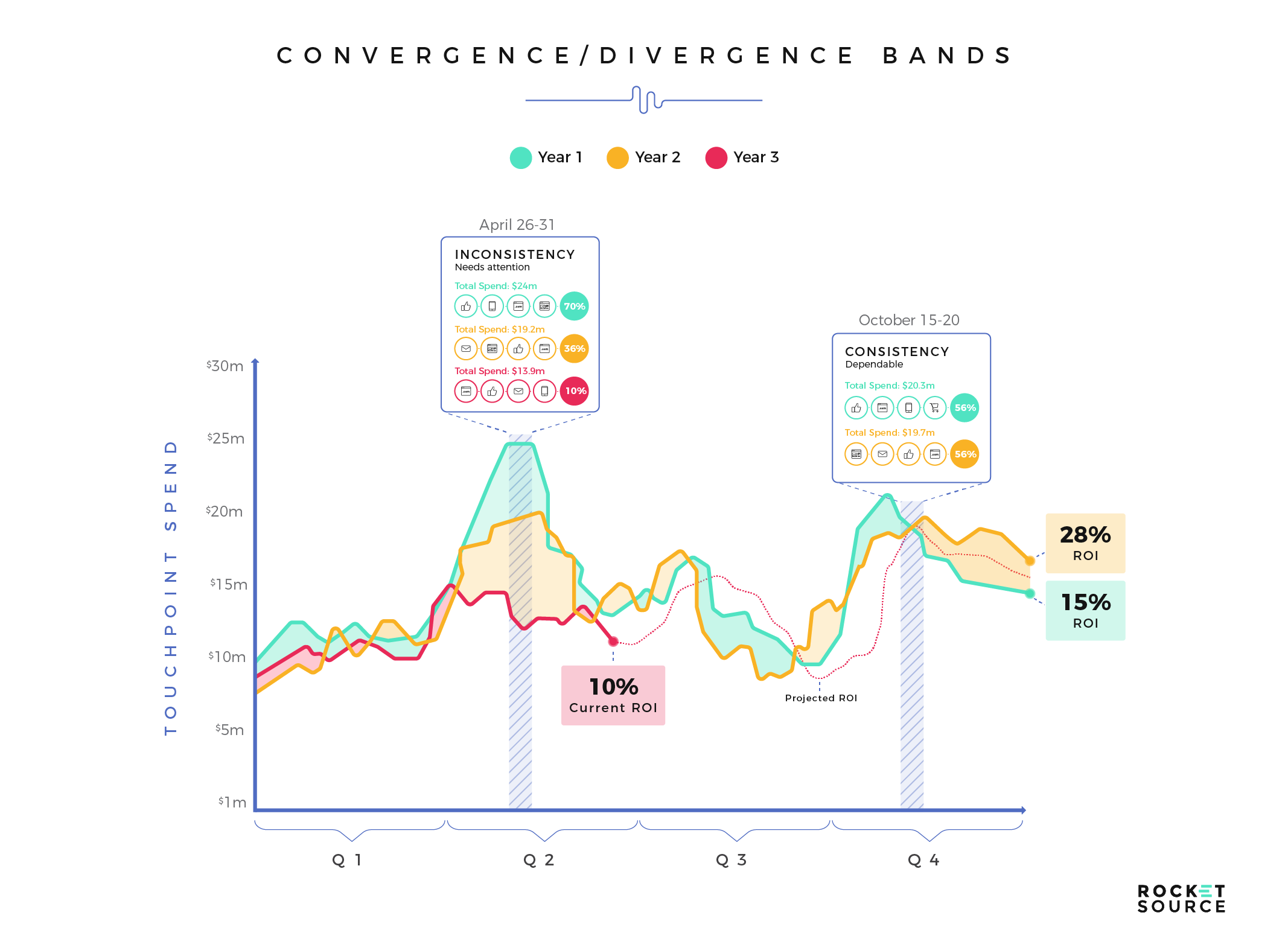

The graphic above shows how powerful these bands can be when layering multiple years of spending and the return on that spending. It’s clear that something different took place between the three years in quarter 2. Perhaps it was a new product/feature release. Perhaps it was a new marketing strategy or messaging. No matter what the cause was for this big divergence between years, it’s a clear point that we, as a team, would want to address when analyzing behavioral data within the organization. What happened differently in year 1 versus where we’re heading in year 3, and how can we get out ahead of it before sales plummet?While these bands are great for predicting sales trends and forecasting growth, they’re perhaps even more powerful for anticipating customer needs and developing automations that will reduce churn among both employees and customers. In order to do this alongside behavioral data and while taking an empathetic approach, we map our convergence/divergence, or Barlow Bands as we lovingly call them, onto our User Insights Map. This approach allows us to pair the bands with the customer’s journey, sentiment data, and empathy mapping to get a clearer idea of what’s happening at each stage.

On the User Insights Map, we’re able to drill down into where the bands come together and where they diverge, which allows us to pinpoint specific areas where churn problems could arise. For product-led growth companies, this can shine a bright light on potential trouble in your internal paradise among your team, or potential friction points within your product that can cause your users to bounce. Once friction points are identified, you can leverage the data to directly address problems before they arise.

For example, let’s say that your development team is having a hard time understanding why certain bug fixes are being requested. Your marketing and sales teams are frustrated because their messaging is off, eroding their performance and thus, making it harder to stop the bleed of customers. Your HR department is frustrated because they’re fielding these frustrations and watching top talent leave the company. There’s clearly a breakdown. Using the convergence/divergence bands, you can identify where that breakdown occurs by pinpointing the touchpoint and spot in the journey where the separation occurs. In this case, it’s probably during onboarding when the team wasn’t properly skilled in the framework you use in your organization, so all communication is disjointed. What one department is seeing, another is not, and soon, everyone is confused about how to work together effectively.

Once the organization identifies a specific area of friction, the team can then leverage the data to create new onboarding paths specific to each cohort within the team. To be able to leverage this data requires that you first identify your baseline — the middle line you’ll use to know how well you’re doing and gauge what these convergences and divergences really mean.

Finding Your Convergence/Divergence Baseline for Product-Led Growth

Before you can predict critical events in your employee and customer journeys, you must identify the baseline you will use to predict churn. The baseline is the horizontal dotted line that goes in the middle of your bands. This is perhaps the most important part of leveraging convergence/divergence bands for product-led growth, and the least understood.

Often, many people assume that a baseline is automatically 50%. Anything below 50% signals problems. Anything greater than 50% is smooth sailing. That’s too superficial of a level to look at these indicators though. Instead, it’s all about how you construct, formulate, and weight your data that will determine where the baseline goes.

As you’re identifying your baseline, you must tie it back to a specific goal. It’s only after you have that specific goal in mind that you can then construct a formula for it against the EX and CX alignment. For example, let’s say we’re choosing a baseline around the goal of improving employee and customer effort scores. If our lowest ever employee effort score (EES) and customer effort scores (CES) were 80%, we’d want our baseline to be higher. The baseline needs to be relevant to the data you’re measuring, while simultaneously allowing you to spot the areas that signal trouble in paradise, so you can make the necessary adjustments for product-led growth.

Insights From Convergence/Divergence Bands

Often, when we present this approach of visualizing experience data with other organizations, there’s a knee-jerk assumption that divergences are bad and convergences are good. If you’ve been around the data block long enough, you know that things just aren’t that simple. There are behavioral nuances baked into every insight, and patterns that can equip us to take a more predictive stance when identifying key areas for product-led growth at the enterprise level.

With that said, we’ll start with the general and get to the nuanced as we go.

Let’s first imagine that we’re looking at the convergence divergence bands of EX and CX scores for an airline company using a 50% baseline. We’d rarely, (if ever) use a 50% baseline because it’s highly unlikely that 50% is the exact middle point where the EX and CX scores break. Still, we want to keep this as simple as possible for the sake of this example, so we’re rolling with it.

On the 50% baseline, at a specific touchpoint, imagine that you have a score of 25% for EX and a score of 75% for CX. Upon closer analysis, you can see that this divergence happens when a customer talks to an employee to resolve an issue with a reservation. A possible reason for this divergence could be that the employee’s score is low for this touchpoint because they’d rather the customer use an online knowledge base instead of talking to a live agent. On the other hand, the customer has a higher score because they value having that personal connection when resolving an issue.

The company’s gut reaction might be to immediately fix the problem to close the gap, but we work differently. We don’t simply aim to fix the divergences. Instead, we look closely at what’s happening to better hone in on which areas in the bow tie funnel require attention. In the case of the airline above, we might not make the adjustment to the divergence just to boost the EX score because we do not believe adding a knowledge base over allowing a customer to speak to an employee would drive revenue growth. Instead, we can just chalk up those areas as being part of the business model and focus resources, such as better training for the team, where there will be a bigger impact.

The impactful divergences are those where there’s a specific solution that can grow LTV. When the divergence is resolved, revenues, profits, or usage can increase. Those are the areas that deserve the most attention. There are a variety of ways to pinpoint the areas that matter the most when it comes to LTV. To get there, we like to look at this candlestick approach when analyzing the EX and CX scoring.

These various candlesticks show how the patterns in data can relate to the bigger picture. We can keep peeling back the layers to understand what’s really happening in the experience. For example, if we see a divergence that feels like an easy fix, we will only touch it if it feels like it’s a core lever for driving revenue and growth.

Convergences, on the other hand, typically come in two categories — convergences above and below the baseline.

Positive convergences occur above the baseline. If your baseline is off, you could be running forward with the false expectation that things are okay because you have what appears to be a positive convergence. However, with the right baseline and a convergence above that baseline, you can sit easier knowing that things are probably going smoothly in those areas.

On the other hand, a convergence sitting below the baseline is something extremely problematic. This convergence signals that both employees and customers are unhappy, which can amplify the amount of friction they’re experiencing. Anytime we see a convergence below the baseline, we know something has gone off course and needs to be fixed ASAP.

To find those areas and get very specific about what’s missing in the experience, we run a gap analysis, which we showed you above. A gap analysis is done through the lens of the 3 Ps — people, processes and platforms — which gives us the opportunity to identify where we can rectify those critical convergences. Sometimes, it’s the leadership, or the people, who are causing the divergence. Other times, there’s a problem in the tech stack that, with a few intentional swaps of platforms, we can fix. And yet, other times again, it’s a process issue that’s causing a core breakdown.

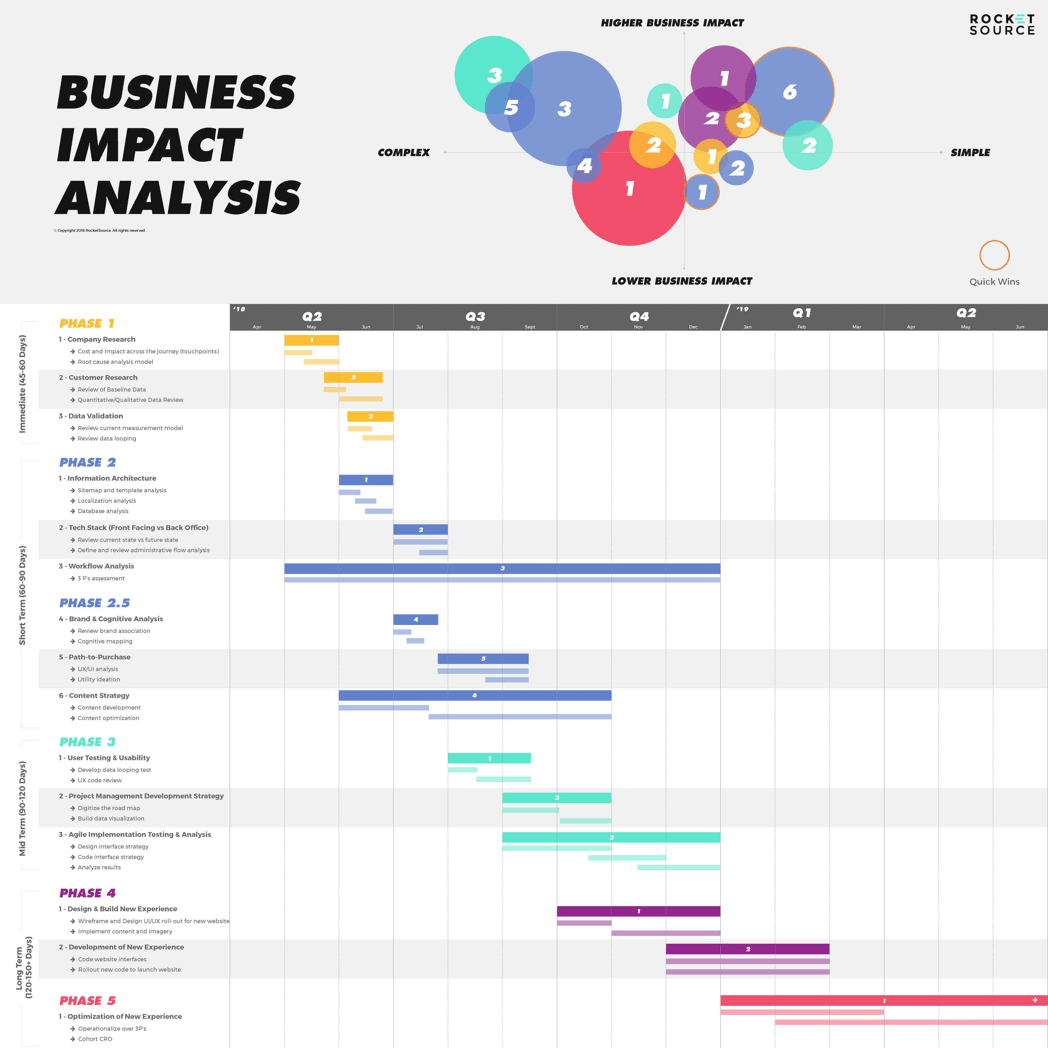

Again, each time we use convergences and divergences to help clients identify areas that need to be fixed, we think about those solutions and their specific impact on LTV. If it’s not a quick win or not big enough of a win to bring significant change, we won’t touch it right away. Still, we’ll keep a close eye on it and mention it to the client so our team can continue to monitor what’s happening in and around those areas. Using that data, we can then prioritize what needs to happen first, second, and so on through a Business Impact Analysis.

As strategic changes are made to remedy negative convergences or glaring divergences, you can’t just assume everything gets instantly fixed. You must maintain an ongoing employee experience data looping process in order to ensure things are getting fixed entirely, rather than causing other problems elsewhere in the journey.

In addition to patching up broken micro-experiences, you can get predictive about what your employees need. At the enterprise level, that’s no easy feat, especially for leaders managing hundreds, if not thousands of employees. A massive disconnect between the top and bottom makes it hard to create these amazing journeys. That’s where automation comes in.

Humanized Automation of the Employee Experience

We might sound like a broken record here, but employee experience is paramount in product-led growth. When you can leverage a User Insights Map like ours to identify points in the employee’s journey where they might churn, you can get out ahead of many problems, such as lower customer LTV, poor customer experiences, and more. To be more predictive requires that you understand what’s happening with your team.

Perhaps unsurprisingly, at RocketSource, we use our StoryVesting framework to shape this construct and keep the guardrails up as the data moves through the feedback loop.

Full disclosure: We don’t care which framework you use as long as you’re using one. We believe strongly in the StoryVesting framework because we’ve seen the results it yields for enterprise organizations, but you must choose one that’s right for you and your team. If you’re not familiar with the business transformation framework, Storyvesting, be sure to set aside time to read this in-depth post about how it came to life. If, after understanding the framework, you decided that StoryVesting isn’t right for you, you won’t hurt our feelings. Still, for the sake of this post, it’s the lens we’ll take when talking about how we approach this data.

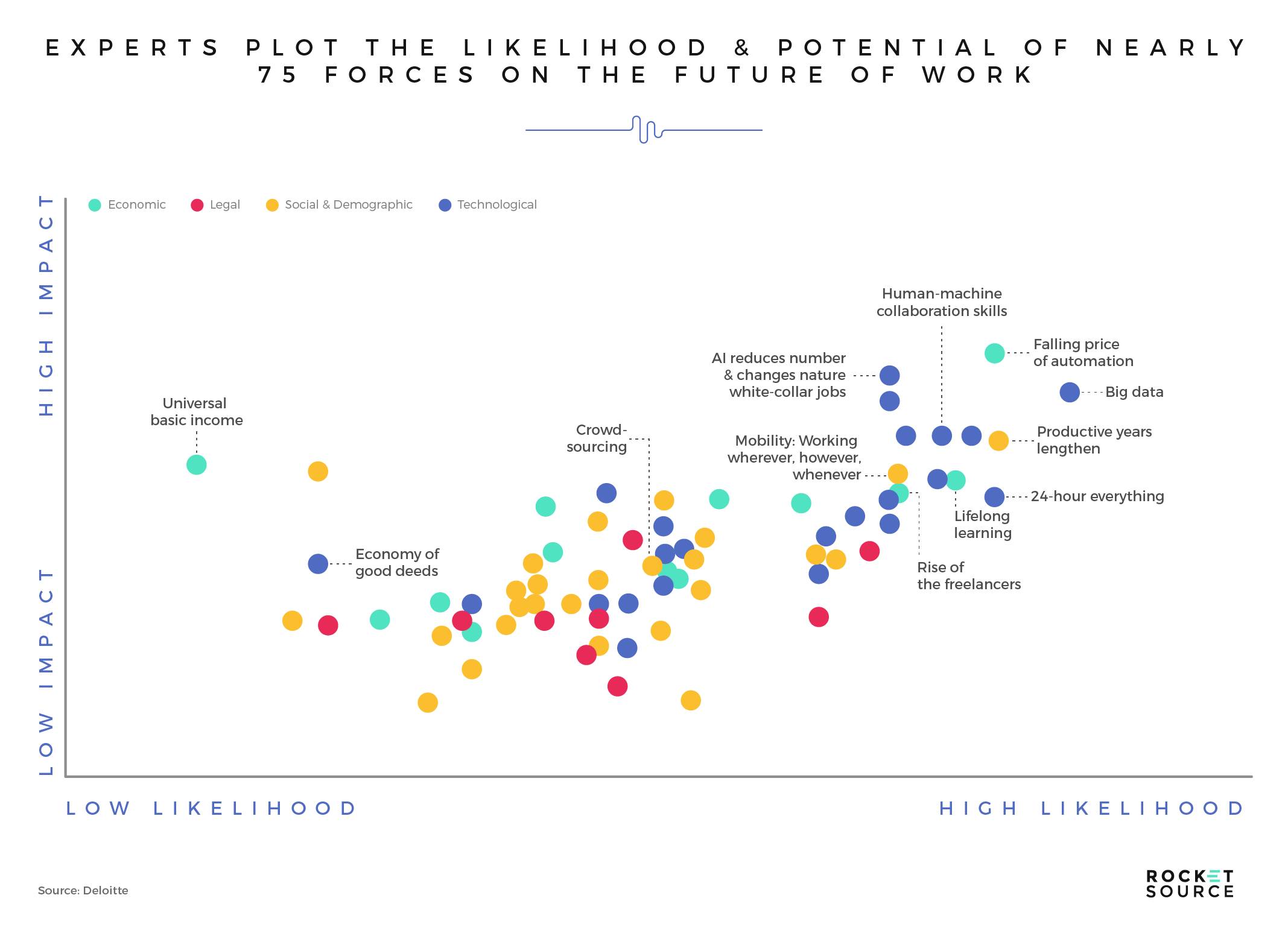

Whenever we’re gathering employee experience data, we’re doing so with the end goal in mind. For us, that end goal is most often the alignment of the employee’s experience with the customer’s experience. Here’s a prime example of where this type of research really starts to pay off — take a look at Deloitte’s findings on the evolution of work.

Working wherever and however. Human to machine collaboration. These are just some of the significant shifts taking place in the world today when it comes to how employees work and their experience at work. Businesses that fail to acknowledge these shifts could quickly become part of the great resignation that’s underway. However, by addressing the employee’s experience at a macro level, organizations can get team members more vested in their roles.

That vesting through is the 40,000-foot view premise of the StoryVesting framework. Through data looping and by being strategic about our employee experience data collection, we can leverage these results across both journeys. For example, we can reduce employee churn while also increasing our customer’s LTV by understanding where there’s friction at work and in the product.

The data collected through the lens of employee experience can then be filtered into a variety of use cases. HR can use the data to deliver a cohort-based onboarding experience. Here’s how.

As we, at RocketSource, are able to identify specific triggers for each employee, we then use software to build loyalty among the team. By becoming predictive in nature, organizations can get out ahead of problems before they erode employee and customer experiences alike. Let’s dig in a little deeper to what that looks like.

Using Predictive Employee Data Profiles to Automate the Employee Experience

Predictive Employee Data Profiles (EDPs) allow organizations to keep a closer pulse on employee performance. That close watch of employee performance allows you to be alerted when things are on the verge of going awry. As soon as you spot the erosion of the employee experience, and a specific pattern that you know typically leads to employee churn, you can get out ahead by adding an automated touchpoint in your employee’s journey. For example, managers can award employees automatically with a bonus or a video to the employee letting them know they’re seen and they’re doing a great job right at the moment they might typically put up their resume on Indeed or start looking at competitors on Glassdoor. As you start to uncover the triggers that boost retention the most, you can then automate more of those triggers throughout the employee’s journey, improving the employee experience and simplifying the workload for the managerial leaders.

One application that does this well is Bluebird. Bluebird lets you send payments faster and more automatically based on specific milestones in your employee’s journey with your company. Here’s a quick example of one way you can use a platform like theirs to reduce churn at a common friction point — the one-year anniversary — simply by automating a bonus to be given at that time stamp.

By building out these unique journeys based on employee data, you’re able to operate more empathetically with each employee cohort. Building event-driven journeys is a far more potent strategy that, when implemented, can have a dramatic impact on employee satisfaction and retention.

On the surface, this might sound like an easy one-two punch. However, let us warn you — simply mapping experience scores on two overlapping lines and circling the gaps and overlaps, isn’t enough to give you the kind of predictive power needed to design elegant and effective predictive journeys. It requires that you find the right baseline and have a solid grasp on how to understand what the convergences and divergences mean — because translating convergence & divergence bands is not as clear cut as you might think.

Meshing Employee Experience With Customer Experience to Fuel Product-Led Growth for Enterprise

The inception of the product-led growth strategy and terminology came from the SaaS world. We’ve mentioned that before, but it deems mentioning again because it frames why so many conversations about this methodology center around the user experience (UX). Heck, having a UX focus is so important that many venture capitalists won’t invest in non-user-generated growth outside of product-led growth.

User experience and user interfaces (UX/UI) are tantamount to having amazing success. But, when you bring up customer experience, you’ll often lose the attention of venture capitalists. For this reason, we’re being intentional with how we talk about the users of the product. Don’t let that terminology trip you up. You can easily substitute the term customer for user, but what’s interesting and unique between those two terms is that ‘users’ implies a more self-serve experience. The person is using the product, so they’re in the experience driver seat. Knowing this, you can build machine learning and automation around the user experience, which in turn can alter the way you sell your products or services. Customers imply a more in-person or interactive experience, which can sometimes feel harder to build digital automation around.

With this slight differentiation in mind, you can likely see how our journey map is a little different. You won’t bring in the same touchpoints for a SaaS business as you would for traditional or enterprise businesses. That’s because the entire goal of a product-led growth company is to create word of mouth coefficients and viral loops through word of mouth. That only happens when the product itself is the experience, which is what spurs those higher word-of-mouth coefficients and viral loops.

The way the product meshes with the employee experience over time is critical. Take a look at this visual of the various layers that go into creating a product-led growth strategy for enterprises.

User Experience Layer

What user experience will drive word of mouth coefficients for your product? Well, the answer to that question will continuously change. Yeah, sorry to tell you it’s not as easy as figuring out a great UX once and calling it good. As the front-facing layer of your product, UX is constantly changing— for many reasons. Technology gets updated. User behaviors adjust based on the macroeconomic backdrop. You gather new data around how your customers are using your product, such as through heat mapping or product-market fit surveys, and find holes in your user experience.

While all those changes are happening, your employee experience is impacted too. In a perfect world, your employees are the power users who will identify the need for these changes up front so you can test, tweak, and update your product often. Without valuable feedback from your employees and vested players, you could quickly fall behind.

But here’s the catch — when you have turnover, such as getting a new designer, a new product owner, or a new CMO, your user experiences will continuously change. That’s because, with the new team members comes a new focus, new ideas, and a new approach. Those new approaches can impact consumer sentiment too. Regularly auditing your team and your users will ensure that your most vested users — your power employees — are continuously happy and vested in the product’s success, so that your user experience can continue to drive growth through the product experience.

Application Layer

The application layer of a product-led growth strategy is another critical component of your employee and user experience. Your application layer is the tech stack of platforms that run your product. Your application layer is more consistent than your UX layer — since making shifts to the platforms you use is far less common than making tweaks to the user experience. Typically, we’ve found that these shifts happen every three to five years, as technology becomes outdated and new technology comes onto the market.

At RocketSource, we pride ourselves on being tech agnostic. We will never recommend a tool simply because we get some sort of affiliate check if a client signs up. In fact, we don’t create affiliate partnerships with platforms, so that we can continuously maintain our ability to be purely objective when recommending platforms to clients. Instead, we recommend technology and applications based upon the alignment of the 3 Ps — or the people, platforms, and processes of your business. Deciding what to put in your application layer stems from the desired outcomes within the context of your business’s 3 Ps— and in most cases, that boils down to higher revenues, higher profits, higher user growth, and so on.

Data Layer

As time goes on, you will have gathered a tremendous amount of data from both your employees and your customers. By sifting through these data points with a fine-tooth comb, looking for causation and correlation between the findings, you can uncover various elements of the experience that are paramount. This also lets you identify bloated features that don’t contribute to your product-led growth strategy, empowering you to further refine the experience, lower costs, and build a product people will love to share.

Enterprise organizations have a wealth of data at their fingertips, but having the data alone isn’t enough. In order to gain valuable insights at this level, you must know how to appropriately mine and model the data to better understand what’s happening from a product-led growth perspective.

The employee experience plays a crucial role in how quickly updates are made and problems in the user experience are spotted. The product experience can be a CORE experience but it can never, ever be THE experience. Here’s why:

By approaching product-led growth strictly through a user experience lens becomes a problem when you stop understanding that human behavior is driven by an emotional response — even with software. All users have an emotional response to the brand and the culmination that makes up that brand experience.

The brand experience encompasses so much from the people and the videos to the software experience, where they found it, and what their peers are saying about it. Features inside a piece of software, a product, or service don’t matter nearly as much as the culmination of those experiences. If you don’t align experiences with something as warm as a human element or personal touch, your product will suffer.

The 3 Ps Matter in Product-Led Growth

One of the most important and compelling elements of the StoryVesting framework is the 3 Ps — process, platforms, and people. Let us demonstrate how these meld together to create a sublime customer and employee experience.

Process

Product-led growth is often fueled by the process the customer takes before, during, and after their purchase. That process is developed by the internal team. Without having the internal processes buttoned up so that they yield a sublime employee experience, the customer’s experience on the front-facing product will often suffer. Feature upgrades won’t get released in as timely of a manner. Bug fixes will feel more like patching a leaky hole rather than building a whole new bucket. A breakdown in internal communication can cause shipping delays, service hassles, and other experience-eroding processes.

Yep, it’s all about the experience it delivers both to the customer and to the employee.